The USDJPY has been relatively determined in its recent resolve to move lower and test the key 110.50 support level. However, despite the growing Dollar bearishness, the downside is likely to be relatively limited for the pair.

The past few days have seen the Yen appreciating sharply against the US Dollar, as a bevy of negative sentiment eroded any gains from the strong US Non-Farm Payroll result. Subsequently, it would appear that the broad negative move against the US Dollar cross pairs was mainly due to changing rhetoric from the US Federal Reserve.

In addition, further complicating the fundamental analysis is a range of mixed Japanese economic data with the Average Cash Earnings figures, a strong indicator of wage growth, rising from 0.4% to 0.9% y/y. In contrast, the Bank of Japan’s Tankan index, which models corporate price expectations, fell sharply from 12.0 to 6.0. Additionally, it would appear that the central bank’s inflationary expectations have also diminished in the near term. There is, therefore, a very mixed picture emanating from the Japanese economy, albeit biased to the negative.

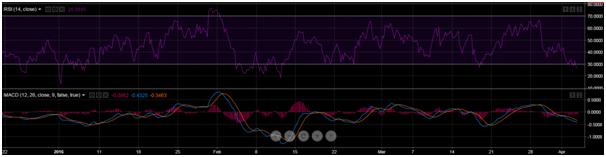

Subsequently, it would appear that the ongoing selling of the Dollar is largely overshadowing much of the negative indicators emanating from Japan and thereby depressing the USDJPY’s valuation. However, whilst the market may still be adjusting to the Fed’s current outlook, the re-balancing of expectations is likely near to completion. Therefore, don’t expect the pair to continue declining forever. In fact, there are some technical indications that the USDJPY’s recent demise could be coming to a close, as the 4-Hour chart shows the RSI Oscillator entering in to oversold territory. In addition, the stochastic indicator is also showing a reversal status which seems to indicate that, at the very least, a corrective reversal is in order.

Taking a look at the recent price action also provides some interesting visual cues as it is clear that the pair has been trapped within a channel since early February. Subsequently, as the key 110.50 support level comes into play, so too does the bottom of that channel. There is therefore plenty of stiff support in the current price range that would make any push towards the 110.00 handle problematic.

Ultimately, the most likely scenario in the coming session is that the pair forms another bottom right at the convergence of the channel and support at 110.50, before commencing a reversal and rally back towards the 111.50 mark. Over the past few months the same trade setup has produced some quick reversals from between 110.50 and 111.00 and this pattern is likely to repeat itself. So watch the pair closely over the next session as there is likely to be a dramatic move one way or another.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

USD/JPY drops toward 142.00 ahead of BoJ policy decision

USD/JPY has turned south, approaching 142.00 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.