Market Brief

Gold & Silver drop, GBP Maintains its Gains

Gold remains the core story of today, erasing most of its 2014 gains. We anticipated before that the massive gains of the US equities, the strength of the USD and the collapse of the real risks in the global markets had an impact on the demand of gold that dropped by -0.34% today in Asia edging lower to $1211.51 per ounce , the lowest since the beginning of 2014 . Silver dropped as well by -1.65% today to $17.57 per ounce m the lowest level in four years, since September 2010.

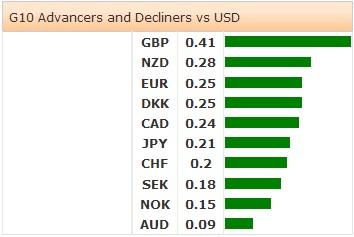

Despite the selling of the USD in Asia this morning, the correction had been expected at any time after the good momentum of the greenback in the last few weeks. The yields on the US treasuries retreated to 2.56% today on the US 10 Years, after heading 2.62% last week. The USD declined against the major currencies today in Asia, especially the British Pound that gained 0.37% heading $1.6350.The performance of GBP was aggressive in the last few days as the Scotland Independence referendum announced on Friday where the majority voted NO for independence. The British Pound rallied massively to 1.6520$ on Friday before dropped to 1.6305$ at the end of last week. It seems, the investors will refocus again on the Economic factors, and BoE’s Carney last update who officially announced that the interest rate hike will start next spring 2015.

Today in Asia, the Asian equities dropped in both China and Japan after strong gains in the last two weeks. In Japan, Nikkei dropped by -0.88% today in Tokyo, Topix was down by -0.28% as the Yen gained 0.20% versus the USD to 108.82. BOJ Kuroda clarified in G20 meeting that the monetary easing policies will remain as needed. In China, Reuters indicated that China will not change its policy because of one economic indicator which means that Bank of China will not consider any measure based on only one economic sluggish sector. Hang Seng was down -1.37%, Shanghai -1.57%. In New Zealand, NZD increased today versus the USD to $0.8136as the general parliamentary elections showed that New Zealand Key’s National Party won 48% of the vote in September.

ECB President Mario Draghi’s speech will be the most important economic incident for today, EURUSD rallied by 0.29% today in Asia heading $1.2867. In the US, the existing Home sales for August will be announced later today, it’s likely to increase. The US equities indexes dropped on Friday ignoring the massive IPO of the Chinese E-commerce giant Alibaba that listed on NYSE achieving the biggest U.S. IPO in history with more than $20 billion.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.