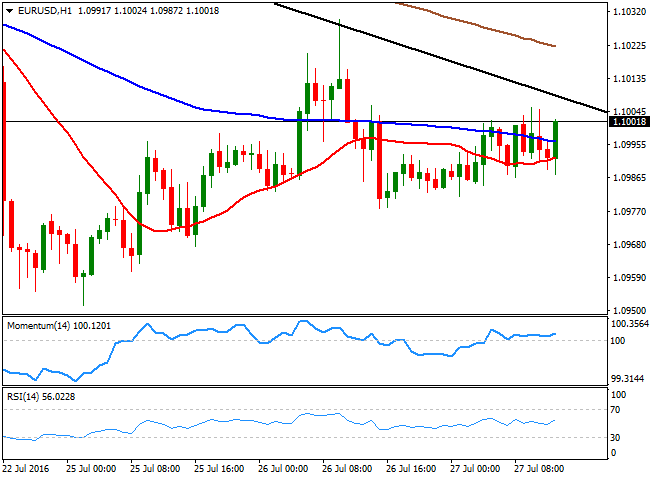

EUR/USD Current price: 1.1002

View Live Chart for the EUR/USD

Markets were all about the yen and the Aussie at the beginning of the day, with Japan unveiling a 28 trillion yen stimulus plan, and Australian trimmed inflation beating expectations, trimming chances of a soon-to-come rate cut in Australia. Europe released some minor data, among which, German CFK consumer confidence stood out, printing 10.0, against the 9.9 expected. Nevertheless, the EUR/USD pair remained confined to a tight 25 pips range ever since the day started, maintaining the bearish bias seen on previous updates.

Ahead of the US FED´s economic policy announcement, the dollar was marginally higher across the board, but turned lower after the release of poor US Durable Goods orders figures for June, down by 4.0% against a 1.1% drop expected. The core reading came in at -0.5%, from previous -0.3% and expectations of 0.3%. The 1 hour chart for the EUR/USD pair shows that the price is a few pips above its 20 and 100 SMAs, whilst the technical indicators turned higher around their mid-lines, in lacking enough momentum to confirm any directional move. In the 4 hours chart, the price is holding a few pips above a bearish 20 SMA, while the technical indicators remain around their mid-lines, also lacking directional strength.

Support levels: 1.0955 1.0910 1.0840

Resistance levels: 1.1000 1.1050 1.1090

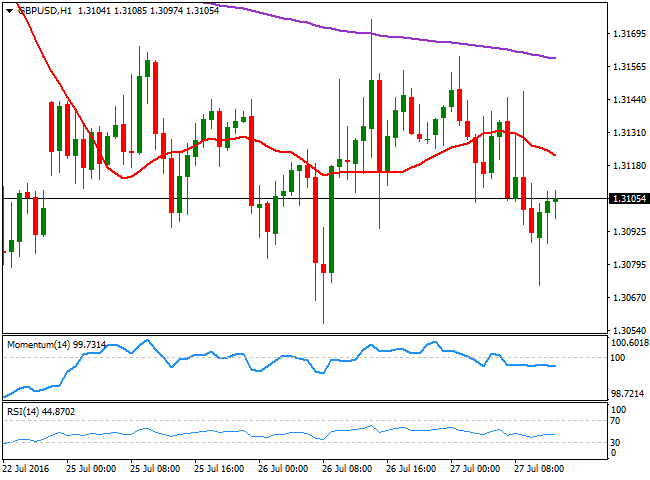

GBP/USD Current price: 1.3106

View Live Chart for the GBP/USD

The GBP/USD pair hovers around the 1.3100 level, having erased most of the tepid gains posted on Tuesday. The release of the UK second quarter GDP failed to motivate investors, as it was mostly pre-Brexit data. Nevertheless, the figures surprised to the upside, with the economy growing by 0.6% in the three months to June, up also compared to a year before by 2.2%, against previous 2.0%. The pair is trading within 1.3071 an 1.3160, and with short term technical readings supporting a downward extension, given that in the 1 hour chart, the price is below a bearish 20 SMA, whilst the technical indicators head modestly lower within bearish territory. In the 4 hours chart, the price is a handful of pips below a horizontal 20 SMA, while the technical indicators keep hovering around their mid-lines, with no directional strength.

