Volatility continues to collapse Yesterday’s range for EUR/USD was a mere 0.12%, the second-narrowest range since the beginning of the euro, excluding New Year’s day (the /narrowest range was back in April). It’s not just the euro, either. During the same time period, USD/JPY has had a narrower range only twice. That’s pretty astonishing when you consider the number of big announcements coming out this week, including the FOMC meeting, US NFP, US Q2 GDP and Eurozone inflation data. Currencies only move when there is a disagreement on the price – it looks like people have pretty well reached agreement on the value of the major currencies.

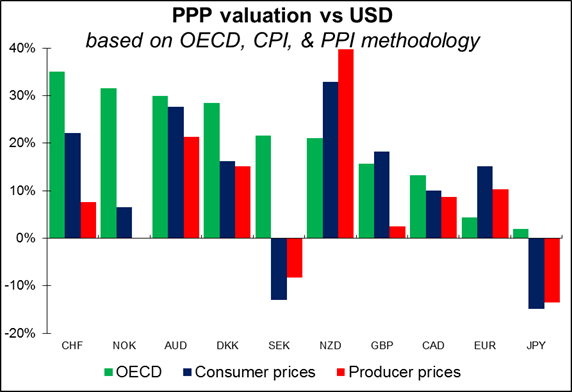

In fact when we look at the OECD measures of purchasing power parity (PPP), EUR is only 4.2% overvalued vs USD and JPY is only 1.5% overvalued. That suggests the low volatility in these two currencies may be appropriate – they are trading around their fundamental values. (Based on CPI and PPI measures however they are less fairly valued.) In that case, perhaps we should listen more to the central bank governors of New Zealand and Australia, who have been complaining bitterly about the overvaluation of their currencies (overvalued by 19.6% and 29.6%, respectively, on the OECD measure). But in that case we would all be short CHF, 35% overvalued, and NOK, 31.2% overvalued. And GBP is 15.3% overvalued vs USD on that measure, not so far behind NZD.

The only thing that these measures seem to agree on is that USD is undervalued. The only measures on which the dollar is overvalued are the CPI and PPI methodology vs SEK and JPY. So in theory the dollar should rise. However, we know that although currencies do generally mean revert towards PPP, it can take a long long time.

In any case, the drop in volatility has had a big impact on interbank trading volumes – or is it the other way around? Central banks yesterday reported the results of their twice-yearly survey of turnover in the FX market. The average daily currency volumes in most key financial centers around the world rose or were little changed in April from October, but were far below the year-earlier levels. Daily currency trading in London for example rose 7% in April this year from October, but trading in the spot market was down 21% from a year ago.

As for the indicators, US pending home sales fell unexpectedly in June, raising doubts over the housing market recovery. Following last Thursday’s disappointing reading in new home sales for the same month – a drop from an initially reported six-year high in May to just above the low for the year — yesterday’s figure confirmed Fed Chair Yellen’s remarks before the Senate Banking committee earlier this month about the overall slowdown in the housing sector. So although it’s likely that the FOMC will upgrade their view of the economy in this month’s statement following the meeting, the Committee is still likely to include warnings about housing that could hedge the upward revision to the view that I expect. In June they said that “the recovery in the housing sector remained slow.”

In Japan, retail sales fell more than forecast in June, suggesting that the rebound from the hike in the consumption tax is going more slowly than expected. At the same time, the unemployment rate unexpectedly rose, although the job-offers-to-applicants ratio rose slightly too. The struggling Japanese economy and PM Abe’s slumping popularity rating suggest that the Bank of Japan is going to have to get busy later this year expanding its quantitative easing, which could put downward pressure on the yen.

Today: There is a relatively light calendar today. We have no major events or indicators coming out from the Eurozone.

In the UK, mortgage approvals for June are expected to rise slightly after four consecutive declines. The modest increase from the lowest level this year may confirm that buyers are concerned about paying the current high prices.

From the US, S & P/Case-Shiller house price index is forecast to show that the pace of increase in house prices accelerated in May from the previous month.

