RBA’s projections for the next fiscal year

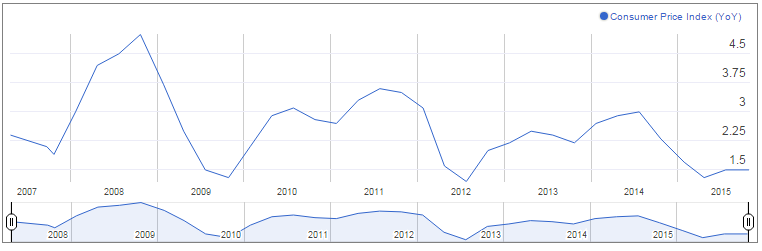

Australia's central bank softened its economic outlook for 2016. The economy was expected to be growing between 2.5 and 3.5 per cent by the end of 2016, and by 3 to 4 per cent by the end of 2017. The RBA has trimmed its 2016 figures to 2.5-3.5 per cent, from 2.75-3.75 per cent, expecting it to gradually increase to 3.0-4.0 per cent by the end of 2017. The RBA sees underlying inflation at around 2 per cent for most of next year and then gradually increase to around the middle of the 2 to 3 per cent target range. "The outlook for inflation may afford scope for further easing of policy should that be appropriate," the RBA said.Mining investment expected to fall sharply in 2016 after a decade of expansion. Also, the central bank saw little of a material pick up in other sectors. Pick up in non-mining investment seems unlikely in the near term. Resource exports can be expected to be the major growth driver. Lower Australian dollar may continue to favor net service exports.

Employment growth will likely remain relatively strong in 2016 while jobless rate is set to hold steady. The RBA sees unemployment between 6-6.25 per cent over in 2016 and fall gradually in 2017.

Meanwhile, average national house price growth is expected to come in at 2.3% in 2016. The slower growth can be attributed to the moderation in price growth in both Sydney and Melbourne.

RBA to continue accommodative policy

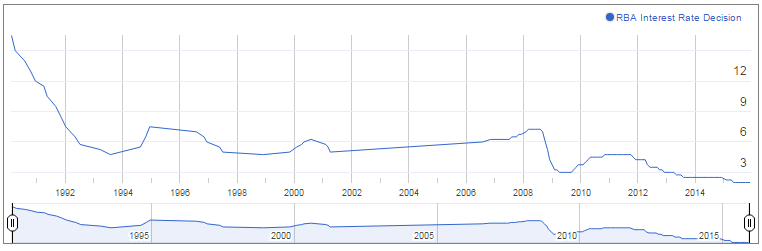

Policy makers have reduced borrowing costs by 2.75 per cent since late 2011 to boost industries outside of mining. Interest rates were slashed twice this year and stands currently at 2 per cent. Stevens feels the low interest rates are “acting to support borrowing and spending.†The RBA plans to continue with its accommodative policy as it opined that monetary policy is required to be loose at this juncture when inflation in Australia remains low and the economy has some spare capacity. The low rates have helped the housing sector as well by enhancing construction activity in this sector.

The economy saw a significant improvement in consumer confidence, which has in turn sent a message across that there is no immediate need to add further stimulus. RBA governor Glenn Stevens said “The board again judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate.â€

The economy grew 0.9% to record 2.5 per cent growth in the July-September quarter of 2015 helped by exports of goods and services which moved up 4.6 to contribute 1.0 per cent to the final growth figure. Mining activity was up 5.2. Household final consumption expenditure, which in essence constitutes the largest part of the Australian economy, increased 0.7%. As per the latest data unemployment rate dropped 5.8 per cent in November indicating a robust labor market. The unemployment rate in November was the lowest since May 2014.

Sectors that have disappointed this year

Australia's trade balance came in at $3.3 billion in October, worse than the $2.4 billion deficit estimated by economists and higher than the $2.4 billion deficit recorded in September. Gross fixed capital formation, both from the public and private sectors also declined. Investments in both mining as well as non-mining businesses also remained weak. The investment in the public sector dropped 9.2% on falling military spending; while inventories subtracted 0.1 per cent from GDP growth.Mining related construction plunged 7.1 per cent. Non dwelling construction in the private sector fell 5.3 per cent. Machinery and equipment spending declined 4.6% on weak business capex report.

Capital expenditure has fallen three times more than expected in the July-September quarter. Overall investment fell by 9.2 per cent to a dollar value of A$ 31.4 billion, marking the biggest quarterly drop in capex data since 1987.

Governor Stevens looks for alternative method to boost growth

While keeping rates steady, the central bank reiterated that low inflation gave them scope to ease further should a rate cut help support growth. He admitted one way to stimulate growth is by lowering rates. He said he would be “content†to lower rates further if it really made a contribution. He however questioned whether cutting rates is the best solution to all economic woes. He has also warned that cutting rates now would not stimulate the economy the same way as rate cut from very high levels in the 1990s did.Stevens also believes in considering an alternative method to boost growth. “…may be that you can make it better most effectively by articulating a case for stability, playing to the positive things that are happening, not smashing the savers over the head further, if the relative effect of that stimulating is not as great as it used to beâ€, he said.

Low inflation keeps door open for more cuts

The central bank lowered its forecast for inflation a little in its latest statement on monetary policy, noting that effects of a decline in the exchange rate were taking a little longer than expected to be impactful. Also, slow wage growth caused domestic costs to pick up slowly. Steven admitted that it is difficult for a central bank alone to create inflation, when other powerful forces are at work. He is however optimistic that as the impact of the decline in mining investment begins to wear out, and the effects of assumed low levels of interest rates and the exchange rate continue to increase, growth will likely pick up. RBA is likely to hold rates steady in 2016 and watch how the double rate cut of 2015 plays out.

Jasmin Argyrou, Aberdeen Asset Management’s senior investment manager aptly said “Low inflation does not provide reason to ease at this time but gives the RBA flexibility to respond should an unexpected shock occur.â€

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.