Support levels: 1.3070 1.3030 1.3000

Resistance levels: 1.3120 1.3175 1.3230

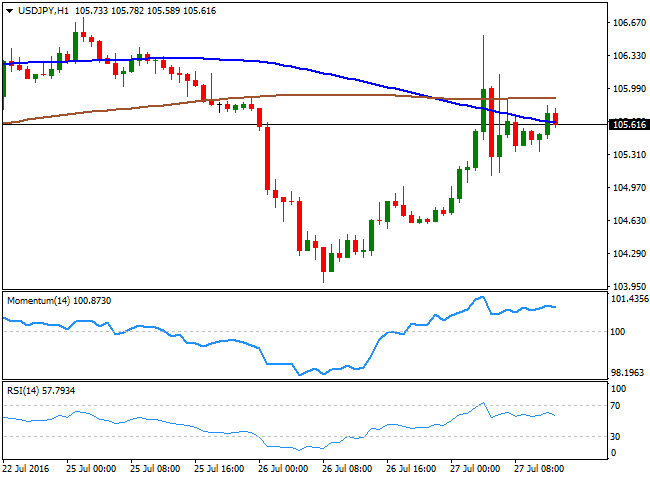

USD/JPY Current price: 105.62

View Live Chart for the USD/JPY

Wild swings on stimulus package. The USD/JPY pair saw some wild moves during the past Asian session, surging up to 106.53, on news that Abe was planning a 28T yen stimulus package, alongside with the emission of 50-year bonds. The Minister of Finance, Taro Aso, denied that they were considering such long term bonds, sending the pair down to 105.95, from where it then recovered back, after the amount of the stimulus package was confirmed. The pair however, stands below the 106.00 level ahead of the US opening, shedding some ground after the release of poor US Durable Goods Orders figures for June. Technically, the 1 hour chart shows that the price is struggling around a modestly bearish 100 SMA, whilst the technical indicators have turned lower within positive territory, having already corrected extreme overbought readings. In the 4 hours chart the pair extended its recovery after bouncing from its moving averages, while the technical indicators present modest bullish slopes, but are still below their mid-lines, not enough to confirm further gains for today.

Support levels: 104.60 104.20 103.70

Resistance levels: 106.10 106.60 107.00

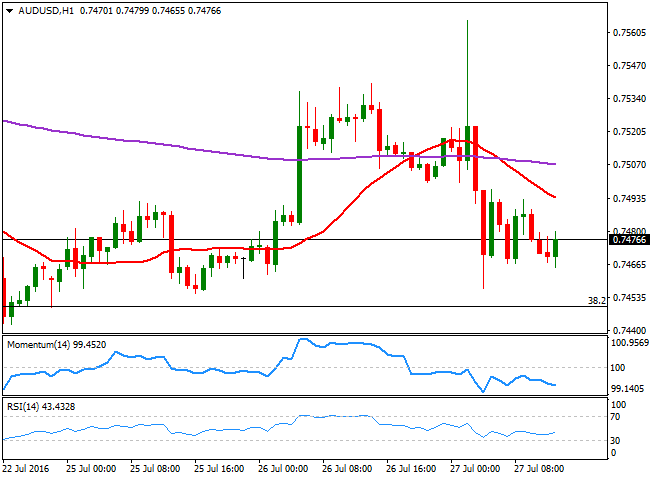

AUD/USD Current price: 0.7476

View Live Chart for the AUD/USD

The Australian dollar surged to a daily high of 0.7565 against the greenback, following the release of much-better-than expected Q2 trimmed CPI, up by 1.7% against expectations of a 1.5% advance. However, the AUD/USD pair was unable to hold on to gains, plummeting to 0.7456 on a sudden dollar recovery after Japanese news, holding below the 0.7500 level ahead of US opening. The inability to retain the 0.7500 level, in spite of strong inflation data should be worrisome for long term bulls. Now bouncing on poor US data, the 1 hour chart retains a negative tone, as the 20 SMA heads lower above the current level, whilst the technical indicators head lower within bearish territory. In the 4 hours chart, technical indicators present a neutral stance, whilst the price remains below the 20 SMA and the 200 EMA, both flat in the 0.7490 region.

Support levels: 0.7450 0.7410 0.7330

Resistance levels: 0.7490 0.7530 0.7580

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.