AUD/USD

The dollar traded mixed against its other G10 counterparts during the European morning Tuesday. It was higher against CHF, EUR and CAD, in that order, while it was lower against AUD, NZD and GBP. The greenback traded nearly unchanged against NOK, JPY and SEK.

The UK service-sector PMI came at 59.1 in July from 57.7 in the previous month. The strong figure reached an eight-month high, exceeding the forecast of a moderate increase to 58.0. The robust reading was in contrast to the recent weak data indicating a slight slowdown in the British economy. Sterling jumped approximately 0.20% at the release of the data, driving Cable to resume its uptrend after last Friday’s lower-than-expected manufacturing PMI.

The Euro fell fractionally below 1.3400 during the European morning after the bloc’s final service-sector PMI declined to 54.2 in July, from the preliminary 54.4. The market reacted the most to the release of Italy’s below consensus figure and at the anticipation of an overall lower print coming out from Eurozone. The pair traded around the 1.3395 level at the time of writing, reversing most of the Friday’s gains against the greenback. Given that, later in the day, the US ISM non-manufacturing index is forecast to have risen in July, I would expect EUR/USD to continue declining, at least towards the support zone of 1.3365, marked by the lows of the 30th of July.

The Reserve Bank of Australia kept its key policy rate at a record low and repeated its stance that “On present indications, the most prudent course is likely to be a period of stability in interest rates.” In a largely unchanged statement the Bank decided to leave the cash rate at 2.5% indicating that rates will probably stay on hold for some time. Aussie weakened slightly at the release of the statement but recovered all the losses and advanced even more in the following minutes to enter the gainers list against the dollar.

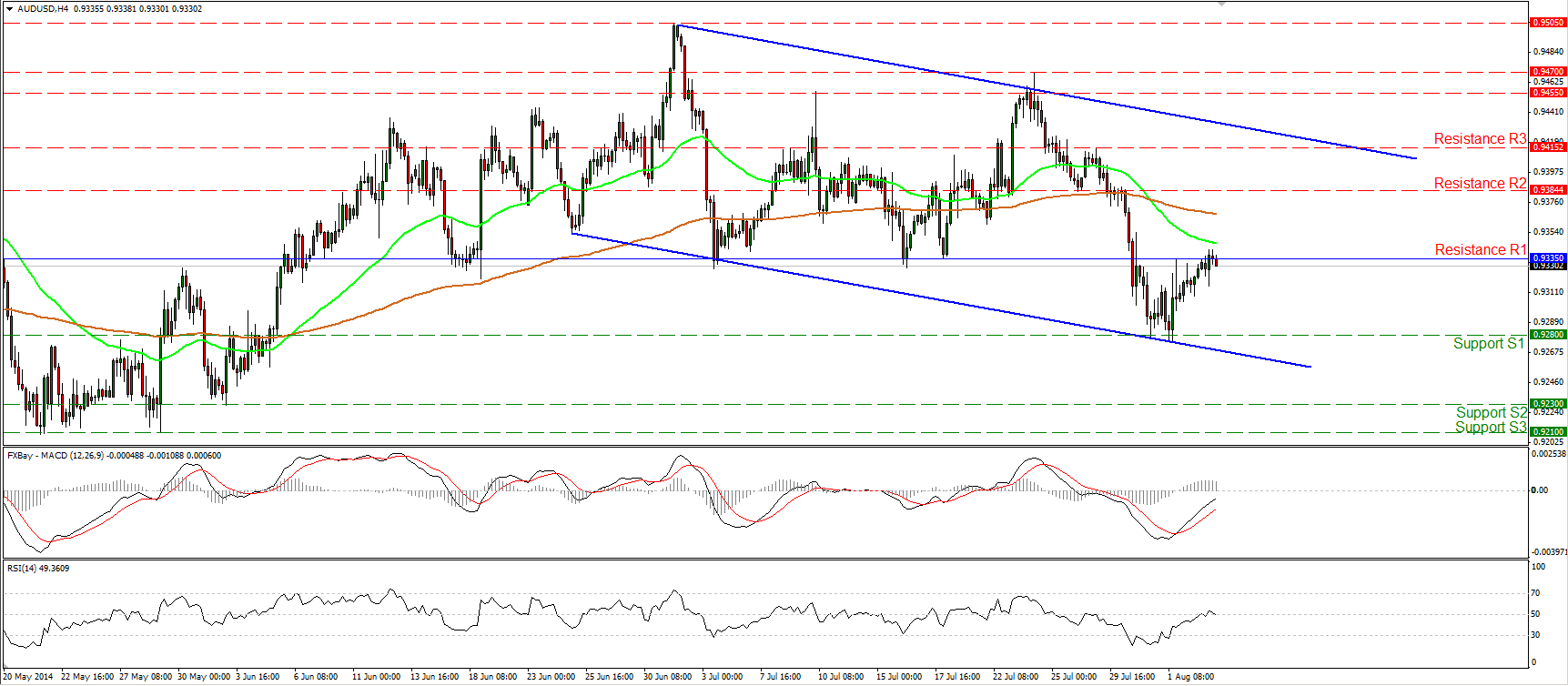

AUD/USD rebounded from the 0.9280 (S1) barrier and the downward sloping support line during the European morning Tuesday, the rate reached our resistance zone of 0.9335 (R1). Taking into account that the 0.9335 level acted as a strong support before its downside violation, I would expect it to act as strong resistance and prevent the rate from moving higher. If the bears manage to take the reins near that line, I would expect them to push the pair lower, perhaps for another test near the 0.9280 (S1) support level. Although the MACD lies above its signal line, the RSI seems willing to re-cross below 50. Zooming on the 1-hour chart, I can see negative divergence between the price action and both our hourly momentum indicators, adding to my view that the forthcoming wave could be to the downside.

Support: 0.9280 (S1), 0.9230 (S2), 0.9210 (S3).

Resistance: 0.9335 (R1), 0.9384 (R2), 0.9415 (R3).

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.