USD/JPY has edged lower on Thursday, as the pair trades in the mid-101 range late in the European session. On the release front, US Unemployment Claims enjoyed another strong week, but Building Permits softened in June. Later in the day, the Philly Fed Manufacturing Index will be released. In Japan, the BOJ will release the minutes of this week's monetary policy meeting.

US Unemployment Claims dropped slightly to 302 thousand, beating the estimate of 310 thousand. This figure marks a seven-week low, as the economy continues to churn out impressive employment data. At the same time, the housing sector is struggling, and Building Permits fell to 0.96 million, its lowest level since January. The markets had expected a much stronger reading, with an estimate of 1.04M. Housing Starts followed suit, coming in at 0.89 million, compared to an estimate of 0.89 million.

Federal Reserve Chair Janet Yellen concluded two days of testimony on Capitol Hill on Wednesday, testifying before the House Financial Services Committee. Yellen declined to answer questions about when the Fed would begin to raise rates, but she did acknowledge that most economists expect the Fed to make a move in the third quarter of 2015. On Tuesday, the dollar moved higher when Yellen said that the economy still required monetary stimulus, but rates could increase sooner than expected if inflation and job numbers improved more quickly than anticipated. The Fed's asset purchase program (QE) has flooded the economy with over $2 trillion, keeping interest rates at ultra-low levels, but the Fed has been steadily reducing the program since last December. Currently, the Fed is pumping $45 billion/month into the economy, and the next taper is expected in August, with plans to terminate QE in October.

Recent US inflation numbers have been weak, so the markets were pleasantly surprised with the June release of the Producer Price index, the primary gauge of inflation in the manufacturing sector. The index improved to 0.4%, beating the estimate of.0.2%. Core PPI, which excludes volatile items, posted a weak gain of 0.2%, matching the estimate. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, if inflation data continues to beat expectations, there will put more pressure on the Fed to raise rates.

At a policy meeting this week, the Bank of Japan opted to hold course with its current monetary easing, and the minutes will be released later on Thursday. Any unexpected dissensions amongst policymakers in the minutes could have an impact on USD/JPY. Under current monetary policy, the money base has been increasing at an annual pace of 60-70 trillion yen. This has led to a severe weakening of the yen, so traders can expect the currency to remain below the 100 level, absent unexpectedly strong data out of Japan.

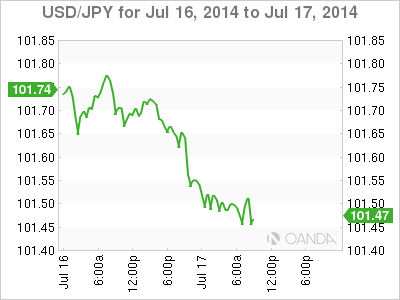

USD/JPY 101.47 H: 101.66 L: 101.40

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.