The global market experienced a significant fluctuation yesterday with the Russian Ruble crisis causing a chain effect. The Ruble once plummeted by 20% hitting 80 per Dollar, after the central bank raised the interest rate to 17%. As Russia faces falling oil prices and sanctions from international society, their economy is devastated. Traders now are comparing the current situation to 1998 and capital control may be the next move of the authority led by Putin.

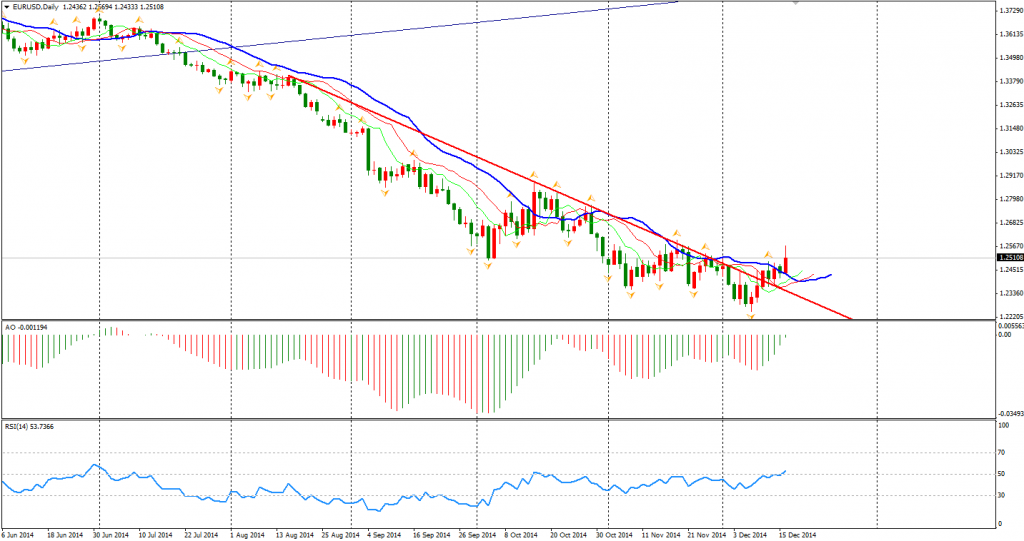

The Dollar index fell as the Euro area confidence rose on QE expectations while US manufacturing PMI fell for the fourth month. The Eurozone composite PMI is 51.7 – higher than the forecast and former reading. The data also showed that demand is recovering in the Euro area and job position growth hit a 5-month high. The Euro Dollar broke the 1.25 resistance after the data release and touched the month high of 1.2570, giving a more confirming sign of bullish reversal.

