Analysis for November 27th, 2014

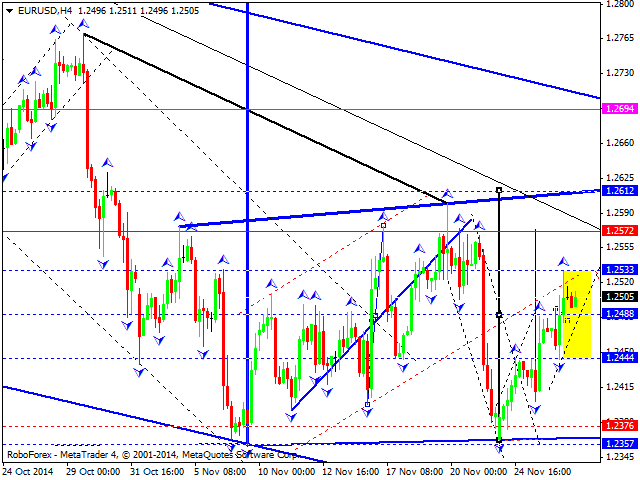

EUR USD, “Euro vs US Dollar”

Eurodollar is under pressure and continues moving upwards; the pair has formed a continuation pattern towards level of 1.2488. We think, today the price may test this level from above and then continue growing to reach the target at level of 1.2610.

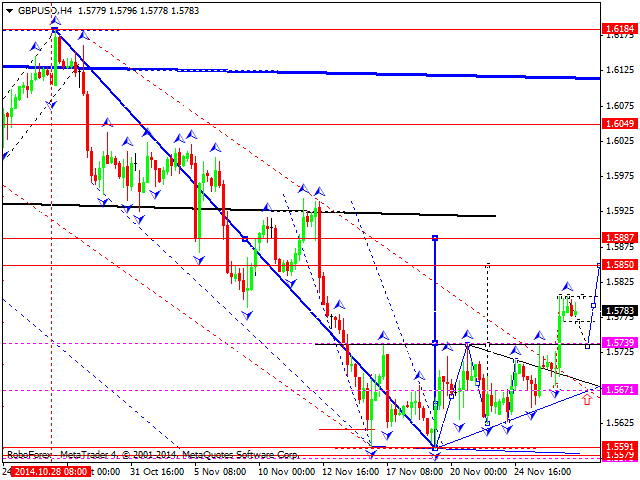

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken its consolidation channel upwards. We think, today the price may fall towards the channel’s broken border to test it from above and then continue forming an ascending wave to reach a local target at level of 1.5850. Later, in our opinion, the market may form the fourth structure as a correction towards level of 1.5740 and then the fifth one to reach level of 1.5888.

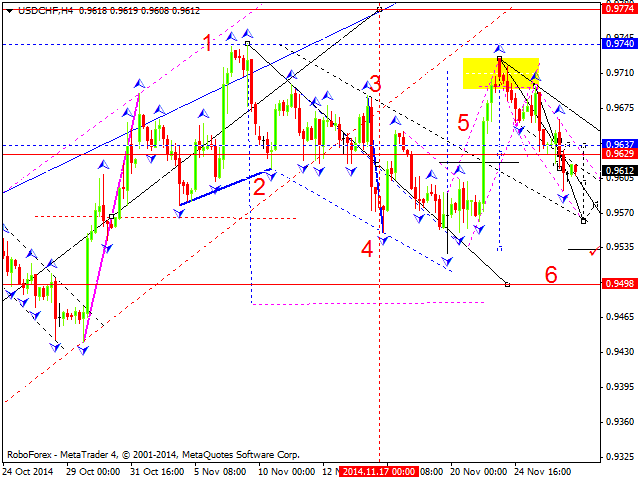

USD CHF, “US Dollar vs Swiss Franc”

Franc is under pressure and continues moving downwards; the pair has formed a continuation pattern near level of 0.9629. We think, today the price may test the broken level from below and then continue falling towards the main target of this extension at level of 0.9533.

