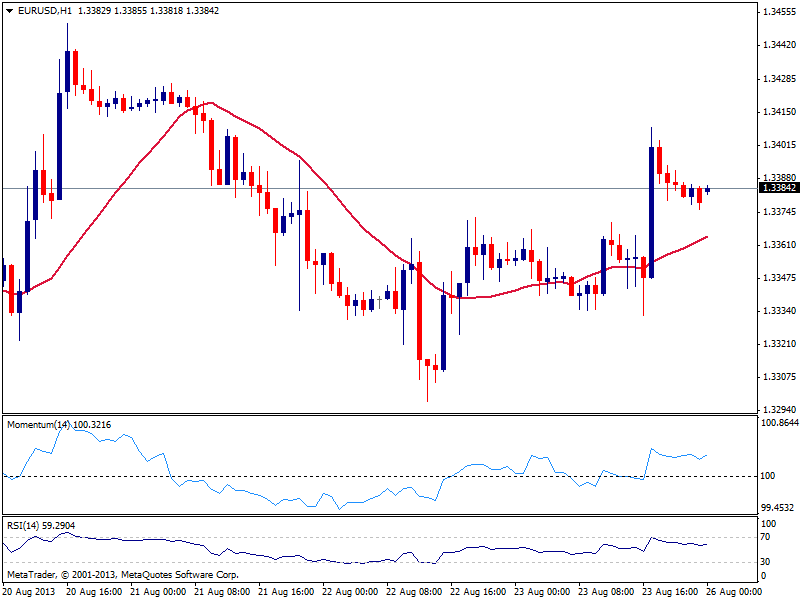

EUR/USD Current price: 1.3384

View Live Chart for the EUR/USD

Quiet start of the week with little to report but some early yen strength sees EUR/USD trading steadily near its recent highs. Despite some selling pressure seen along past week, bulls hold the lead taking dips as buying opportunities. Whether the FED may start to tapper and for how much, are questions that remain unanswered, and the one major risk for current trend. In the meantime, the last week of low summer volumes may see even thinner moves across the board.

As for the short term, the hourly chart supports the upside, with indicators heading north in positive territory and price above a bullish 20 SMA. In the 4 hours chart technical readings present a more neutral stance, although indicators stand in positive territory supporting the shorter term view. A clear acceleration above 1.3420 is now required to confirm a retest of 1.3450 recent highs.

Support levels: 1.3370 1.3330 1.3290

Resistance levels: 1.3420 1.3450 1.3485

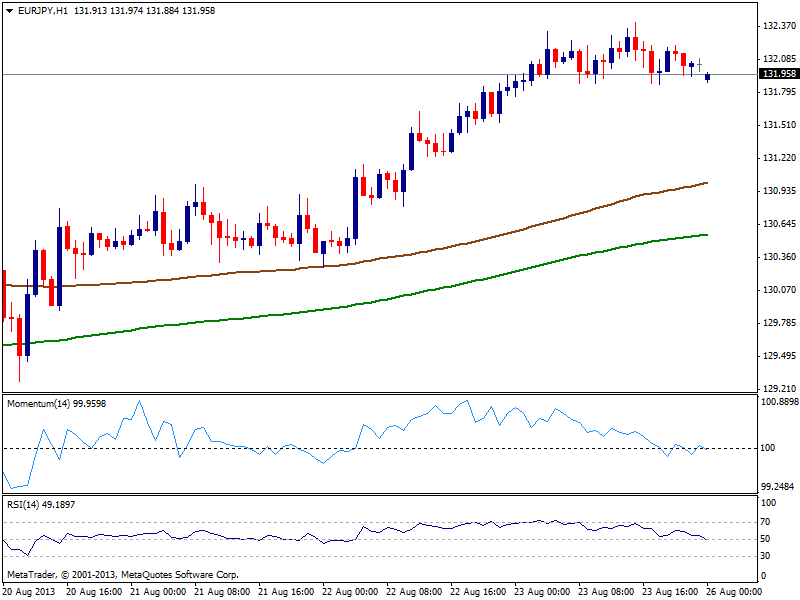

EUR/JPY Current price: 131.95

View Live Chart for the EUR/JPY

Slightly lower yen is up across the board as Bank of Japan Governor Haruhiko Kuroda, now in Jackson Hole, said his asset buying program “has started to exert effects”. The pair however, is little changed from Friday’s close holding around the 132.00 area. The hourly chart shows 100 and 200 SMAs advancing higher below current price, although indicators heading lower around their midlines. 4 hours chart shows indicators exhausted to the upside and turning south in overbought levels, supporting some downside correction towards 131.60, although further losses are not yet seen.

