| Rationale | Bullish/Bearish | Levels anticipated |

| Main Theme - Fed to begin slow tightening, BOE liftoff could be delayed to H2 2016, weak UK services activity, BOP concerns to weigh over Pound | Bearish | 1.45 in H1, followed by a recovery in H2 as BOE liftoff nears |

| Bullish Surprise – BOE lifts rates in Q1/Q2 (low probability) | Bullish | 1.59 in H1, followed by profit taking in H2 |

| Bearish Surprise – UK BOP concerns take Centerstage (high probability) | Bearish | 1.45-1.4280 followed by further sell-off if trade deficit does not drop in H2 |

The cable weakened in the first four months of 2015 on the threat of a hung parliament. But a decisive victory for the Tories led to a spike to 1.5929, which was followed by a drop to 1.5026 in November on falling BoE rate hike bets and increased odds of the Fed tightening.

Throughout 2015, Sterling remained relatively resilient to increased odds of the Fed tightening as the markets believed the BoE would follow the Fed with its own liftoff

2016 – Fed tightening begins, BoE could wait till H2 2016

The Fed tightening is likely to be painfully slow as the new normal calls for a less than conventional – 25bps move in the rates. The Fed is clearly worried about the financial asset bubble and thus a move away from the ZIRP appears more likely.Read: Central banks to continue trying to achieve 2% inflation in 2016

Meanwhile, the BoE could hold the policy steady till H2 2016 on balance of payment concerns. The labor force participation in the UK is on the rise, while the service sector growth is in a declining trend. Overall, the bank is likely to keep rates unchanged in H1 as:

- There is little risk of inflation overshooting the target

- Labor force participation is on the rise and could continue to do so on low rates

- Strong Sterling could worsen Current Account to GDP ratio

GBP/USD – Odds of a bearish move are high in 2016

- Overall, the odds of a bearish move in Sterling are high, especially if the markets begin focusing on the UK’s balance of payment situation.

- The bear’s could reassert their presence in the H1 2016 as the Fed tightening begins amid delay in the BoE liftoff, pushing the pair to 1.45 levels

- A recovery could be seen in the H2 2016 in case the services PMI establishes a fresh uptrend till June.

- A major surprise could come in the form of a delay in the Fed liftoff and/or BoE liftoff in H1, leading to a rise in the GBP/USD to 1.59 levels, in the H1 of 2016. However, the probability of the delay in the fed liftoff is very low.

GBP/USD Technicals – Increased odds of a drop to 1.45-1.42

Monthly chart

Cable witnessed an upside break from the symmetrical triangle formation in 2014, which stalled at a high of 1.7191, following which the pair made its way back to symmetrical triangle formation and witnessed a bearish break in the Q1 2015.

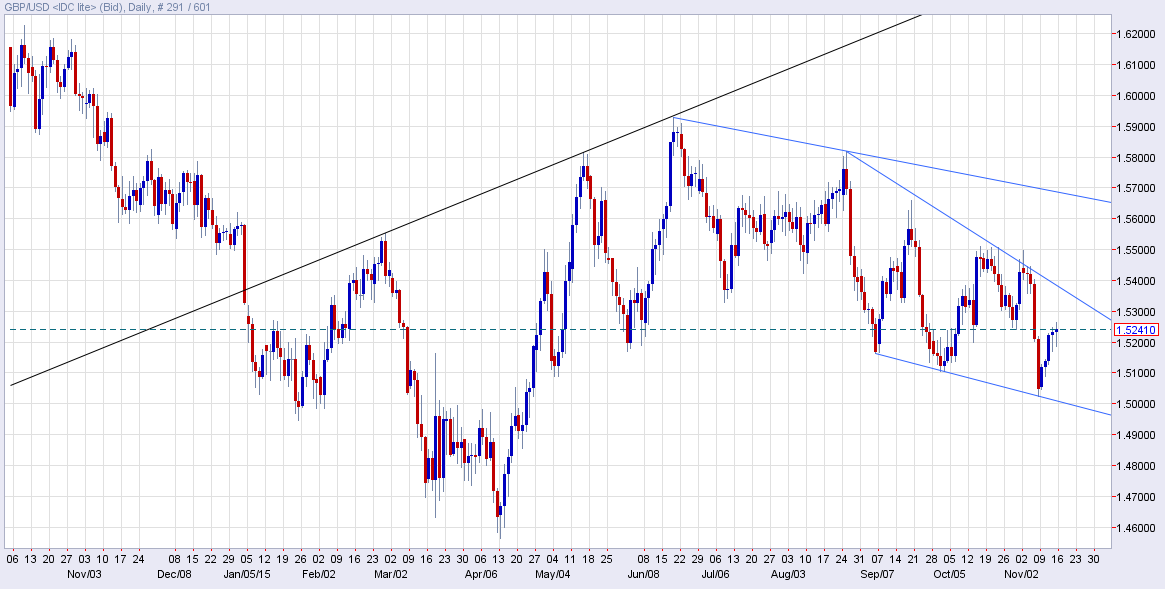

Daily Chart

Bulls made another attempt, thereby forming an inverted head and shoulder seen on the daily chart. However, cable saw a failure around the neckline resistance at 1.5930 in June 2015, following which the currency pair has been moving in a falling channel.

