USD/JPY is almost unchanged on Monday, as the pair trades at 106.50 in the European session. On the release front, manufacturing indicators are the focus at the start of the trading week. In Japan, Final Manufacturing PMI continued to lose ground, dropping to 48.2 points in April. This marked a second straight reading below the 50 line, pointing to contraction in the manufacturing sector. Over in the US, today’s highlight is ISM Manufacturing PMI. The estimate stands at 51.6 points. Japanese markets are closed for a holiday, so we’re unlikely to see much movement from the pair in the Monday session.

The Bank of Japan surprised the markets last week, holding off from further easing at its Wednesday policy meeting. The yen surged on Thursday and Friday, gaining 500 points in response. USD/JPY is currently trading close to its lowest level since mid-October 2015. The BoJ left unchanged its 80 trillion yen for expanding the monetary base and the 0.1% negative rate on some bank funds held by the central bank. The BoJ also postponed its time frame for its target of 2 percent inflation until 2017. In remaining on the sidelines, the BoJ sent a message that it won’t be rushed into more monetary action and will any further easing will be data-dependent. The BoJ remains concerned about the strengthening yen, but may have concluded that there is little it can do to stop the currency from breaking below the symbolic 100 level, which last occurred in November 2013.

US GDP climbed 0.5% in the first quarter, shy of the estimate of 0.7%. This was considerably lower than the 1.4% gain in the fourth quarter of 2015, and marked the weakest quarter of growth in two years. Although economic growth remains moderate, the lukewarm reading will not help the cause of Fed policymakers who favor a rate hike, especially with inflation at low levels. The markets, which were not expecting an April hike, are keeping a close eye on key numbers, looking for clues as to whether the Fed will make a move at its June policy meeting. The April policy statement sounded cautiously optimistic about the US economy, but did not provide any clues about a hike in June.

One sore spot in the US economy remains the manufacturing sector. Last week, Core Durable Goods dropped 0.2%, well off the estimate of a 0.6% gain. This marked the fourth decline in five months. Durable Goods Orders was stronger at 0.8%, but also missed expectations, as the estimate stood at 1.9%. Recent manufacturing reports, such as the Philly Fed Manufacturing Index have also been soft, as the industry has been hard-hit by weak global demand and a downturn in the US oil industry due to low crude prices. We’ll get a look at the ISM Manufacturing Index later on Monday.

USD/JPY Fundamentals

Sunday (May 1)

- 10:00 Japanese Final Manufacturing PMI. Estimate 48.0. Actual 48.2

Monday (May 2)

-

13:45 US Final Manufacturing PMI. Estimate 51.0

-

14:00 ISM Manufacturing PMI. Estimate 51.6 points

-

14:00 US Construction Spending. Estimate 0.5%

-

14:00 ISM Manufacturing Prices. Estimate 51.0

-

Tentative – US Loan Officer Survey

| S3 | S2 | S1 | R1 | R2 | R3 |

| 104.12 | 105.18 | 106.19 | 107.57 | 108.37 | 109.87 |

-

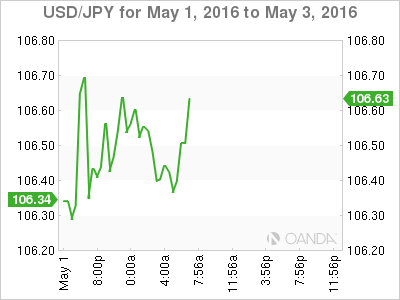

USD/JPY has been drifting in Monday’s Asian and European sessions

-

106.19 is providing weak support, following strong losses by USD/JPY on Friday

-

There is resistance at 107.57

-

Current range: 106.19 to 107.57

Further levels in both directions:

-

Below: 106.19, 105.18 and 104.12

-

Above: 107.57, 108.37, 109.87 and 110.66

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.