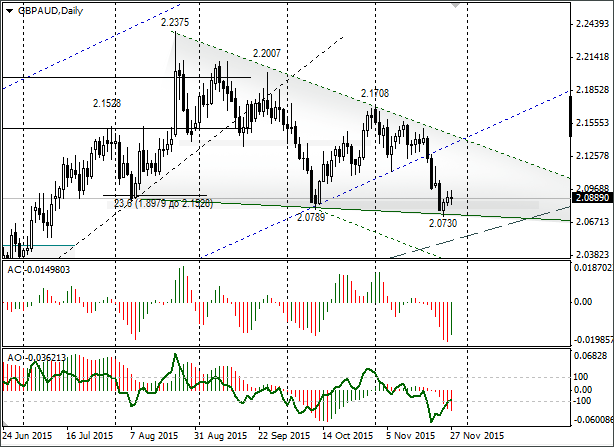

Trading opportunities for currency pair: a strong support from which the GBP/AUD managed to return to 2.0889 has formed. I’ll take a risk in saying that there’ll be growth to 2.13. Any growth above 2.1046 should tell you to hold off selling. A break through 2.0730 will see the rate drop to the trend line at 2.0525.

Background:

The last GBP/AUD idea I made came out on 14th September. The rate at that time was 2.1750. In September I looked at two scenarios. The first was a rebound (sticking basically with the trend) and the second was for if a break in the trend was to take place. In actual fact, the GBP/AUD broke the trend line and after a recoil the pound reached the calculated 2.0913 level (23.6% 1.8979 – 2.1528).

As things are at the moment:

Since August a support (2.0730-2.0873) has been forming. The support is strong. If we make a line along the minimums, we can see a formation that comes together. We now need to set out what we expect from the pair in December.

All trader attention is now on the ECB and FOMC meetings, along with the NFP that is on the horizon. For this cross it’s more important how the pound and the Aussie act against the USD. At the moment, we can look at setting buy stops below 2.0730 as well as pound sales if there’s a break in the support.

The potential for a strengthening of the pound is significantly higher than the potential for a weakening of the currency. If we see a bounce of the price from the support, we can set our eyes on 2.13 and if we see this break then we’ll be looking to 2.0525. I reckon that a fall in the pound will hold the main trend line from the 1.7212 (8th September, 2014) minimum – 1.8979 (6th May, 2015).

Last week saw representatives of the Bank of England, in addition to UK stats, disappoint the buyers. However, whilst the support isn’t broken, we better work with a rebound. A growth above 2.1046 should make you more than think twice about selling.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.