Boeing Co.

The dollar traded unchanged against most of its G10 peers during the European morning Monday in the absence of major economic events. The greenback was marginally lower only against SEK and CHF.

Russia's Foreign Ministry has criticized the European Union for its decision last Friday to impose additional sanctions, saying the "irresponsible" move would "be greeted with enthusiasm by international terrorists."

The additional sanctions will hurt Russia's economy, but the consequences will probably be felt by Western companies as well. One of the firms that will be most likely affected is British oil and gas company BP, which holds a 19.75% stake in Rosneft, one of the sanction target entities. At the time of writing, BP shares are trading down approximately 0.50% from their opening level.

Russia’s Foreign Minister Sergei Lavrov said that Russia will not impose tit-for-tat measures or act "hysterically" over Western economic sanctions. Nonetheless, there is a risk that Russia could react against western sanctions by blocking the sale of metals that are widely used by car and aerospace companies. This could hit US aerospace giant Boeing, which acquires much of its titanium from Russia. Being forced to find another supplier quickly could increase its costs unexpectedly and hurt the company’s revenues.

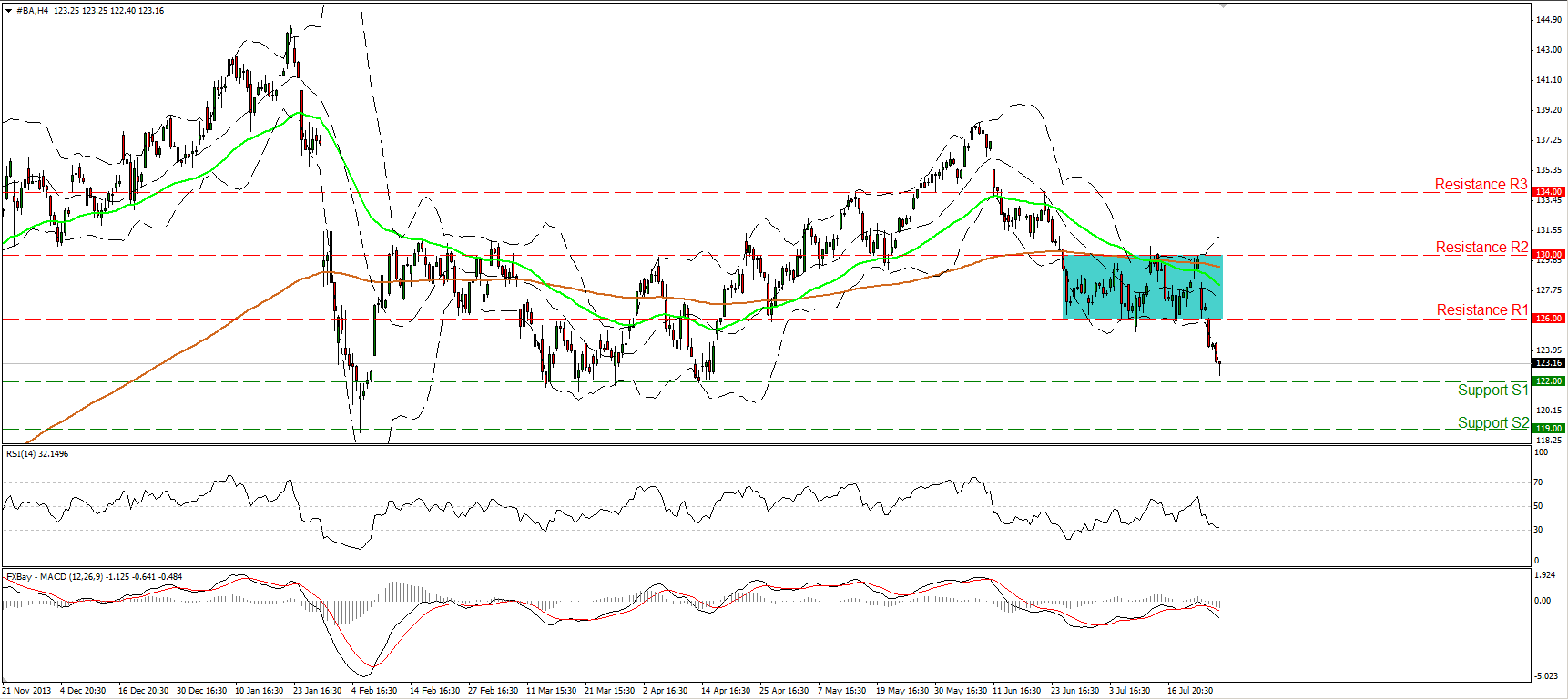

Boeing Co. fell sharply on Friday, breaking the lower boundary of the trading range it has been trading since the 24th of June (between the 126.00 and 130.00 barriers). Such a move reinforces the near term downtrend and flips the outlook back to the downside. However, taking into account that the price is approaching a strong support zone, near 122.00 (S1) and also bearing in mind the hourly momentum signs, I would expect some short-covering or a minor bounce before sellers regain control. A possible bounce could test, as a resistance this time, the 126.00 (R1) barrier, which coincides with the 200-day moving average (see daily chart). On the 1-hour chart, the 14-hour RSI exited its oversold field, while the hourly MACD shows signs of bottoming and could move above its trigger line within the day. In the bigger picture, as long as the price remains below the 200-day moving average, the overall outlook remains mildly bearish. A weekly close below the support barrier of 119.00 (S2) is likely to complete a failure swing top formation and could signal the beginning of a new downtrend.

Support: 122.00 (S1), 119.00 (S2), 113.00 (S3).

Resistance: 126.00 (R1), 130.00 (R2), 134.00 (R3).

Recommended Content

Editors’ Picks

Bank of Japan holds interest rate in September, as expected

The Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, following the conclusion of its two-day monetary policy review meeting. The decision aligned with the market expectations.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.