1. Retail Sales (Tues, 1:30 am GMT)

The fun starts on Tuesday when Australia prints its retail sales report for the month of June. Analysts are expecting to see a 0.5% increase in consumer spending, higher than the previous month’s 0.3% uptick.

Keep in mind, however, that the retail sales report has been churning out weaker than expected results for the past three releases and that two of those even suffered downward revisions later on. With that, there could be a good chance of seeing another downside surprise this time, which might spur Aussie weakness.

Here’s how AUD/USD reacted during the release of the May retail sales report:

2. Trade Balance (Tues, 1:30 am GMT)

Australia is set to release its trade balance at the same time as its retail sales report on Tuesday, which suggests that the Aussie’s forex reaction could either be magnified or be limited depending on the results. For the month of June, the trade deficit is expected to have widened from 2.75 billion AUD to 3.06 billion AUD, reflecting weaker export activity.

The past three releases have come in below expectations, with a couple of reports undergoing negative revisions and one enjoying a small upgrade. This suggests that the odds are also tilted to the downside for this one, possibly putting more weight on the Australian currency.

Here’s how AUD/USD reacted to the May trade balance report:

3. RBA Interest Rate Decision (Tues, 4:30 am GMT)

Perhaps the biggest event for the Aussie this week is the central bank’s interest rate decision, which is also scheduled on Tuesday. Most market watchers are still expecting RBA Governor Stevens and his gang of policymakers to keep rates on hold at 2.00% for the time being.

Take note that the RBA has already cut interest rates in two instances so far this year so it’s likely that policymakers will continue to sit on their hands and assess the impact of their latest easing efforts. However, the outlook for the Australian economy ain’t looking too good at the moment due to the slowdown in China and another potential drop in commodity prices, which means that a dovish announcement is a possibility.

In their June rate statement, the RBA mentioned that economic growth has been below its long-term average and that unemployment remains elevated but refrained from giving an explicit easing bias.

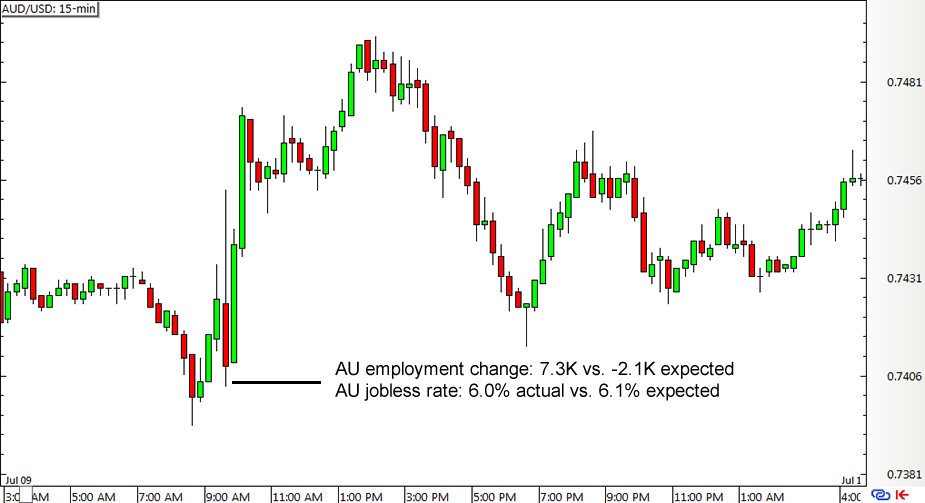

4. Employment Report (Thurs, 1:30 am GMT)

On Thursday, Australia will release its June jobs report and probably show a 12.5K rise in hiring, a faster pace of increase compared to May’s 7.3K figure. Meanwhile, the unemployment rate is expected to climb from 6.0% to 6.1%.

Three out of the last four releases have beaten market expectations, but the last two ones were downgraded later on, suggesting that the Australian Bureau of Statistics’ labor market estimates should be taken with a grain of salt. That’s probably why AUD/USD typically has a short-lived initial reaction to the report then stages a reversal in the latter sessions.

5. RBA Statement on Monetary Policy (Fri, 1:30 am GMT)

Last but definitely not least is the RBA’s official statement on monetary policy, which is different from the central bank’s interest rate announcement. This report is released on a quarterly basis and contains more deets on the economic and financial factors that influenced the policymakers’ decisions and biases.

The earlier release back in May 8 suggested that the central bank is prepared to lower interest rates again if necessary. Policymakers also cut their growth forecasts for the next couple of years, citing the delay in the recovery of non-mining investment as one of the main reasons for the downgrades.

The upcoming release could feature more downbeat remarks, as central bank officials could factor in the recent stock market tumble in China plus further declines in iron ore prices and exports. But if RBA officials shrug off these headwinds and try to restore confidence in the Australian economy, the Aussie might still be able to stay supported in the long run.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.