RBA Cuts Rates:

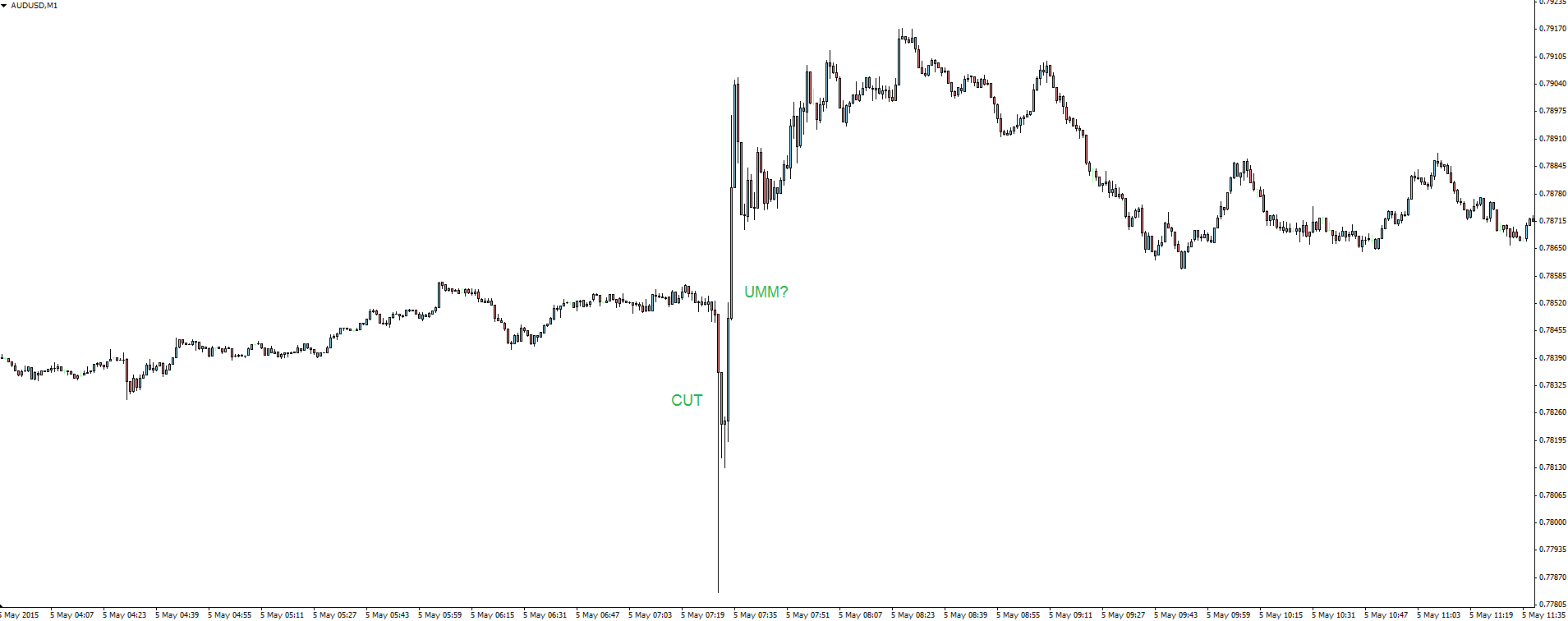

In a widely expected move, the RBA yesterday cut rates to a record low 2.00%. What was slightly less expected was the price action following the release (and for once it wasn’t dodgy front runners!).

The Aussie was smashed on the headline of the cut but as the statement was digested, buyers swooped and pushed the currency to new highs. The buying was due to the statement being interpreted as more hawkish than expected, not mentioning the need for additional cuts and possibly signalling the end of the RBA’s easing cycle.

AUD/USD 1 Minute:

It does seem a little strange that Stevens would talk about the need for further reduction in the exchange rate while removing the easing bias when maybe he didn’t have to word it the way he did. But it does show that the RBA believes that the Fed will look to raise rates sooner rather than later and do some of the heavy lifting for them.

Speaking of the US, last night’s missed Trade Balance number will now see the first quarter GDP number revised lower. With a rebound expected in the 2nd quarter and a better ISM non-manufacturing print, rate hike expectations didn’t change too much. Something that Stevens will be relieved to hear.

