In today’s edition of my Forex Trading Guide, let’s zoom in on the upcoming jobs release from Canada. As usual, we’ll be taking a look at what the report is all about, what happened last time, what’s expected this time, and how the Loonie might react.

What is this report all about?

Canada’s jobs release typically contains two main figures: the employment change reading and the jobless rate. Since the employment change figure measures the change in the number of employed Canadians from the previous month, it is considered an indicator of job creation. Meanwhile, the jobless rate shows the percentage of the work force that is unemployed and is actively seeking employment.

These jobs figures are important economic indicators because these can provide clues on how consumer spending might fare. After all, a stable jobs market usually makes consumers more confident about their financial situation, making them more likely to spend instead of keeping their hands in their pockets.

What happened last time?

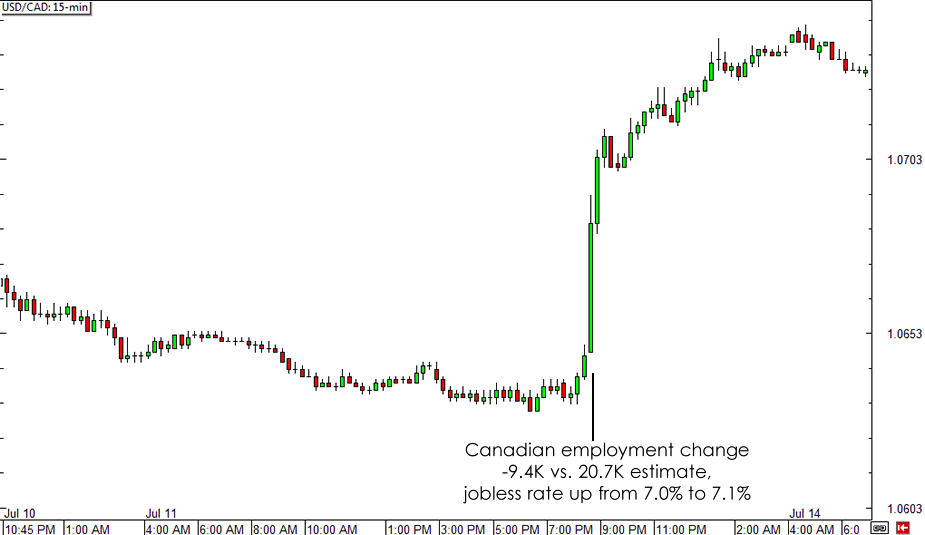

Unfortunately for the Canadian economy, the June jobs report printed dismal results as it showed a 9.4K drop in hiring versus the estimated 20.7K increase. The June employment change figure was also much weaker compared to the previous month’s 25.8K increase in hiring.

With that, the Loonie suffered a massive selloff against most of its major forex counterparts, including the Greenback. USD/CAD jumped by around 60 pips moments after the release then continued its ascent in the next trading sessions.

USD/CAD 15-min Forex Chart

What’s expected for the upcoming release?

For the month of July, Canada’s jobs sector is expected to get back on its feet and print a rebound of 25.4K in employment. This should be enough to bring the jobless rate back down from 7.1% to 7.0%.

Bear in mind though that the Canadian employment change figure has missed the mark in three out of the last five months, suggesting that there’s a good chance of seeing another disappointing result this time.

How could the Loonie react?

A quick review of USD/CAD price action after the Canadian jobs release reveals that the pair has a strong reaction to the actual data, with better than expected results spurring a Loonie rally and weaker than expected figures leading to a Loonie selloff. The price reaction lasts anywhere from 50-80 pips, depending on how far off the mark the actual data lands.

Another dismal jobs report for July could lead to a sharp selloff for the Canadian dollar, especially if the employment change reflects more job losses. Do you think Canada will print another weak employment report for July or will it show a rebound?

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.