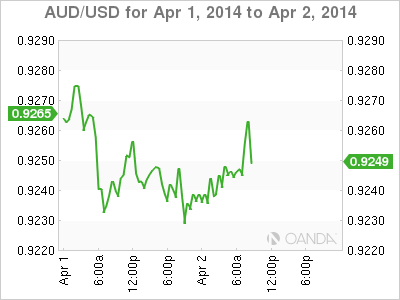

AUD/USD is showing little movement on Wednesday, continuing the trend we've seen throughout the week. Early in the North American session, the pair is trading in the mid-0.92 range. In economic news, Australian Building Permits dropped sharply, slumping to an eight-month low. Australian AIG Services Index will be released later in the day. Over in the US, ADP Nonfarm Employment Change looked sharp, posting a strong gain in February.

The first US employment release of the week met high expectations, as ADP Nonfarm Payrolls jumped to 191 thousand, up from 139 thousand a month earlier. This practically matched the estimate of 192 thousand. The markets will get a good look at the US employment picture in the next few days, with Unemployment Claims, the Unemployment Rate and NFP still to come.

Australian Building Permits looked awful, plunging by 5.0%, compared to a gain of 6.8% a month earlier. The estimate stood at -1.7%. The key indicator is notorious for strong fluctuations, which of often in estimates that are way off the mark. Meanwhile, the RBA maintained the benchmark interest rate at 2.50%, where it has been pegged since last August. RBA Governor Glenn Stevens took a swipe at the Aussie, saying that the high value of the currency in the past few months was not good for economic growth. After the rate decision, the Australian dollar briefly pushed above the 0.93 line, its highest level in four months. Last week, Stevens said that interest rates are unlikely to rise in 2014, as the RBA tries to boost consumer spending and residential construction.

Earlier in the week, Fed chair Janet Yellen said that inflation and employment levels needed to improve considerably, and the Federal Reserve would continue to provide monetary stimulus for some time. Currently, the Fed is purchasing $55 billion in assets under its QE scheme. There have been three tapers to QE so far, and Yellen plans to wind up the program in the fall, provided that the US economy does not run into any serious turbulence. At the same time, the Federal Reserve has stated that it has no plans to raise interest rates until sometime in 2015.

AUD/USD 0.9249 H: 0.9364 L: 0.9223

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.