A few fundamental factors are weighing on the ZAR:

Growth fears in South Africa

A rapidly rising budget deficit

Another flare up in social unrest in the mining region

A general dislike for carry currencies like the rand, the AUD, etc.

The last point is of particular concern – the market is ditching risky EM and carry currencies in favour of safe havens like the yen and the CHF. After falling for most of this year, JPYZAR is up more than 10% in the last 2 weeks.

It is not only the yen that has an inverse relationship with the rand, stocks seem to as well.

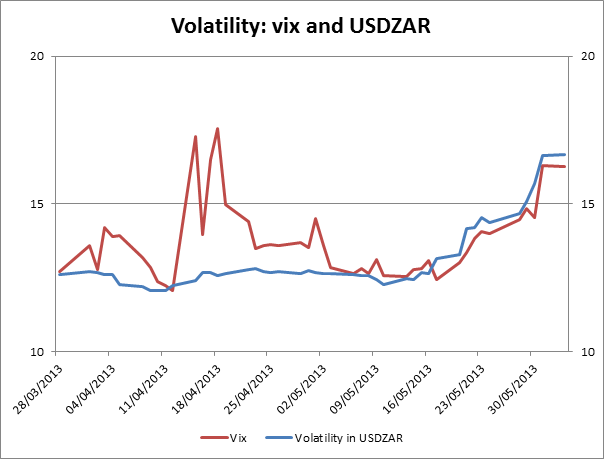

At the same time as pressure on ZAR has grown, stock markets have come off their highs. We believe there is a link between rising volatility in emerging market FX and the performance of the stock market. The chart below shows 3-month volatility for USDZAR (as measured by the option market) and the Vix volatility index, which measures volatility in the S&P 500. As you can see, volatility in USDZAR has surged and this has coincided with a rise in the Vix. When the Vix spikes stocks tend to sell off, and vice versa.

Source: FOREX.com and Bloomberg

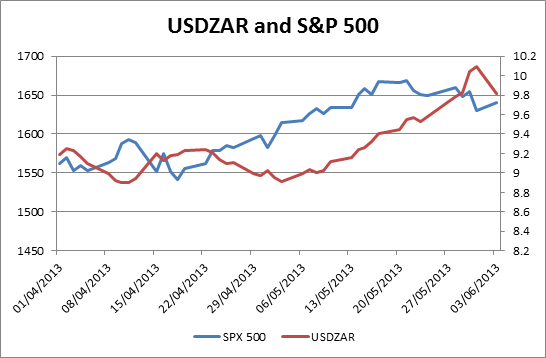

Takeaway: emerging markets are a good reflection of fears that are starting to grip the market. Thus, it is worth watching USDZAR if you trade stocks, since in recent weeks stocks and USDZAR have tended to peak around the same time.

Short term market idea: USDZAR has fallen back from highs above 10.00 in the last two trading sessions; this could help stocks to stage a short term recovery.

Key levels to watch in S&P 500:

Resistance: 1,645, 1,655, and then 1,675.

Support: 1,635 – daily pivot, then 1,615,

Source: Bloomberg and FOREX.com

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.