![]()

One of the main problems new traders have when they begin their journey down the education path to self-empowerment is that they skip the most important first step, how to properly “think” money and markets. Many of my articles deal with thinking about the trading side of the equation; everything from the mechanics of when to buy and sell to understanding the psychology of you and the person on the other side of your trade. Today, let’s take a walk through the history of one of the best trending markets in the world, Forex. It is an important first step in properly thinking the Forex markets, which is key when attaining an edge in anything we do. The more prepared we are, the more we understand, the better the results.

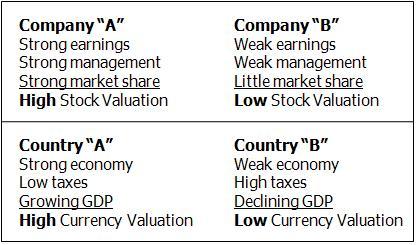

Strong economies tend to have strong currencies. When we trade the Forex markets, we are trading economies. Therefore, supply and demand for currency depends on the current and expected future health of a country’s economy. To keep things simple let’s discuss the chart just below. The way we value the health of a company when assessing a stock’s valuation is not all that different from how we value a country’s currency.

Foreign Currency (Forex) trading traces its history centuries back since before the Babylonians. While they were the ones credited with the first use of paper notes and receipts, forms of currency had existed for quite some time already. In the beginning, the value of goods and services was expressed in terms of other goods and services, also called “the barter system.” Limitations of this system were the catalyst for establishing more generally accepted methods of exchange.

Means of Payment/Reliable Storage of Value Evolution

Stones, Teeth, Feather Metals: Gold and Silver Governmental Paper Money

Before the First World War, most Central Banks supported their currencies with convertibility to gold. However, the gold exchange standard had its weaknesses of boom-bust patterns. As economies moved more and more to paper money not supported by gold, other problems arose. A greater supply of paper money without the backing of gold led to devastating inflation resulting in political instability.

Benton Woods

Agreement: July 1944 (end of World War II)

This agreement created a global currency system built on the US Dollar. The result was to fix the US Dollar at $35.00 per ounce of Gold and also fix other main global currencies to the US Dollar. This was initially meant to be permanent but things change. The system ran into trouble when national economies moved in different directions during the 1960’s. The system collapsed in the early 1970’s when US President Nixon suspended gold convertibility. At a time when the US was going through economic hardship, the US Dollar was no longer suited as the only international currency.

Forex Today

Over the past few decades, foreign exchange trading (Forex) has developed into one of the world’s largest global markets. Restrictions on capital flows have been removed in most countries, leaving the market forces free to adjust foreign exchange rates according to their perceived values based on pure supply and demand for currency. The Candles on your trading screen represent the footprints of buyers and sellers. Each and every candle is created because of an ongoing demand and supply relationship. This order flow is driven by demand and supply for Currency based on people’s perceived value.

OTA Supply/Demand Grid and Market Screener: GBPUSD – 5/8/15

Notice on the chart above from last week of the GBPUSD, a supply level is identified in this market. When price comes back to this level, it declines strongly from that area. What is key to understand is, any and all influences on price are reflected in price. We don’t need to focus on or consider the economic influences on price in this market because all those influences are reflected in price and seen on the chart.

At the end of the day, this all comes down to objectively quantifying demand and supply when looking at your Forex charts. The Forex markets are filled with economic news, economic reports, and many more potential influences on your decision making process. Try not to let this subjective information influence you too much. Instead, understand that the movement of price in these markets is nothing more than an ongoing demand and supply equation for currency. Low risk, high reward, and high probability trading opportunity is present when this simple and straight forward equation is out of balance. For more information on exactly what a demand and supply imbalance looks like on a price chart, please see my prior articles.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD slides nearly 1% to test the 0.7000 handle

AUD/USD fell about 1% on Thursday, wrapping the day up near the 0.7010 level after testing below the key 0.7000 handle intraday. The pair has now pulled back sharply from Tuesday's bounce, with two consecutive bearish sessions erasing most of the week's early gains. Price continues to chop within the roughly 150-pip consolidation band between 0.7000 and the year-to-date high close to 0.7150 that has defined the range since early February.

USD/JPY: Bulls defend 157.00 as upside-pressure builds

USD/JPY advanced on Thursday during the North American session, up by nearly 0.30% as the Greenback is boosted by risk appetite deterioration, solid US jobs data and hawkish comments by the Richmond Fed President Thomas Barkin. At the time of writing, the pair trades at 157.50 above its opening price.

Gold slumps below $5,100 as US Dollar gains

Gold price tumbles to near $5,085 during the early Asian session on Friday. The precious metal loses ground amid a stronger US Dollar. The US employment report for February will take center stage later on Friday.

NYSE parent Intercontinental Exchange partners with OKX, invests at a $25B valuation

OKX announced an investment from Intercontinental Exchange, raising its valuation to $25 billion, alongside a partnership to expand regulated crypto futures and tokenized equity offerings globally.

Two PMIs, two Chinas Premium

China’s economic data are often treated with a degree of caution by global investors. The challenge is not necessarily that the numbers are incorrect, but that they can describe very different parts of a vast and complex economy. Nowhere is that more evident than in China’s PMIs.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.