The EUR/USD pair starts the week with a slight positive tone, having advanced up to 1.1261 during the Asian session. A stronger Japanese Yen drove the dollar lower across the board, amid falling stocks.

Chinese equities are once again under pressure, down 1.5%, as last week intervention optimism seems to be fading. European indexes are struggling around their opening levels, with an increasing bearish potential that should weigh on the greenback if it continues. Germany released its Retail Sales for July, up 1.4% in the month, and 3.3% compared to a year before, which also supported the advance in the EUR.

View live chart of the EUR/USD

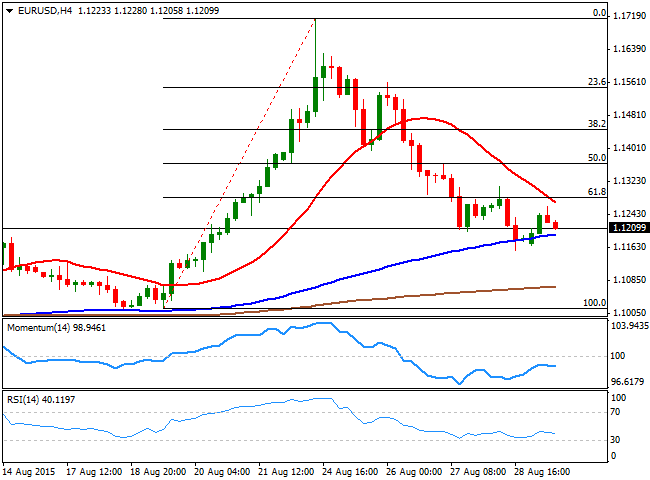

Nevertheless the technical picture is still bearish for the EUR/USD, as the 4 hours chart shows that the intraday recovery stalled below the 61.8% retracement of these last two weeks rally around 1.1280, whilst the 20 SMA maintains its sharp bearish slope around it. In the same chart, the technical indicators are grinding lower in negative territory, supporting a downward continuation for the upcoming hours. The immediate support comes around 1.1160, with a break below signaling a downward continuation towards the 1.1120 price zone.

Only above 1.1280, the mentioned Fibonacci resistance, the pair may revert its negative intraday tone, and be able to recover up to the 1.1330 price zone.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.