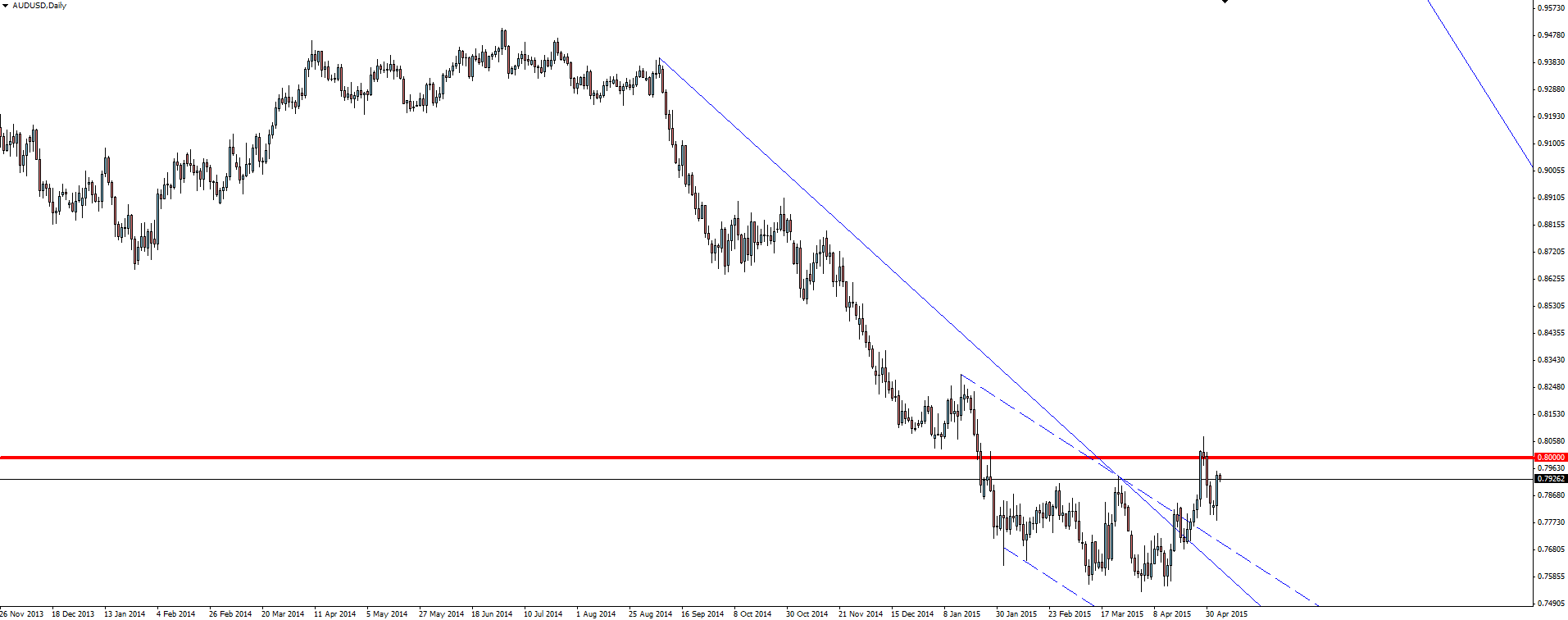

AUD/USD Daily:

Even though on the surface it’s hard to grasp the concept of the Aussie rallying on a rate cut, something to keep in mind is that even in the midst of this rally, price is actually still well over 100 pips off where it was when the actual cut was called… last Thursday in the newspaper.

Anywayyy! 80c is the in play level at the moment.