Overall, the charts indicate a high probability of a break lower to 1.4563 (Apr 2015 low). A break below the same would expose strong support around 1.4281-1.4290 (confluence of 23.6% of lifetime high-low & 78.6% of 2009 low-2014 high).

A caution is advised if the pair breaks above the black rising trend line seen on the monthly chart. Meanwhile, the technical outlook would turn bullish once the pair sees a monthly close above black rising trendline as it could open doors for a break above 1.5930, thereby leading to a re-test of 1.6380 (Jan 2013 high).

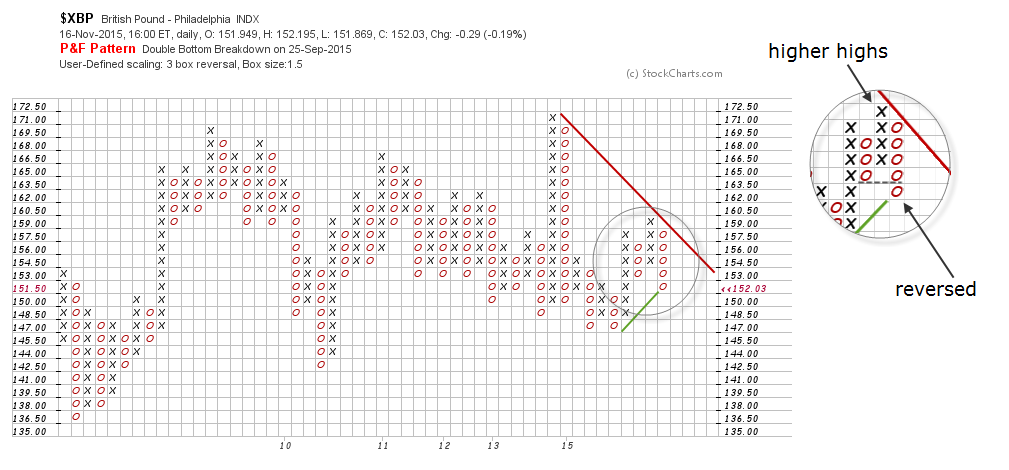

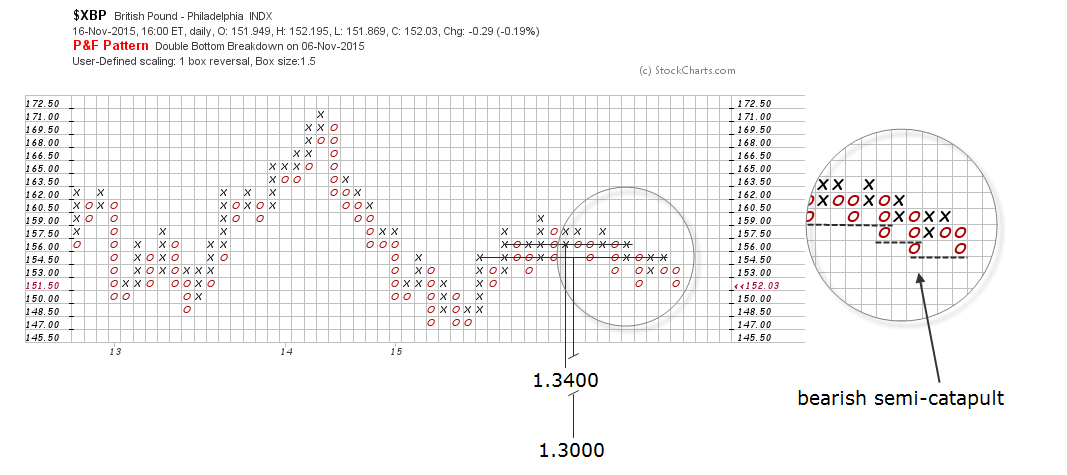

GBPUSD Point & Figure Charts Forecast by Gonçalo Moreira, CMT

In point and figure charts, the price is always subject to an uptrend or to a downtrend line. In a GBP/USD 3-box reversal chart, where each box is worth 150 pip, the trend comes dictated by a bearish 45º line. This ceiling, which was threatened by a double-top signal in July this year, was reversed with a bearish reversal pattern erasing at the same time the bullish trend line drawn from the April low at 1.4565. This signal reinforces the bearish development for the next months and perhaps years in this pairing.

The same negative bias is seen in a 1-box reversal for the sterling market. The downside risk implied by two horizontal counts resulting from the consolidation formed since Spring 2015 is 1.3400 and well below the early 2009 low, 1.3000. No upside target is valid in this resolution, the reason being the bearish semi-catapult already breaking down on two occasions (see chart below).

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.