ASIA ROUNDUP:

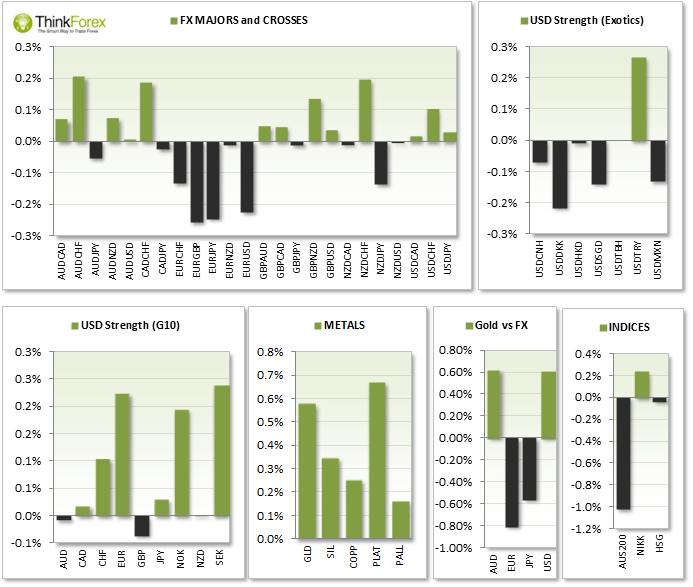

As the situation win Ukraine intensifies money has continued to flow into safe havens such as Gold and JPY, however XAUJPY is also going up making the yellow metal the clear winner of the safe havens during Asian trading.

Relatively quiet across FX as markets await London open.

The Euro gapped down following Draghi's comments at G20 minutes and the gap is yet to be closed.

AUDUSD range trades beneath 0.940 and within Friday's Hanging Man Candle;

Cable retraced some of Friday;s losses but looks bearish below 1.675 resistance

USDCAD came close to testing 1.10 resistance but may favour bearish setups below this key level. US Retails sales tonight should be the catalyst to respect or break this level.

UP NEXT:

TECHNICAL ANALYSIS:

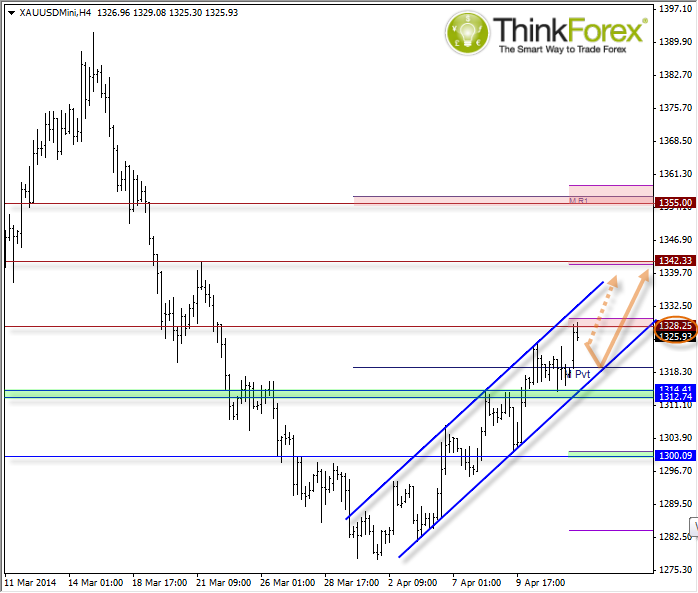

GOLD: Finds resistance beneath 1328 but bias remains bullish

Gold continues to gain strength and already tested $1328 resistance just after Asia open. Within a clear bullish trend and well defined cycles the bias for continued gains is pretty clear.

If $1328 holds as resistance then buying opportunities above $1320 should be considered.

Only a break below the lower bullish channel and / or the $1314 swing low invalidates the bullish bias on the H4 and D1 charts.

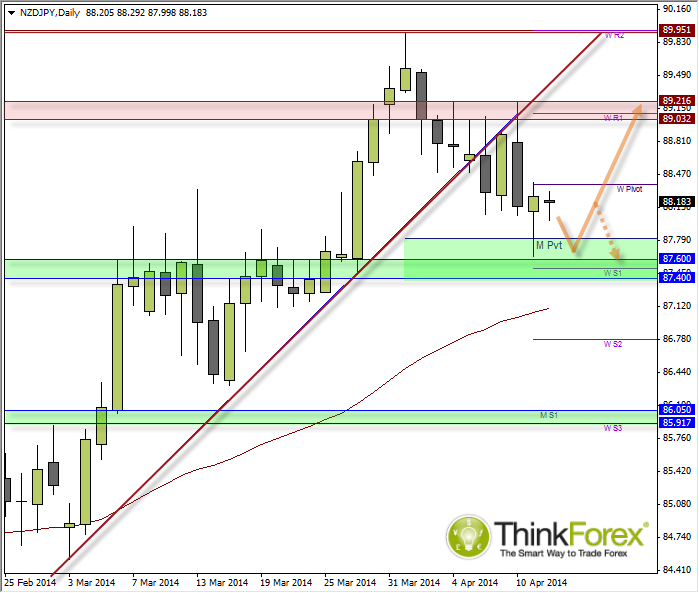

NZDJPY: Potential for pivotal low above 87.60

The previous analysis called for a return to the bullish trend following the Bullish Engulfing candle 3 trading session ago (comparing the open and close to the previous open and close). Whilst the trade started out well, sadly it did not maintain the bullish stance to break through the support zone and drop down to 87.60.

However this low is now part of a Bullish Hammer which has formed above a revised support zone, comprising of the Monthly Pivot and horizontal S/R.

Overall I am an NZD bull due to the positive sentiment, fundamental outlook and suspected rate increases this year. All that is required now is for Yen's 'safe haven' status it has enjoyed this part week and a half and I believe we will see our swing low.

As we are currently trading beneath the weekly pivot I suspect we will range trade within Friday's candle until a new catalyst arrives. Potential ones to look out for are NZ CPI on Wednesday, China figures, Yellen speech on Thursday (USD strength/weakness), and the Ukraine at any moment.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.