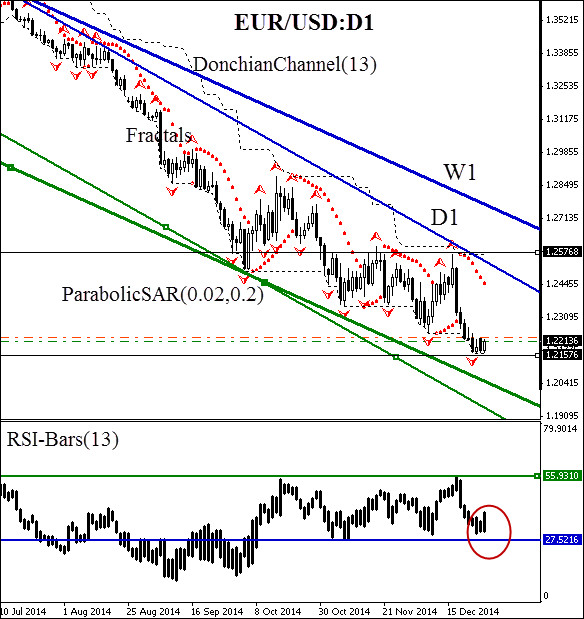

Today we consider EUR/USD currency pair on the D1 chart. In line with long-term bullish players (W1), there is a bearish momentum formation on the daily chart. Parabolic historical values are moving along the D1 downtrend line, confirming the market sentiment. Donchian Channel is also demonstrating the negative bias. The only alarming signal comes from the RSI-Bars oscillator: it indicates the sideways movement. The support breakout at 27.5216% may be considered as a confirmatory signal. It is expected to be preceded by a strong bearish momentum and the price level intersection at 1.21576. This mark can be used for opening a pending sell order with Stop Loss placed above the fractal resistance at 1.25768. This key level is also confirmed by ParabolicSAR historical values, the upper Donchian Channel boundary, and the D1 trend line crossing. We deem that the proposed scheme of risk management should be comfortable for conservative traders.

After position opening, Stop Loss is to be moved after the Parabolic values, near the next fractal high. Updating is enough to be done every day after a new Bill Williams fractal formation (5 candlesticks). Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Sell

- Sell stop below 1.21576

- Stop loss above 1.25768

Recommended Content

Editors’ Picks

EUR/USD maintains its constructive tone and targets 1.1200

EUR/USD managed to add to Wednesday’s gains and climbed to the area of weekly tops around 1.1180 following further weakness in the US Dollar as investors continued to factor in the likelihood of extra rate cuts in the next few months.

GBP/USD retreats below 1.3250 after BoE-inspired rally

GBP/USD loses its bullish momentum and retreats below 1.3250 after touching its highest level since March 2022 above 1.3300 with the immediate reaction to the BoE's decision to leave the policy rate unchanged at 5%. In the US, weekly Jobless Claims declined to 219K.

Gold maintains the upward pressure near $2,600

Following a pullback in the early American session, Gold regains its traction and trades decisively higher on the day at around $2,580. The 10-year US Treasury bond yield retreats toward 3.7%, supporting XAU/USD in the Fed aftermath.

Bitcoin extends gains after Fed cut interest rate

Bitcoin extends recent gains and trades above $62,000 at the time of writing on Thursday, following a 2.4% increase the previous day after the Federal Reserve’s (Fed) dovish decision to cut interest rates by 50 basis points.

BoE expected to keep interest rate unchanged at 5% as price pressures persist

After a close call in August, the Bank of England’s September interest rate decision is keenly awaited for fresh cues on the bank’s future policy action and the pace of its bond sales.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.