EUR/USD Current Price: 1.1134

View Live Chart for the EUR/USD

The EUR/USD pair edged lower for a third day in-a-row, down as the dollar benefited by a reversal in oil's prices and fading risk appetite. During the European morning, news hit the wires announcing an agreement among Saudi Arabia, Russia and other oil producers, to freeze output at January levels. Oil was trading higher ahead of the news, but suddenly reversed course, as the announce was quite short of market's expectation which pointed for a production cut. Also, and as broadly expected, the German ZEW index disappointed, hit by market turmoil. According to February data, the assessment of the current situation fell to 52.3 from 59.7 in the previous month, while expectations dropped to 1.0 from a previous 10.2. In the US, the February 2016 Empire State Manufacturing Survey indicates that business activity continued to decline for local manufacturers, posting a larger-than-expected drop, down to -16.6.

The technical bias for the pair is bearish, as its again pressuring the 1.1120 region by the end of the day, and with the short term picture pointing for a continued decline, as in the 1 hour chart, the price broke below the 20 SMA and remained below it during the American afternoon, whilst the technical indicators head lower within bearish territory. In the 4 hours chart, the 20 SMA has accelerated its decline above the current level, now offering resistance around 1.1210, whilst the Momentum indicator hovers near oversold levels and the RSI indicator heads south around 34. A downward acceleration through the mentioned support should see the decline accelerating towards the 1.1040/50 region during this Wednesday.

Support levels: 1.1120 1.1080 1.1045

Resistance levels: 1.1160 1.1210 1.1250

EUR/JPY Current price: 126.82

View Live Chart for the EUR/JPY

The EUR/JPY pair turned south this Tuesday, as the Japanese yen recovered its charm on renewed risk aversion, and the EUR maintained a weak tone against all of its major rivals. The pair initially rallied as Asian share markets closed generally higher, but was unable to extend beyond the 128.00 level, and turned south following oil's decline. Having erased all of its recent gains, the pair is poised to extend its decline in the short term, given that in the 1 hour chart, the price is accelerating below a firmly bearish 100 SMA, while the technical indicators maintain their negative slopes near oversold territory. In the 4 hours chart, the price remains well below its moving averages, although the 100 SMA is still above the 200 SMA, while the Momentum indicator stands flat in neutral territory, and the RSI indicator hovers around 38, indicating no directional strength at the time being.

