Market Commentary

Equities rallied persistently throughout yesterday’s session, discounting the slightly weaker than expected Chinese growth numbers for Q2. ECB source comments seem to have fuelled a rally that progressed despite the subsequent report from the FT that put the validity of the initial source comments in ques-tion.

The equity rally progressed into the overnight session for US equity index futures, yet upside momentum subsided going into the start of the European session and has largely been subdued since the European morning.

The main theme in the FX space so far today is USD strength which has been escalating following the release of US CPI numbers for September. The M/M print came in at 0.1% vs. prev. –0.2.

Intraday Strategy: E-mini S&P

The E-mini S&P extended circa 60 points from the lows of yester-day’s session to the overnight highs following ECB source com-ments. It seemed like upside momentum was waning ahead of the cash open, yet, despite a downtick, selling pressure did not prove to be committed.

Taking into account that current price action is provide to be a little whippy just post cash, open, we feel there is scope to be patient in these market conditions. As a result, we are going with a conserva-tive entry at the pivot.

Intraday Strategy: EUR/USD

The EUR/USD broke out of the range formed in the latter half of last week in yesterday’s session, primarily as a function of EUR weakness following ECB source comments. Mild USD strength, persisting throughout the session only exacerbated the scale of the sell-off. Downside dynamics have continued into today’s session, albeit with choppy momentum.

We are also keeping our approach to the currency pair on the con-servative side, going with a pullback entry at the lower boundary of the aforementioned range.

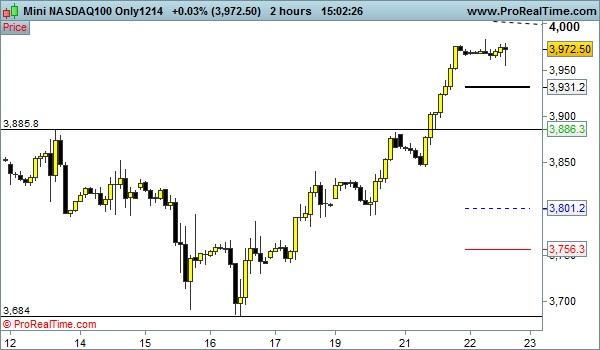

Technical Analysis: Nasdaq and DJIA

Nasdaq and DJIA largely flat so far today.

Technical Analysis: Bund and US 10-year T-note Futures

US 10-year futures and German bunds started ticking lower follow-ing US inflation numbers.

Technical Analysis: GBP/USD and USD/JPY

Sterling is weaker today following the maintenance of the 7-2 MPC split and a couple of dovish comments from the BoE. USD/JPY is moving largely as a function of USD strength.

City Trading & Investment Ltd are an incorporated entity registered in England & Wales. Company registration number is 08677745. Registered address: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB. Trading futures contracts on margin carries a high level of risk and may not be suitable for all investors. This excessive leverage can work against you at a significant capital cost. Before deciding to trade futures products you should carefully consider your investment objectives, level of experience and risk appetite. It is possible that you may lose some or all of your initial capital/investment and, there-fore, you should not invest money or financial assets that you cannot afford to lose. You should be aware of all of the risks associated with futures trading and trading financial instruments in general. You should seek advice from an independent financial advisor.

Any opinions, news, research, analyses, prices or other information contained in these reports is provided as general market commentary and is for educational purposes only. The content does not constitute investment advice in any shape or form. City Trading & Investment will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The content of this report do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments. Furthermore, the content of this report does not constitute advice or a recommendation with respect to such securities or other financial instruments or investments.

The content on this report is subject to change at any time without notice, and is provided for the sole purpose of assisting the educational appetite of traders. City Trading & Investment has taken reasonable measures to ensure the accuracy of the information within this report; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content of the report or from your inability to access the report, or for any delay in or failure of the transmission or the receipt of this report. Furthermore, no part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of City Trading & Investment Ltd.

This report is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of the readers of this report to ascertain the terms of and comply with any local law or regulation to which they are subject.

Investment asset valuations and pricing can go up and down. Investment price fluctuations can be violent and can result in the loss of some or all of your initial investment/capital. The financial assets referred to in this research and the potential income or losses from them may also fluctuate violently as described. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.