Market Brief

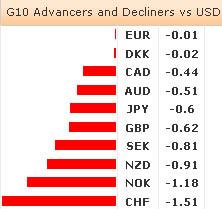

The Asian trading session was dominated by a risk-on rally amid China’s economic data came in better than expected. Chinese y/y real GDP (4Q) increased by 7.9% (vs. 7.8% exp. & 7.4% prev), the real year-to-date GDP came up to 7.8% (vs.7.7% expected & previous), December y/y Industrial production advanced to 10.3% (vs. 10.1% prev), while December y/y retail sales surged to 15.2% (vs. 15.1% exp. and 14.9% prev). The encouraging data out of the World’s leading emerging economy drove the markets to the upside overnight. The Nikkei 225 rallied 2.86%, Hang Seng advanced 0.99%, Shanghai’s Composite surged 1.39%, while Kospi and Taiex added 0.69% and 1.53% respectively. The US and European stock futures followed the bullish move. The currency markets focused on the aggressive rally of USDJY, as the Japanese media speculated on BoJ’s consideration on removing 0.1% floor on short term interest rates. Overnight Japan announced that the foreign bond purchases surged to Yen391.3B from the Yen -398.2B, the foreign stock purchases decreased to Yen -155.3B from Yen 6.8B, while Foreign purchases on Japanese bonds and stocks increased to Yen 139.0B (vs Yen -1.8B) and Yen 233.8B (vs. Yen178.9B previously). The Japanese November m/m and y/y Industrial Production improved to -1.4% and -5.5% respectively (from -1.7% and -5.8%), while the November Capacity Utilization disappointed ( -0.2% vs. 1.6% previously). USDJPY crossed over 90.00, its lowest level since June 2010, while EURJPY broke 120.00 to the upside, and hit 120.71 early in the session. In US, the initial jobless claims and December Housing starts surprised to the upside, while Philadelphia Fed business outlook index reversed to -5.8% from 8.1% the month before. In New Zealand, the consumer confidence increased, the q/q CPI pointed down at -0.2% m/m, while y/y CPI failed to beat the expectations (actual 0.9%, vs. 1.2% exp. & 0.8% prev). In European leg, EURUSD recovered to month’s highest levels, EURCHF continued its rally up to 1.2569 early in the session. EURGBP hit 0.8380 (highest level since March 2012), while GBPUSD slumped down to 1.5964, amid David Cameron’s speech raising the specter of a potential U.K. exit from EU. Today, the focus is on UK m/m and y/y Retail Sales ex&with Auto Fuel, Canadian m/m November Manufacturing Sales, and the University Of Michigan Survey of Consumer Confidence Sentiment.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.