![]()

1, Inflation – price data for April showed headline prices stayed at 0.5% in June, this is one of the lowest readings since 2009. Although it is too early to assess the impact of the ECB’s recent actions on inflation, the fact that prices have been below 1% since September last year is still a major cause for concern. Although prices in Germany have picked up a notch, they are still only half of the ECB’s 2% target rate. Things across the periphery are even worse, in Italy, the third largest economy in the currency bloc; prices fell to 0.2% from 0.4% in June, and the lowest level since September 2009. The battle against deflation is far from over, and Draghi may have to keep the door open to further action at this week’s ECB press conference, to scare off the threat of deflation.

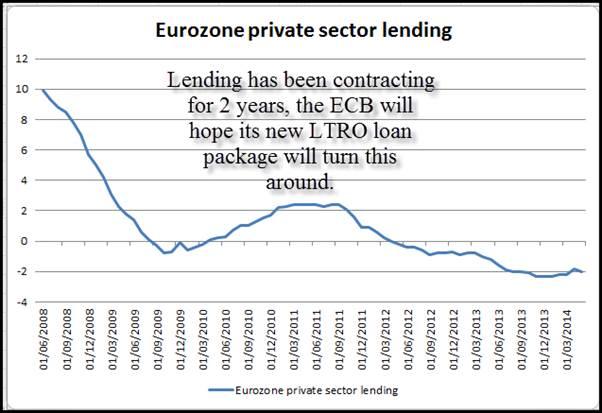

2, Lending: the latest money supply data from the currency bloc showed that private sector loans fell 2% on an annualised basis in May, down from -1.8% in April. The ECB will be hoping that their package of fresh LTRO funds can boost this number; however this data reinforces the uphill battle the Bank has to encourage demand for loans. Credit growth to the private sector has been contracting since April 2012, so the Bank may need more aggressive action down the line if it wants to bring this back into positive territory.

3, France: The second largest economy in the currency bloc is becoming a big problem, and it could make it on to the ECB’s agenda later this week. Its PMI data is lagging the periphery and earlier on Monday its statistics agency published its debt to GDP ratio for Q1, which rose to 93.4%, a record high. A country’s debt is considered a major problem if it gets above 100% of GDP, and if French debt accumulation carries on at its current pace, then we may reach 100% in the next 12 months. It appears that President Hollande’s 75% top rate of tax has had no impact on French debt levels, and today’s data may trigger more explicit wording in the ECB’s statement to get governments to do more to reduce debt loads. If the ECB sounds concerned about France then we could see the market panic.

It is also worth noting that as French debt-to-GDP has continued to jump, the opposite is true in Germany where the rate has fallen from a peak of 83.4% of GDP in 2010, to 79.9% in Q1 this year. Watch out for signs that Germany is getting annoyed with France’s inability to keep its borrowing under control. A spat between the two largest economies in the currency bloc could dent investor confidence and weigh on euro-based assets.

4, The EUR: Last but not least, the single currency hasn’t played ball since the last ECB meeting. It has risen for two consecutive weeks and is close to the high before the ECB meeting on 5th June at 1.3665. If Draghi and co. want to limit further upside for the single currency, and protect the recovery, it may need to keep the door open on Thursday to further policy action in the future.

The technical picture is fairly neutral for EURUSD. If it can break above 1.3670-80, the high from early June and also the 200-day sma, this would be a bullish development that could take us back to 1.3800 in the medium-term, however, the ECB may be hoping that it does not break this level, which could open the way to another leg lower.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.