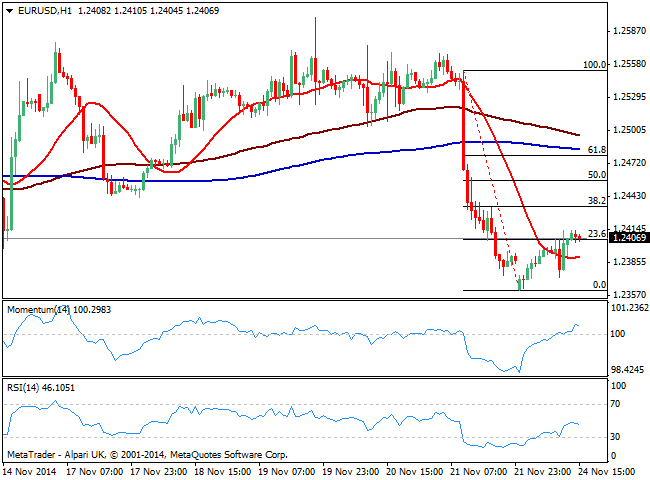

EUR/USD Current price: 1.2410

View Live Chart for the EUR/USD

The EUR/USD found intraday support in a better than expected German IFO number, showing local confidence rose to a 7-month high after the tepid GDP growth in the country; nevertheless, the pair’s recovery stalled so far at 1.2414 daily high, having been lifeless after the news. The US will release some manufacturing and services data in the upcoming hours which may imprint some life to the pair, but volume seems to be missing in action today. Technically, the 1 hour chart shows indicators losing upward strength and turning lower above their midlines, while price hovers above a flat 20 SMA and around the 23.6% retracement of the post Draghi decline. In the 4 hours chart indicators bounced from oversold levels, but remain well into negative territory, as 20 SMA gains bearish slope well above current price. The 1.2440 price zone stands as immediate resistance, whilst downward pressure will increase only with a break below 1.2360 year low.

Support levels: 1.2360 1.2325 1.2280

Resistance levels: 1.2440 1.2485 1.2520

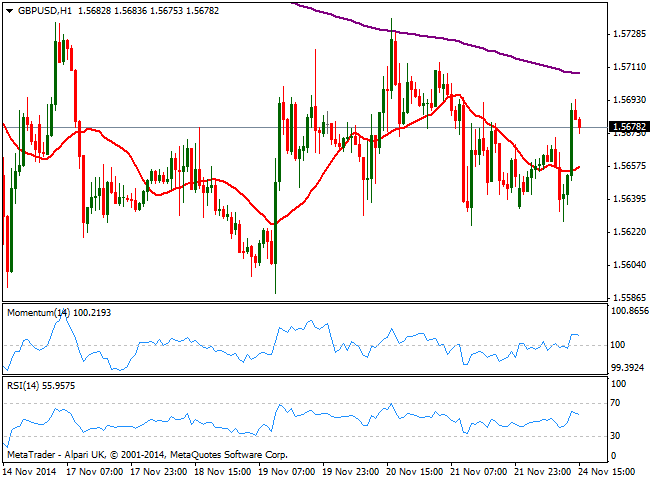

GBP/USD Current price: 1.5678

View Live Chart for the GBP/USD

Pound saw a short term demand alongside with EUR against the greenback, yet the pair was unable to regain the 1.5700 level. The 1 hour chart shows no directional strength coming from technical readings, although price stands above its 20 SMA and indicators in positive territory. In the 4 hours chart technical readings present a neutral stance, as per price contained for seventh day in a row within range. The top of this last stands around 1.5740 and will probably contain the upside today ahead of tomorrow’s BOE inflation hearings.

Support levels: 1.5650 1.5610 1.5585

Resistance levels: 1.5695 1.5740 1.5770

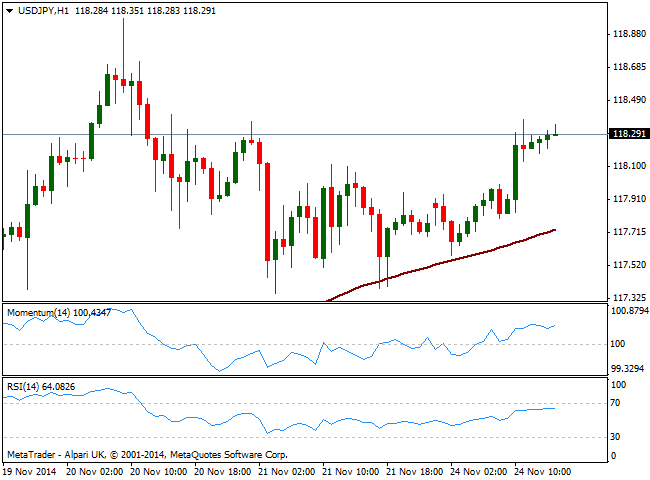

USD/JPY Current price: 118.29

View Live Chart for the USD/JPY

The USD/JPY presents some limited advances this Monday, extending above the 118.00 level ahead of US opening. The 1 hour chart shows indicators aiming slightly higher above their midlines, while 100 SMA provides support now in the 117.70 region. In the 4 hours chart momentum diverges from price, crossing its midline to the downside within neutral territory, whilst RSI aims higher at 64 and moving averages maintain their strong upward slopes well below current price.

Support levels: 118.20 117.70 117.45

Resistance levels: 118.60 119.00 119.40

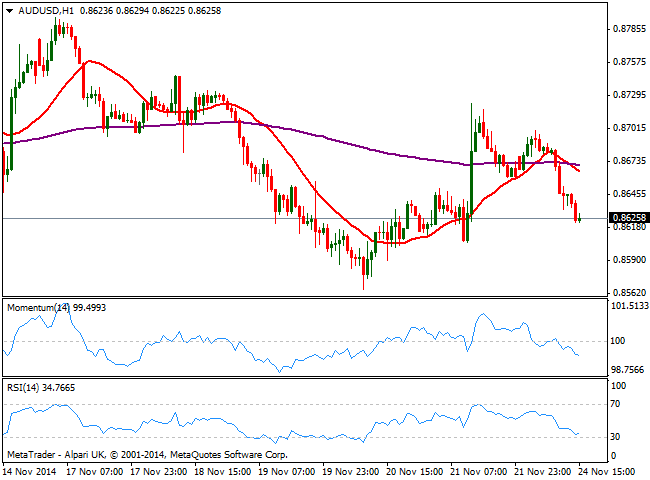

AUD/USD Current price: 0.8625

View Live Chart of the AUD/USD

Australian dollar trades at its daily low against the greenback, gaining bearish momentum in the short term, as the 1 hour chart shows 20 SMA turning strongly south above current price as indicators accelerate below their midlines, supporting some further short term declines. The 4 hours chart supports the shorter term outlook, with price accelerating below a bearish 20 SMA while indicators turned strongly south, albeit momentum holds for now above 100; immediate support stands now at 0.8590 with a break below exposing recent lows in the 0.8550 price zone.

Support levels: 0.8590 0.8550 0.8510

Resistance levels: 0.8660 0.8700 0.8740

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.