Support levels: 131.60 131.10 130.70

Resistance levels: 132.40 133.00 133.55

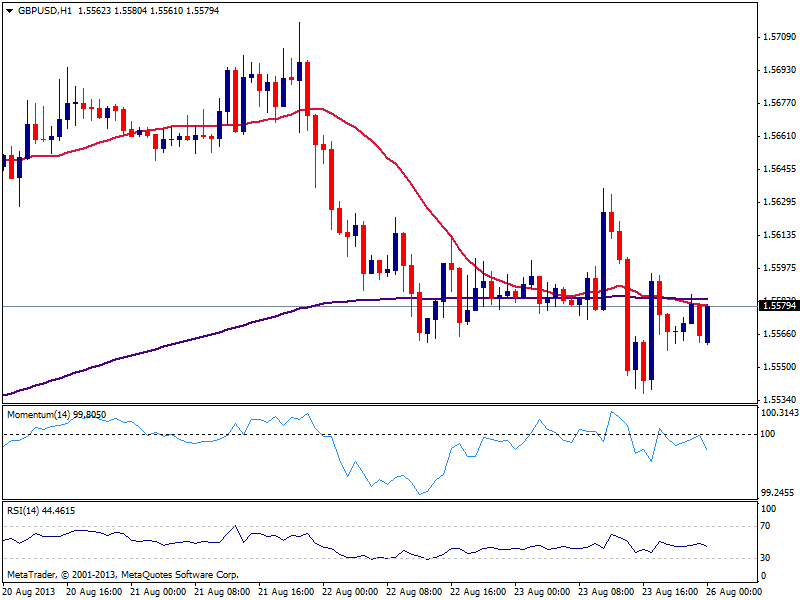

GBP/USD Current price: 1.5579

View Live Chart for the GBP/USD

Pound opens with a positive tone, trying to regain some ground against the greenback, capped so far below its 20 SMA in the hourly chart and with indicators heading south, retracing from their midlines. Bigger time frames seem not that encouraging, as the 4 hours chart shows price capped below a bearish 20 SMA and indicators heading south in negative territory. There’s little place for recoveries as long as price stands below 1.5600/10 area, immediate resistance, while a breach of recent lows around 1.5520 should point for another leg lower.

Support levels: 1.5520 1.5480 1.5440

Resistance levels: 1.5605 1.5640 1.5690

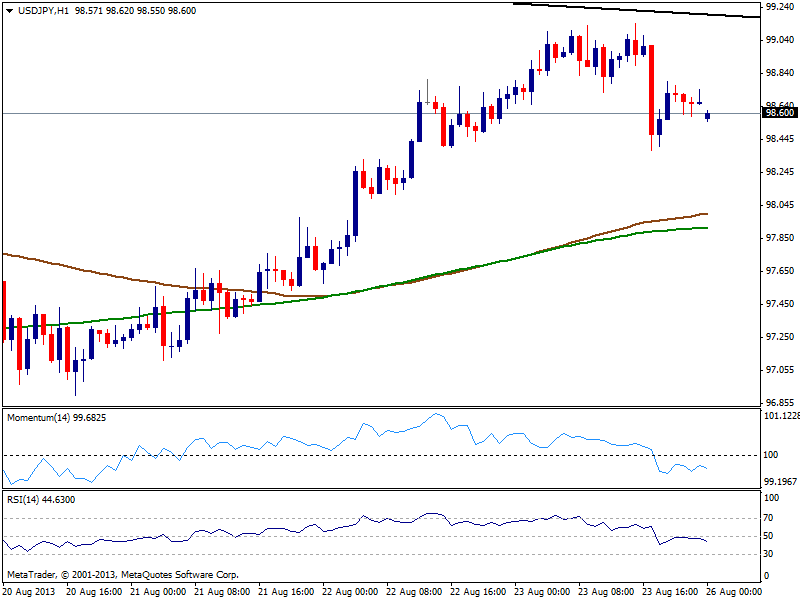

USD/JPY Current price: 98.60

View Live Chart for the USD/JPY

USD/JPY flirted with 99.00 past Friday, only to close the day again below its 100 DMA. The pair found sellers a few pips below a daily descendant trend line coming from 103.72 this year high, currently around 99.20. As for the hourly chart, the technical outlook is bearish with indicators heading south in negative territory, although moving averages converging around 97.80 area should offer support in case of further slides. Overall, bears keep control of the pair and approaches to mentioned trend line should be understood as selling opportunities.

Support levels: 98.40 98.10 87.80

Resistance levels: 99.20 99.60 100.00

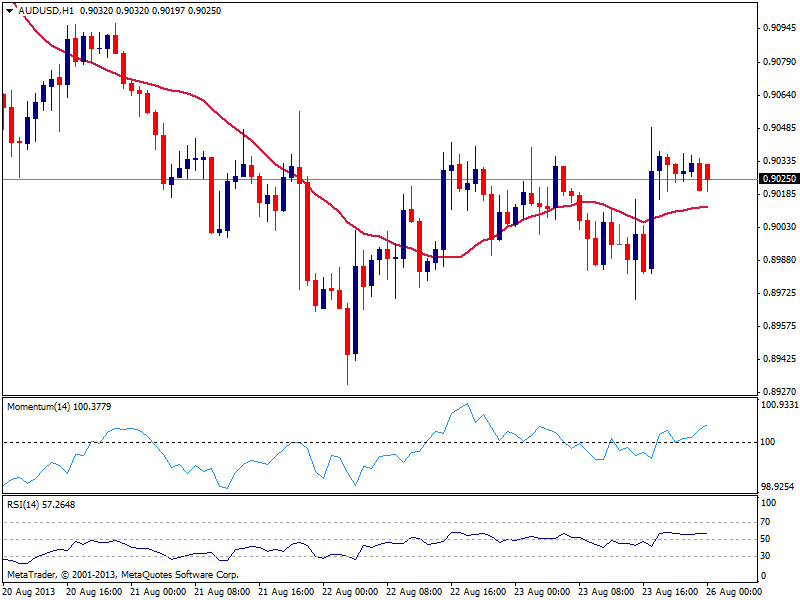

AUD/USD Current price: 0.9025

View Live Chart for the AUD/USD

The AUD/USD continues to refuse to accelerate below the 0.9000 level, having spent most of the past two days ranging around the level. Nevertheless, the upside also remains limited, with sellers so far aligned in the 0.9050 price zone. As for technical readings, the hourly chart shows a slightly positive tone, with indicators above their midlines and price holding above a flat 20 SMA, while the 4 hours chart maintains a neutral stance.

Support levels: 0.8990 0.8955 0.8920

Resistance levels: 0.9050 0.9080 0.9120

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.