Fundamental Forecast for Australian Dollar: Neutral

- AUD/USD Rebounds As Local Data Recovers Amidst Return To Yield

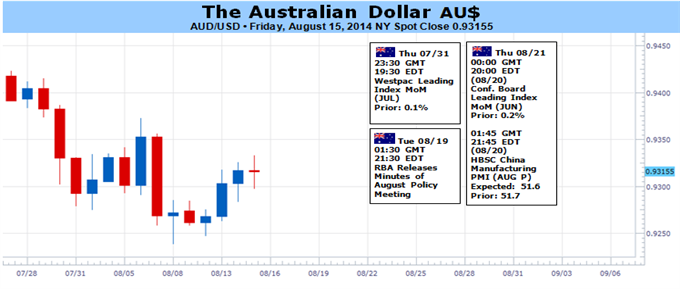

- RBA Minutes and Chinese PMI Figures To Offer Regional Event Risk

- Path of Least Resistance Remains For The Pair To Stay Range-Bound

The Australian Dollar managed to reclaim lost ground over the week to finish marginally higher. A lift in local business and consumer confidence figures offered a positive signal for the domestic economy and kick started the Aussie’s recovery. Further gains were afforded by a broad return to high-yielding instruments as traders looked past disappointing Chinese economic data and Ukrainian tensions eased.

Over the coming week, the RBA’s August Meeting Minutes and the HSBC China Flash Manufacturing PMI data are the most noteworthy pieces of regional event risk for the Aussie. The Reserve Bank has held steadfast in its preference for a ‘period of stability’ for rates and the Minutes are unlikely to reveal any major revelations. In the absence of a more dovish tone from the central bank the Aussie could remain elevated.

Meanwhile, another upside surprise to the Chinese manufacturing data could offer the Aussie a source of support. A string of recent improvements in the leading indicator have helped alleviate fears of a further deceleration in economic growth within the Asian giant. A rebound in Chinese economic data bodes well for the Australian economy via the two country’s close trading ties.

Geopolitical tensions will likely remain in the background over the coming week. Although the embers of the latest flare-up are still glowing, the Australian Dollar may continue to demonstrate resilience in the absence of a material escalation of regional conflicts.

The scarcity ofsentiment-shifting regional catalysts over the coming week suggests the Australian Dollar’s path of least resistance may be for it to remain range-bound between 92 and 95 US cents. Refer to the US Dollar outlook for insights into how the USD side of the equation may influence the pair.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.