Support levels: 126.30 125.85 125.40

Resistance levels: 127.10 127.60 128.15

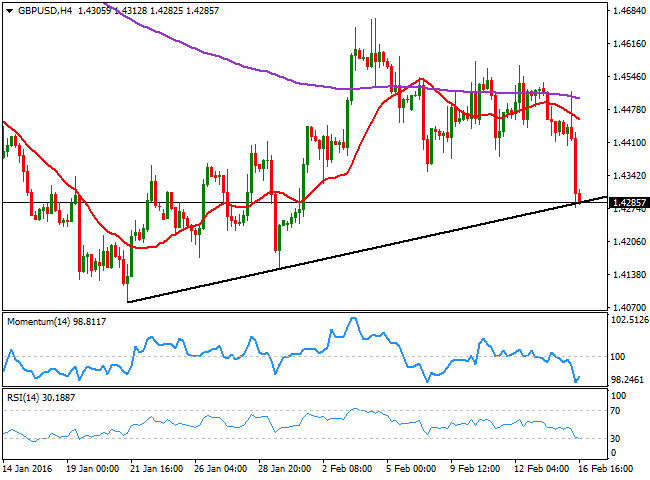

GBP/USD Current price: 1.4286

View Live Chart for the GBP/USD

The GBP/USD pair fell after the release of the UK inflation data, as the headline consumer price inflation rose to 0.3%YoY in January from the 0.2%YoY rate recorded in December, but decline by 0.8% compared to a month before during the same period. Core inflation slowed to 1.2% year-on-year, while the Producer Price Indexes showed a sharp decline both in output and input. The pair was trading higher ahead of the news, but sharply reversed afterwards, extending its decline below the 1.4300 figure in the US session. This Wednesday, the kingdom will release its January employment figures, with wages expected to remain subdued. If that's the case, the reality will be that there isn't enough inflationary pressure over the Bank of England, and therefore a rate hike will remain out of the table for longer than expected. The 1 hour chart shows that the technical indicators have turned back south within oversold territory, while the price is well below a bearish 20 SMA, currently around 1.4410, supporting some further declines. In the 4 hours chart, the technical indicators are showing signs of exhaustion towards the downside within oversold territory, but at the same time the price shows a strong bearish acceleration after failing to overcome its 200 EMA, all of which supports the shorter term view.

Support levels: 1.4250 1.4210 1.4170

Resistance levels: 1.4325 1.4370 1.4410

USD/JPY Current price: 113.92

View Live Chart for the USD/JPY

The USD/JPY pair traded as high as 114.86 during the past Asian session, but reversed course during European trading hours. Now recovering from a daily low of 113.58, the short term picture the upside seems limited, but the downward potential has decelerated, as in the 1 hour chart, the price trades below a bearish 200 SMA, while the technical indicators remain well into bearish territory, but with no directional strength. In the 4 hours chart, the technical indicators are aiming to recover ground within positive territory, after erasing the overbought conditions reached earlier in the day. Nevertheless, the pair will continue trading on sentiment, and upcoming direction will depend on Asian share markets' behavior, as if equities trade into the red, the Japanese will likely strengthen. The main support is the 113.35, as a break below it should see the pair accelerating its decline towards the 111.00 region, last week lows.

Support levels: 113.60 113.35 113.00

Resistance levels: 114.20 114.75 115.20

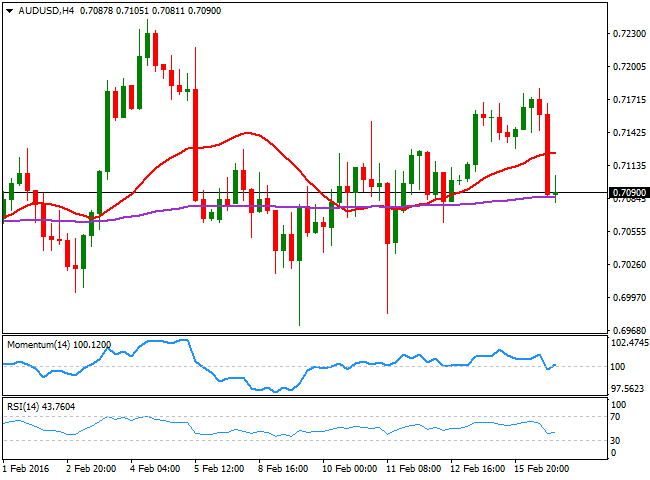

AUD/USD Current price: 0.7089

View Live Chart for the AUD/USD

The Aussie started the day with a strong footing, advancing up to 0.7181 against the greenback at the beginning of the Asian session. The release of the latest RBA Minutes had no impact on the pair as they did not reveal anything new. The Minutes supported the short term advance, as they showed that a weaker currency has boosted demand for domestic production, whilst the RBA seems to be comfortable with the current levels of the AUD. The AUD/USD pair however, accelerated its decline during the American afternoon as the dollar gained momentum, following a sharp decline in oil. The AUD/USD 1 hour chart shows that the price is far below a bearish 20 SMA, while the technical indicators hold flat near oversold levels, maintaining the risk towards the downside. In the 4 hours chart, the price is hovering around its 200 EMA after breaking below the 20 SMA, while the technical indicators hover around their mid-lines, reflecting limited selling interest at current levels, in spite of the latest decline. Further slides below 0.7070 however, will increase chances of a bearish continuation towards the 0.6980 price zone.

Support levels: 0.7070 0.7030 0.6980

Resistance levels: 0.7110 0.7150 0.7190

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.