GBP Election Risk:

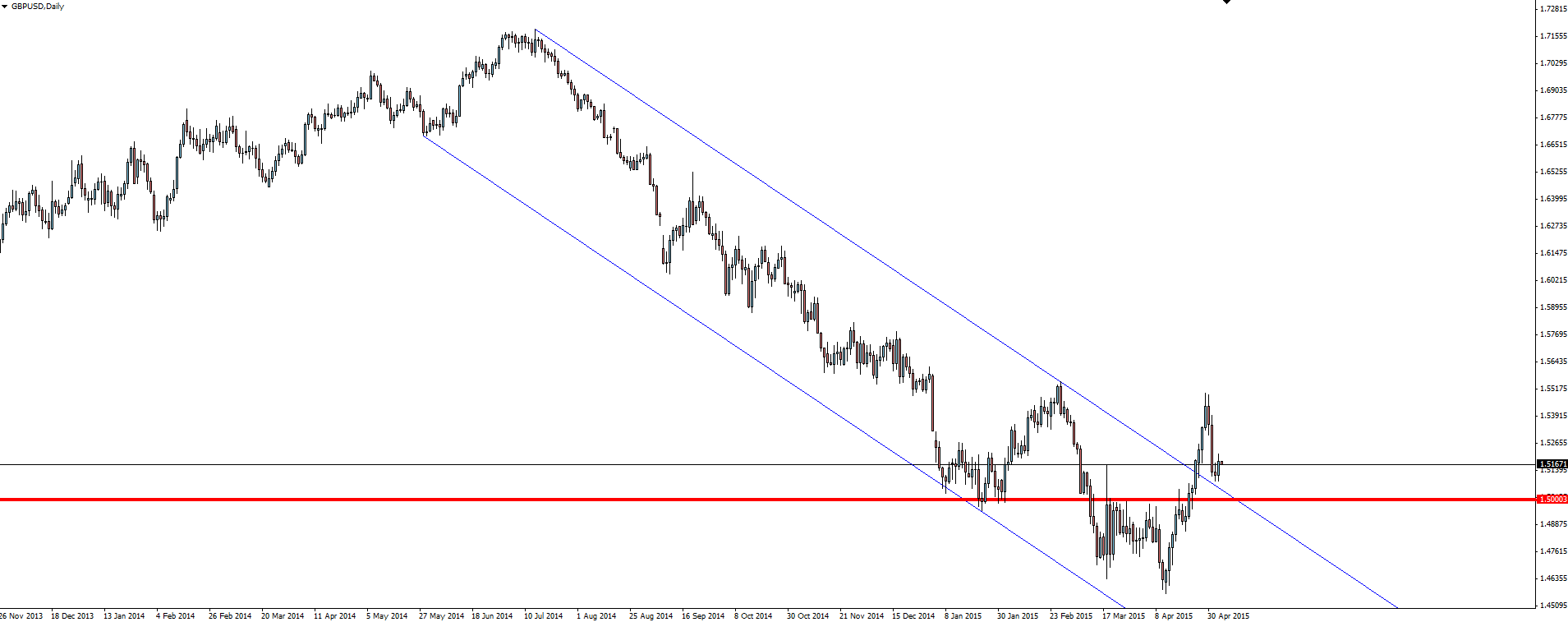

GBP/USD Daily:

1.5000 is the obvious key level on this GBP/USD daily chart as we head into the UK election tomorrow. USD weakness and a raft of hawkish sentiment from the BoE over the last few weeks has given the Pound a lift but the risks of a hung Parliament and the uncertainty that goes along with it will come back into focus in the coming days.

There is real event risk to the downside with a history of uncertain elections causing the Pound to drop hundreds of pips as election fallout settles. If you are interested in building a short position and playing the election uncertainty, a word of warning. We all remember the Scottish referendum where the Pound ripped on the rumour then was sold off after the fact. I’m very wary of something similar in the opposite direction here.

The 1.5000 level as well as the broken channel is there to help manage your risk. Watch for price to tuck back below 1.5000 then possibly give an opportunity to short on a rejected re-test.

On the Calendar Today:

Japan are off again for Constitution Day but Australian retail sales keeps us interested during Asia.

Plenty on the calendar tonight as we head into the US session featuring the ADP number as we move towards NFP on Friday.

Wednesday:

JPY Bank Holiday

AUD Retail Sales

CNY HSBC Services PMI

GBP Services PMI

USD ADP Non-Farm Employment Change

USD Prelim Unit Labor Costs

USD Fed Chair Yellen Speaks

CAD Ivey PMI

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.