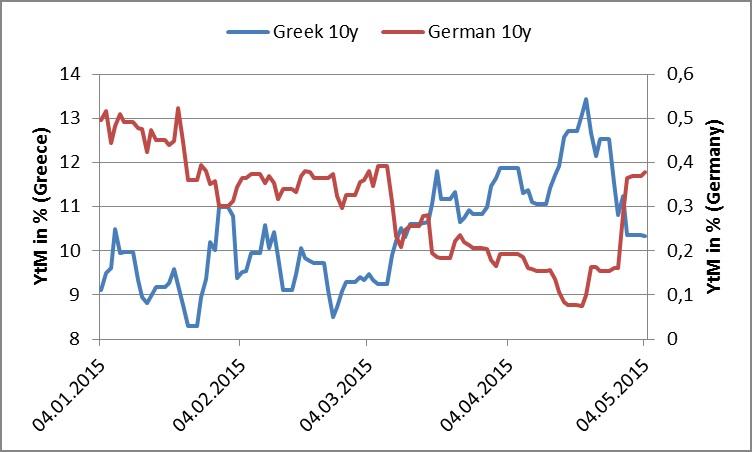

Chart of the Day:

Is the Crisis Over? Greek 10y bond yields collapse just as safe haven Bunds sell-off.

Analysts’ View:

Looking Ahead in CEE This Week: After the previous week’s basically empty macro schedule, the coming week offers much more excitement. The Romanian and the Polish central bank are scheduled to decide on rates on Wednesday, while the CNB will have its regular meeting on Thursday - we expect all of them to keep rates on hold this time. As the month starts, we will have the new PMI readings today and other important economic readings from CEE and Turkey as well. After last week’s yield increases, which now create upside risks to our bond yield forecasts, we are closely monitoring for any further evidence of improving economic activity and inflation in the region.

RS Fiscal: According to media reports, PM Vucic made very upbeat statements about the economy amid a possible softening of the current IMF program last week. According to him, the IMF will increase expectations for GDP for this year. He also told journalists that he is confident that he can agree with the Fund to let he Government reverse expenditure cuts by raising public wages and pensions, as the budget deficit narrowed more than expected but the country’s recession does not seem to be easing yet. Vucic told the press that the government deficit for the first four months of the year will be some 70% below the level agreed with the IMF, meaning roughly EUR 420 m (more than 1% of GDP) in savings. Other data shows, however, that the trade deficit was widening further and industrial output declined too. As the youngest agreement was reached only as late as February this year, we think it will be a difficult task to have the IMF agree to a softening of the programme. We continue to see the EURRSD at 122.5 at the end of this year.

Traders’ Comments:

CEE Fixed income: Many of our markets were closed on Friday and the UK is out today so conditions have been and will be thin, possibly accentuating recent market moves that have taken place on very low turnover. Yields are higher on the week in all of our markets in the sovereign space, most notably in Hungary. The weakness in the HUF and PLN mirrors the sell-off in fixed income and Piotr Marczak, head of public debt department at the Polish Finance Ministry, noted that foreign investors had reduced their holdings of POLGBs in April.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.