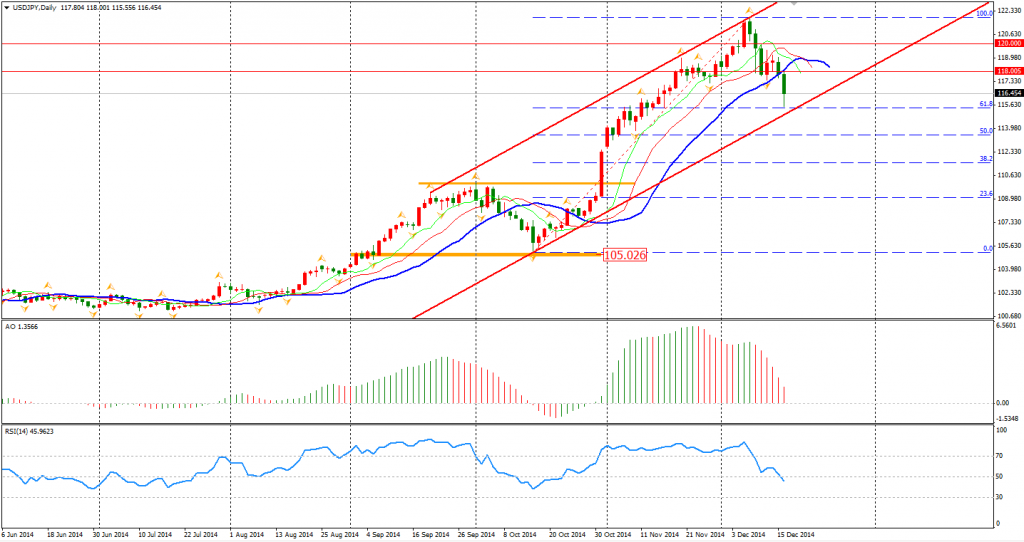

Dollar Yen triggered 115.60 last night. The level is the 38.2% retracement level of the last round of rally from 105 to 122 and lower band of bullish trend. As the middle run outlook of Yen is still bearish, the retreat of the Dollar Yen may be offering a great entry chance for traders using long term strategies.

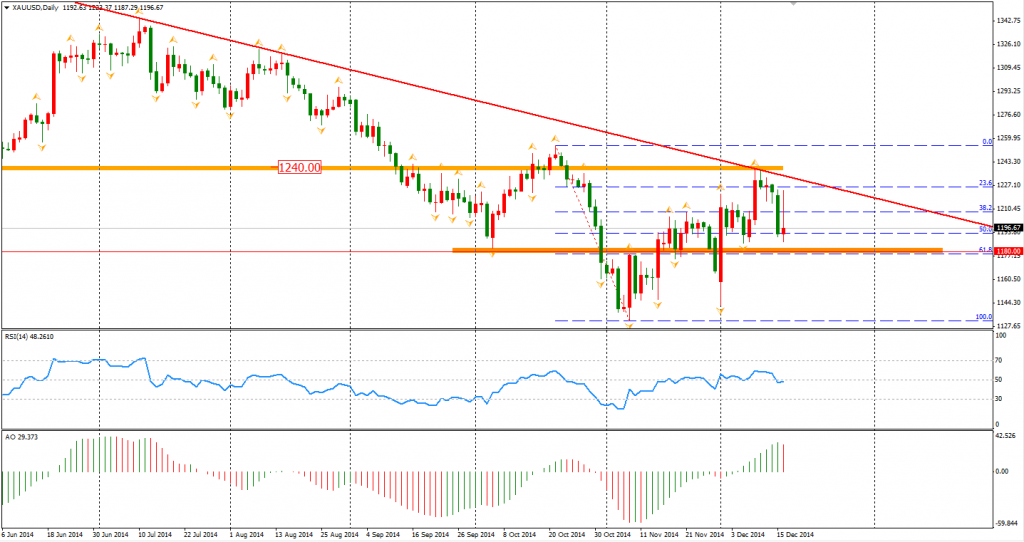

The gold price was on a rollercoaster yesterday. First rallying between $1196 and $1222 and then all gains were erased hitting the day low at $1187. The ripples of the Russian crisis will certainly impact other emerging nations and exacerbate the concerns of the global economy, which support gold‘s safe-haven needs. On the other side, US rate hike expectation limits the upside space. Traders are now waiting for the 2014 last statement of FOMC.

Now to the stock markets. The Shanghai Composite surged 2.31% to 3022 as poor PMI data raised hopes of a stimulus. ASX 200 lost 0.65% to 5152. The Nikkei Stock Average was down 2%. The European markets were inspired by upbeat PMI data, the UK FTSE rebounded by 2.41%, the German DAX and the French CAC Index both bounced over 2%. The US market mostly traded lower. The S&P 500 closed 0.84% lower to 1972. The Dow dropped 0.65% to 17069, and the Nasdaq Composite Index lost 1.24% to 4548.

On the data front, UK Unemployment Rate and Bank of England’s decision will be released at 20:30 AEDST. Euro area final CPI will be at 21:00 AEDST. US CPI and Canadian Wholesale Sales will be out at midnight.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.