![]()

Risk is off the menu today with stocks plunging and the safe haven yen and gold rising. It is not clear what exactly has caused this latest rise in risk aversion. After all, the conflicts in the Middle East had been on-going but ignored by the financial markets for months now and so the bombing of Syria by the US and its Arab allies is unlikely to be the sole reason boosting demand for safe haven assets. For stocks, there have been numerous individual company or sector news that has helped to add to the selling pressure. In London, for example, Barclays, Tesco, Tate and Lyle have all suffered in this regard, while drug makers are down after the US government's tax inversions plans that were announced last night have made them appear less attractive takeover targets. Meanwhile the dollar is also weaker following recent gains. It looks like it is the lack of any major US data today and also yesterday’s release of disappointing existing homes sales data that are both helping to encourage some profit-taking.

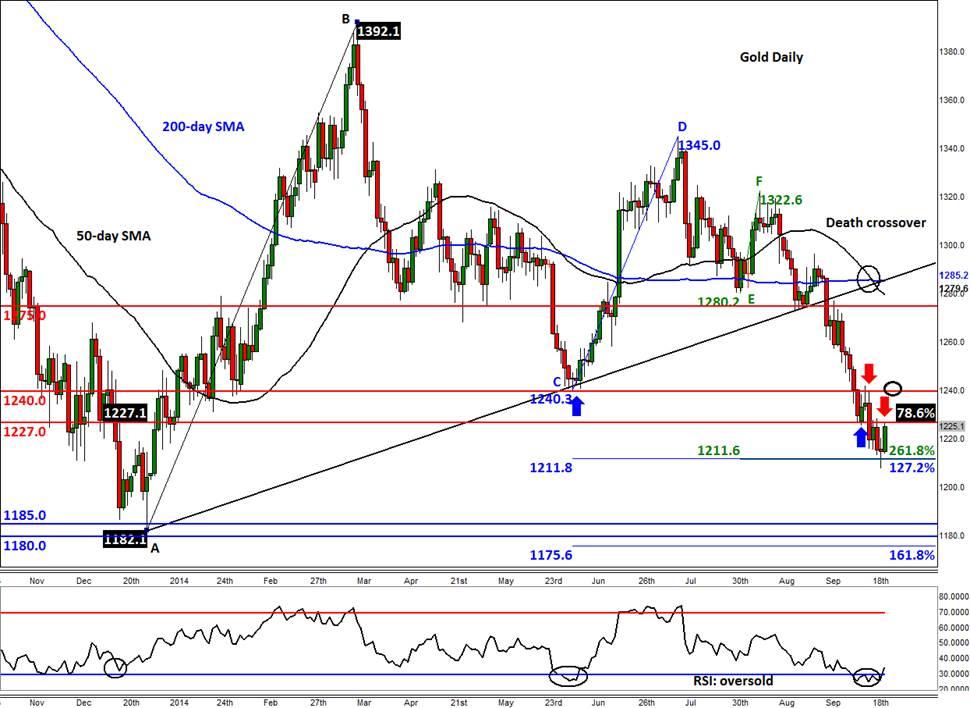

So, with stocks and dollar both lower today it has been a perfect opportunity for the gold bears to book profit and the bulls to take advantage of the weaker prices to establish some long positions. The yellow metal has bounced off the $1210/12 Fibonacci-based support area and is now testing the next hurdle around $1227, which is a support-turned-resistance level. If the bulls manage to push price beyond this area then that could pave the way for a potential move towards $1240 in the short-term (area circled on the chart). The $1240 mark is a more profound level of resistance and so a potential break above it could give rise to follow-up technical buying. Meanwhile the RSI has started to climb above the oversold threshold of 30, suggesting the momentum is shifting into the bulls’ favour. However, for as long at the RSI is below the key 60 level, this would indicate that gold is in an overall downward trend. Indeed, the metal has been making lower lows and lower highs recently, and so this latest bounce could just be a correction. Nevertheless, the technics appear more constructive today and we could see some healthy gains in the very near-term. Silver meanwhile has also bounced back from a key Fibonacci support level, as we pointed out yesterday.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.