Today European stock indices continue to grow at the prospect of 500-550 billion euro emission which is likely to be announced on Thursday at a regular session of the European Central Bank. As exchange markets are closed and Thursday is still far ahead, the European Union observes a rather weak share price growth. Significant macroeconomic data are not expected to be published today. On Friday euro hit a new 11-year low as a result of the National Bank of Switzerland decision we had written about in our previous overview. Today the European currency is slightly moving up. We believe that until the next ECB meeting takes place, euro is likely to be traded sideways.

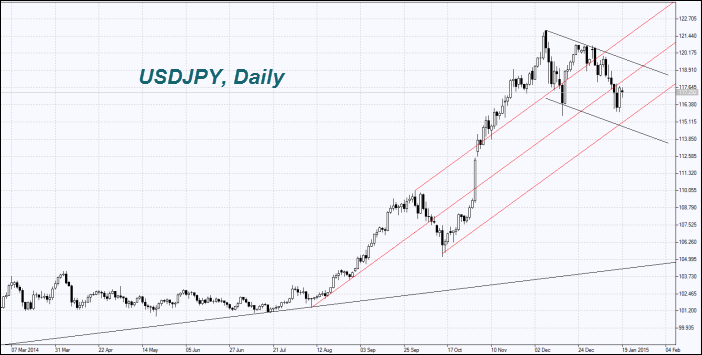

Nikkei has risen this morning together with other world stock indices. It was partly encouraged by the growth of the Japanese consumer confidence marker in December, which slightly outstripped forecasts. JPY/USD slipped in expectation of the Bank of Japan meeting (which is to take place January, 20-21). Investors anticipate the positive forecast of the core inflation rate for the current year, which is likely to decline from 1.7% predicted in October to 1.5%. Herewith, on Wednesday morning the Bank of Japan holds the final press conference and may declare the augmentation of emission and the raised GDP forecast. Analysts do not expect any particular macroeconomic data concerning Japan to be announced tomorrow.

Chinese officials will publish a report on GDP for the fourth quarter along with industrial production and retail sales data in December. In our estimation, forecasts are negative. There is a risk that the GDP growth will not meet the Chinese government’s expectations or even reaches its 24-year low. In this case, commodity futures prices may drop.

As we assumed in our previous overviews, oil and gold prices continued to grow. According to Baker Hughes, the oilfield services company, the number of US-based oil wells reduced by 55. This reduction is the second biggest within 24 years and has already been the sixth one in a row. We recall that the week earlier this number of oil wells decreased by 61. At the moment, there are 1366 operating oil wells, their quantity has been at its minimum since October 2013. We suppose that the rundown in drilling is absolutely logical. When oil price had fell by almost 60% within 6 months, the majority of oil fields became unprofitable. The dwindling number of wellsites may result in oil output declining and the price increasing. According to the U.S. Commodity Futures Trading Commission, the number of net long positions for WTI crude oil rose by 12% last week.

Gold hit its 4-month high at the prospect of the expected euro printing. The SPDR Gold Trust weekly reserves gained 1.9% and made up 730.9 tons. This has been the max growth since May 2010.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.