Silver

The dollar traded mixed against its G10 peers during the European morning Thursday. It was higher against EUR, CHF and NOK, in that order, while it was lower against AUD and NZD. The greenback was stable vs CAD, JPY, GBP and SEK.

The euro was lower during the European morning ahead of the preliminary German CPI for October. All of the regional CPIs were unchanged or 0.2 ppt lower on a yoy basis, indicating that the national inflation rate is also likely to be unchanged or lower. In the meantime, even though the unemployment rate remained unchanged at 6.7% in October, the unemployment change declined 22k from +9k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data on top of the poor data coming out, only reinforce my opinion that the euro has plenty of room to the downside. While the gyration of EUR/USD around 1.2600 may continue, the weaker economic data could push the rate to test the psychological barrier of 1.2500 in the near future.

Silver fell sharply after the surprisingly hawkish FOMC statement and added to its losses after China said to send investigators to probe a surge in precious metal exports. Silver dropped as much as 1.50%, to reach its lowest level since early October.

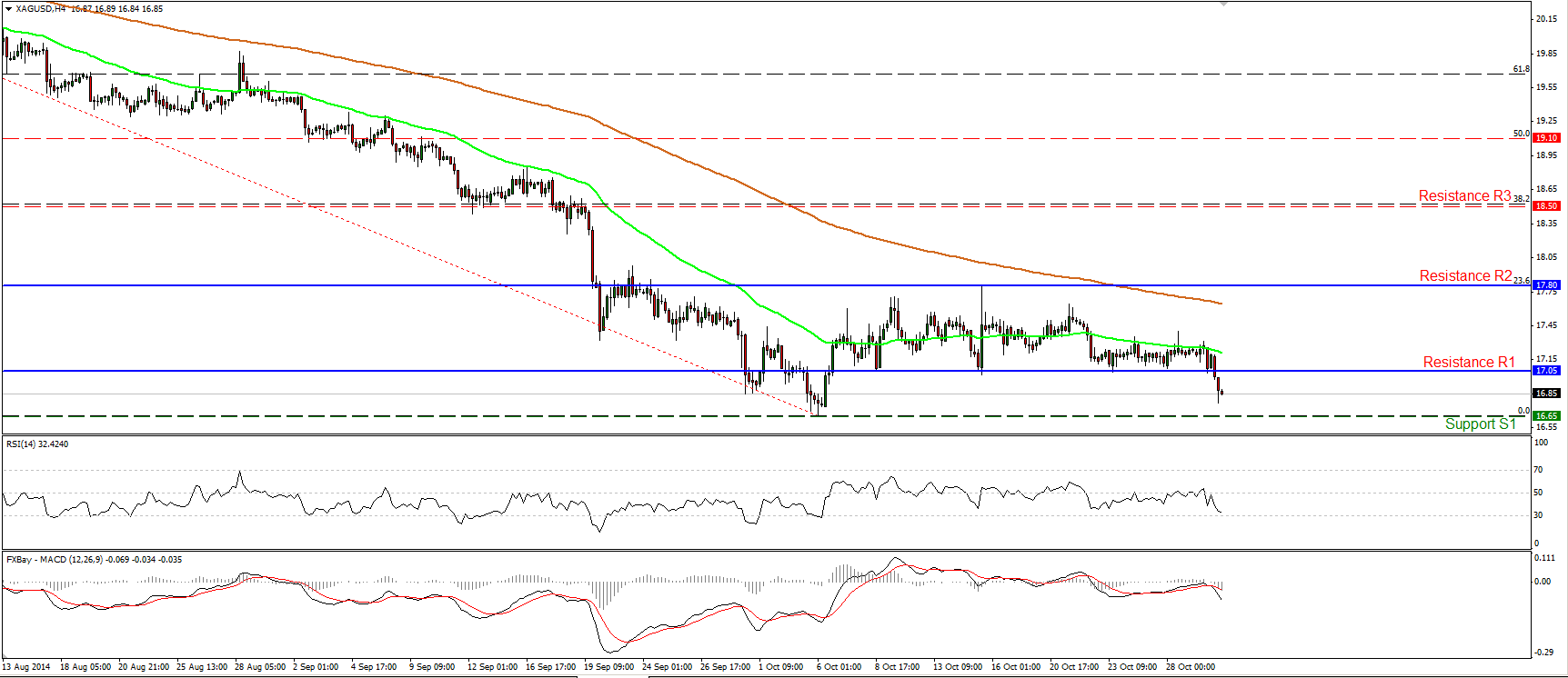

Silver continued tumbling during the European morning Thursday, breaking below 17.05, the lower boundary of the sideways path it’s been trading recently. I would now expect silver to challenge our support hurdle of 16.65 (S1), which is determined by the low of the 6th of October. In my view, the price has the necessary momentum to challenge that line, as the RSI moved lower after finding resistance at its 50 line, while the MACD, already negative, fell below its signal line. A break below the 16.65 (S1) barrier would confirm a forthcoming lower low on the daily chart and is likely to set the stage for further bearish extensions. Such a move could target the support line of 15.60 (S2), marked by the low of the 24th of February 2010. Our daily oscillators maintain a negative tone as well. The 14-day RSI is pointing down and could move again below 30 in the not-too-distant future, while the MACD, already below zero, appears willing to cross below its trigger line.

Support: 16.65 (S1), 15.60 (S2), 15.00 (S3).

Resistance: 17.05 (R1), 17.80 (R2), 18.50 (R3).

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.