The Market

EUR/USD rebounds somewhat

EUR/USD moved slightly higher on Monday, but the near-term bias remains cautiously negative. I still expect the rate to reach the 1.3400 (S2) hurdle, where a decisive dip could target the bar of 1.3350. The price structure remains lower highs and lower lows below both the moving averages and this keeps the short-term trend to the downside. Nevertheless, I can see positive divergence between the rate and both our momentum indicators, indicating that the trend has lost some downside momentum. As a result, we may experience the continuation of the bounce before sellers take control again. On the daily chart, the 50-day moving average lies below the 200-day one, adding to the negative picture of the currency pair.

Support: 1.3425 (S1), 1.3400 (S2), 1.3350 (S3)

Resistance: 1.3445 (R1), 1.3485 (R2), 1.3500 (R3)

Is EUR/JPY set for further upside?

EUR/JPY rebounded from 136.65 (S1), forming a higher low and confirming the positive divergence between our momentum indicators and the price action. Although, the rate remains below the blue downtrend line, I would maintain my neutral stance for now, since the RSI moved above its 50 line, while the MACD, already above its signal line, seems ready to enter its positive field, favouring the continuation of the upside wave. Thus, I would expect the rate to target the resistance of 137.75 (R1), where a clear break would signal the completion of a possible near-term inverted head and shoulders formation and is likely to bring trend reversal. The completion of the pattern could probably pave the way towards the next resistance at 138.45 (R2). On the daily chart, I can identify a possible morning doji star formation, magnifying the case for further advances.

Support: 136.65 (S1), 136.40 (S2), 136.20 (S3)

Resistance: 137.35 (R1), 138.45 (R2), 138.75 (R3)

GBP/USD finds resistance at 1.7000

GBP/USD declined slightly, after finding resistance at the psychological barrier of 1.7000 (R1), which matches with the 38.2% retracement level of the 29th May – 15th of July advance. The short-term outlook remains negative in my view, and I would expect the rate to challenge the support level of 1.6950 (S1), also the 50% retracement level of the aforementioned up move. The next support is found at 1.6918 (S2), near the 80-day exponential moving average which supports the lows on the daily chart and keeps the long-term trend to the upside. If the rate approaches that critical zone, I would give up my bearish stance and wait to see the market reaction near that zone before reconsidering my analysis.

Support: 1.6950 (S1), 1.6918 (S2), 1.6880 (S3)

Resistance: 1.7000 (R1), 1.7035 (R2), 1.7100 (R3)

Gold remains below 1308

Gold moved in a consolidative mode, remaining marginally below the resistance bar of 1308 (R1). A clear move above that obstacle would likely confirm the break of the purple trend line and could probably pave the way towards the next resistance at 1325 (R2).The positive divergence between the precious metal and both our momentum studies remains in effect. Moreover, the RSI remains above 50 and is now pointing up, while the MACD edged above its zero line. This amplifies the case for further upside in the near-term horizon. Nevertheless, I would remain flat as far as the longer-term path is concerned, since on the daily chart, both the 50-day and the 200-day moving averages are pointing sideways.

Support: 136.65 (S1), 136.40 (S2), 136.20 (S3)

Resistance: 137.35 (R1), 138.45 (R2), 138.75 (R3)

WTI heading towards 101.00 again

WTI moved lower yesterday and is now heading again towards the 101.00 (S1) support zone, which coincides with the 50% retracement level of the prior near-term advance and the 200-day moving average. Bearing in mind that the RSI found resistance at 50 and moved lower, while the MACD remains negative and lies below its signal line, I still see a mildly negative picture. However, I would wait for a dip below 100.45 (S2), the 61.8% retracement level of the aforementioned up move, before getting really bearish on oil. Such a move is likely to target the area of 98.65 (S3), the low of the 15th of July.

Support: 101.00 (S1), 100.45 (S2), 98.65 (S3)

Resistance: 102.50 (R1), 103.35 (R2), 104.50 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.