![]()

It’s been a rollercoaster ride of a week for US dollar traders, who were still trying to catch their breath after yesterday’s GDP- and Fed-driven collapse when they were hit by another whirlwind of economic data today. At the top level, there were four major economic releases this morning, and they were evenly split between encouraging and downbeat.

Whenever I’m asked if I “want the good news or the bad news first,†I always opt to get the negativity out of the way immediately. On that note, today’s Personal Income and Spending figures from the world’s largest economy certainly would be classified as “bad news.†Personal Spending rose just 0.4% m/m, while Personal Income was flat at 0.0%, missing expectations of 0.6% and 0.2% respectively. While spending did manage to tick higher, traders were hoping for a stronger rebound after the abysmal readings throughout Q1. Even more discouragingly, the Core PCE Price Index came out at just 0.1% m/m (vs. 0.2% eyed); as many traders know, this is the Federal Reserve’s preferred measure of inflation and unless it starts to rise more durably, the central bank is unlikely to raise interest rates in the next few months (see our full review of yesterday’s FOMC statement here). Based on these economic figures, the storm clouds are still looming over the US economy.

Of course, every storm eventually runs out of rain, and bulls are hoping that some of today’s more timely data releases signal a coming break in the clouds. The (notoriously volatile) initial jobless claims report showed just 262k new unemployed Americans in the most recent week, marking a 15-year low in this employment indicator. While the Fed has been satisfied with the quantity of jobs created, it’s the quality that has been lacking, and for that reason, today’s Employment Cost Index reading was particularly encouraging. This alternative measure of wages rose by 0.7% m/m, besting the 0.6% reading expected, and suggests potential inflation may be coming down the pipeline as consumers eventually spend their rising wages. Therefore, today’s more timely and forward-looking economic indicators hint at a spring thaw in the US economy, though traders and the Fed will need to see the improvement in the US economy sustained before acting too strongly on it.

Technical View: EURUSD

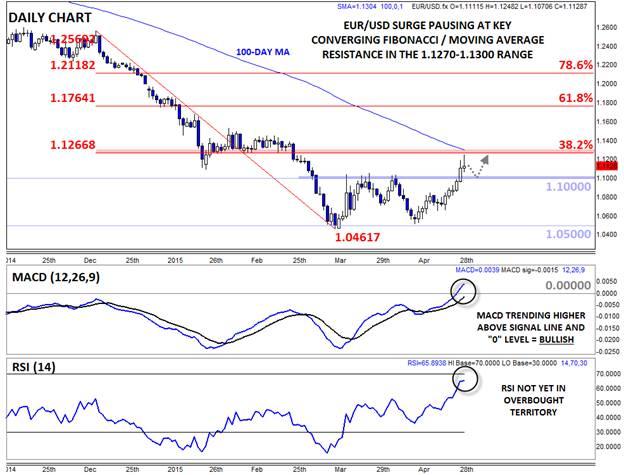

The world’s most widely traded currency pair has had a particularly wild ride over the last 48 hours, but today’s US data releases have taken some of the wind out of EURUSD bulls’ sails. The pair tested its 38.2% Fibonacci retracement near 1.1270 early in today’s European session before retreating on the economic data dump and the convergence of that level with the 100-day MA near 1.1300 may provide a near-term ceiling for the pair after the big rally this week.

That said, yesterday’s move above the key 1.1000-50 zone represents a major breakout and points toward further gains as long as rates remain above 1.10. The MACD indicator is trending higher above both its signal line and the “0†level and the RSI is not yet in overbought territory, supporting the bullish case over the medium term.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.