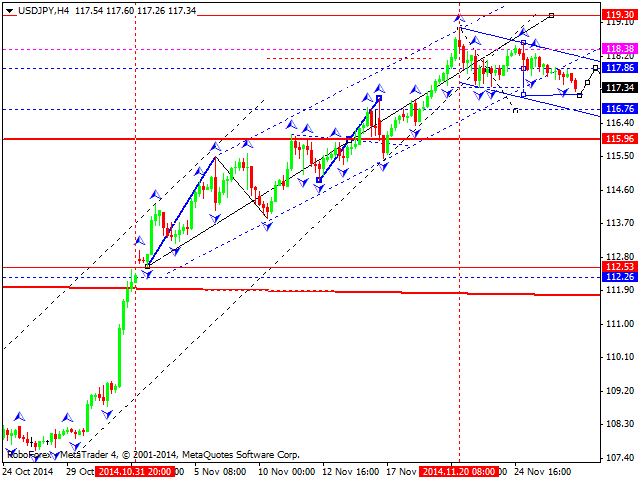

USD JPY, “US Dollar vs Japanese Yen”

Yen is also under pressure and continues falling. We think, today the price may continue this correction towards level of 116.76. Later, in our opinion, the market may resume moving upwards to reach a new maximum.

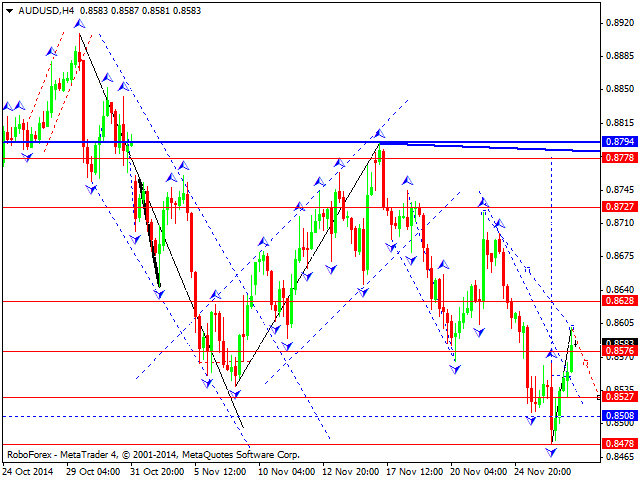

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has completed its descending movement and formed an ascending impulse. We think, today the price may correct this impulse and reach level of 0.8530. Later, in our opinion, the market may start forming another ascending wave with the target at level of 0.8727.

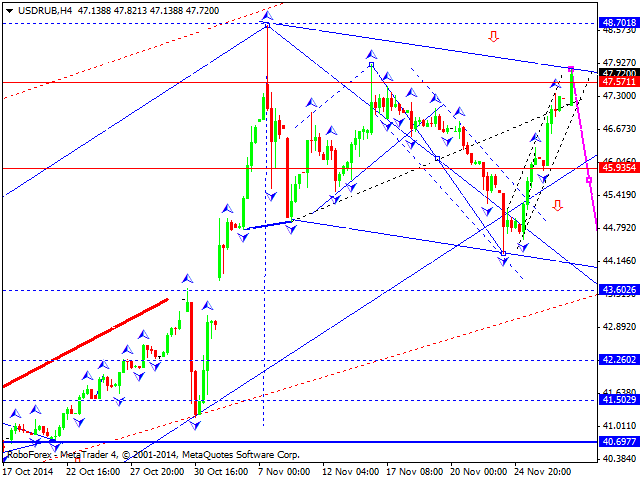

USD RUB, “US Dollar vs Russian Ruble”

Ruble has formed a continuation pattern near level of 45.93 and reached its target. Later, in our opinion, the market may form another descending wave with the target at level of 43.60.

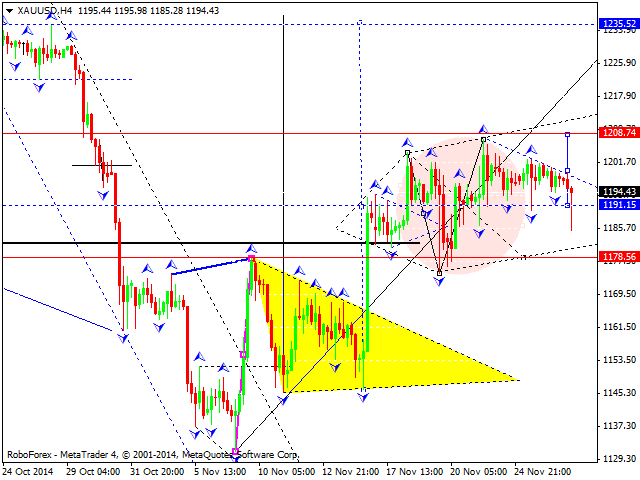

XAU USD, “Gold vs US Dollar”

Gold is still moving downwards inside a consolidation channel. We think, today the price may continue falling and forming this consolidation channel. Possibly, it may test level of 1180. Later, in our opinion, the market may continue growing to reach a local target at 1235.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY drops toward 142.00 ahead of BoJ policy decision

USD/JPY has turned south, approaching 142.00 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.