Newer traders sometimes struggle when trying to identify supply and demand zones. My best advice is to practice and see if your zones are lining up with those identified by your instructors in the Extended Learning Track or the Pro Picks.

There is also an additional method to identify potential turning points in the markets. This method is not to replace identifying supply and demand, but is rather a way to supplement and perhaps to confirm those levels. This is not a magical tool that will work all the time. The tool/method I am talking about is floor trader pivot points.

The pivot points were created to give professional floor traders at exchanges a way to determine possible support and resistance without having to refer to charts. You may notice that I used the terms support and resistance rather than demand and supply as these are not the same things. The terms support and resistance refer to traditional technical analysis techniques and have been shown by many traders not to be as accurate as the patented supply and demand strategy from Online Trading Academy.

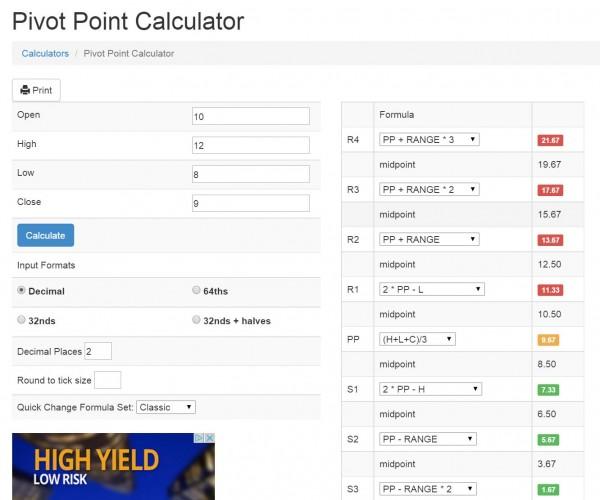

That being said, the support and resistance of pivot points may help to identify or even strengthen supply and demand zones found in your charts. The pivot point itself is simply the previous day’s high + the previous day’s low + the previous day’s close divided by three. This pivot point can act as a support or resistance level for price and can be applied to equities, Forex, and futures charts. Wait a minute! Not so fast, don’t the futures and Forex trade 24 hours a day? How can we get a close price? Actually, the trade price at 5:00PM New York time (EST) is used as the “closing time” for our calculations.

By using this pivot point number and some additional mathematical calculations, we can derive several additional support and resistance numbers. In fact, there are calculations for four support and resistance levels. We can use these pivot support and resistance as possible entry and target points for trading.

Some trading platforms automatically draw pivot points on your chart for you, but if you are creating your trading plans the night before you can easily add the pivots to your chart. There are several websites that will give you the pivot points. One that I like is www.mypivots.com. On the site there is a pivot point calculator where you can enter the numbers and receive the pivot points for any security.

Although the main use for the pivot points is intraday charting, you could plug in the weekly or even the monthly high, low, and close to determine the future support and resistance for swing and position trading. Remember, these pivot points should not take the place of the supply and demand zones that you visually identify on your charts. Those turning points were caused by the emotions of investors and traders and therefore carry more weight. These people will remember how they triumphed or were hurt at those price levels. Since pivot points do not carry those same emotions with them, they only work if traders believe they work and act in the same manner when price reached those levels.

Fortunately, they have gained enough popularity that they are almost a self-fulfilling prophecy on many stocks and markets. So, while not the end all, pivot points could help you determine the turning points of a stock, sector, index, currency, etc. This can be a valuable tool in your trading arsenal. So until next time, may all your trades be green and your losses small!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD looks to stabilize near 1.1600 as focus shifts to US data

EUR/USD is looking to stabilize near 1.1600 in the European session on Wednesday as traders breathe a sigh of relief before the top-tier US ADP jobs and ISM Services PMI data. A pause in the US Dollar uptrend helps the pair's recovery, but surging energy prices due to the Iran war will likely remain a drag.

GBP/USD stays weak near 1.3350 as USD preserves gains

GBP/USD stays in the red below 1.3350 in the European session on Wednesday. Escalating conflict in the Middle East keeps the "flight to safety" theme intact, supporting the US Dollar against the Pound Sterling. Traders will take more cues from the US ADP Employment and ISM Services Purchasing Managers Index reports, which are due later on Wednesday.

Gold retains positive bias amid sustained safe-haven flows and modest USD pullback

Gold maintains its offered tone through the first half of the European session, though it lacks follow-through and remains below the $5,200 mark. Investors remain concerned about a prolonged conflict in the Middle East and its impact on the global economy amid an already uncertain environment.

ADP Employment Report set to signal stronger February jobs growth, little effect on Fed outlook

The Automatic Data Processing (ADP) Research Institute will release its monthly report on private-sector job creation for February on Wednesday. The so-called ADP Employment Change report is expected to show that the United States private sector added 50K new positions in the month, following the 22K gained in January.

Asian stocks fall as South Korea’s KOSPI slumps over 10%

Asian equities drop on Middle East tensions; the MSCI Asia Pacific Index falls up to 4%. South Korea’s KOSPI fell 10.71% near 5,170, with the Korean Won weakened past 1,500 per dollar.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.