USD/NOK

The dollar traded lower against most of its G10 peers during the European morning Friday. It was higher against GBP and JPY, in that order, while it was unchanged vs NOK.

The euro was resilient after all of the German regional CPIs escaped from deflationary territory on a yoy basis. These figures indicate that the national inflation rate, due out late this afternoon, is also likely rebound from deflation. The data add to the growing body of evidence that Germany, the bloc’s largest economy, is strengthening again. This also increases the likelihood that Monday’s Eurozone CPI is likely to show deflation moderating somewhat, which could support EUR.

The Swedish krona gained the most after the country’s Q4 GDP showed a strong 1.1% qoq expansion, more than double the 0.5 qoq pace of Q3 and faster than market expectations. USD/SEK tumbled around 0.70% at the news and dipped below our support of 8.3100, but bounced up to trade above that level again. Despite the strong economic growth, the fact that the Swedish central bank is still fighting with deflationary pressures and can unexpectedly introduce additional expansionary measures is likely to keep SEK under selling pressure. Therefore, we could treat the current setback in USD/SEK as renewed buying opportunity.

NOK was unchanged after Norway’s unemployment rate declined in February, while retail sales plunged in January. The country’s economics are in a good condition overall compared to its peers. The unemployment rate seems to have stabilized near 3% while inflation is just below Norges Bank’s 2.5% target. The only drawback is the low oil prices, which are likely to keep NOK under selling pressure until they stabilize.

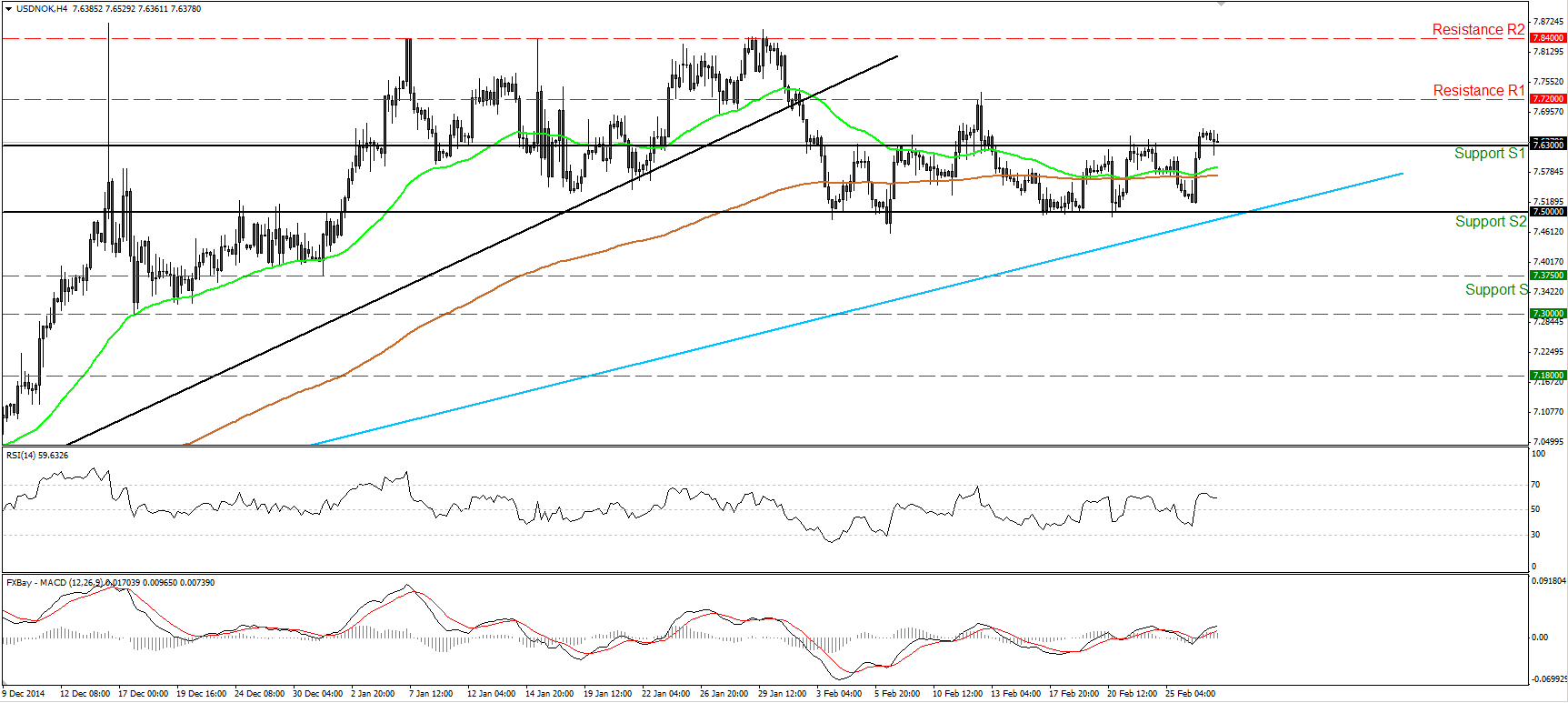

USD/NOK surged on Thursday after finding support slightly above the key support zone of 7.5000 (S2) and the long-term uptrend line (light blue line). The rally drove the rate above the resistance (now turned into support) hurdle of 7.6300 (S1), which happens to be the upper bound of the short-term sideways path the rate had been trading for the last couple of weeks. Today, during the European morning, the rate traded quietly above that line, but I believe yesterday’s move could encourage the bulls to target the resistance line of 7.7200 (R1). On the daily chart, since the rate is trading above the aforementioned long-term uptrend line, I would consider the overall upside path to stay intact. Moreover, our momentum studies support my view that we are likely to see a higher rate in the not-too-distant future. The 14-day RSI is back above its 50 line, while the MACD bottomed marginally below its zero line, turned positive and crossed above its trigger line.

Support: 7.6300 (S1), 7.5000 (S2), 7.3750 (S3).

Resistance: 7.7200 (R1), 7.8400 (R2), 8.0000 (R3).

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.