Until now, you have had lessons in Calls and Puts. When you combine trading a Call and a Put together, you are trading an options strategy.

An options strategy is when you execute more than one option at the same time; buying and selling Calls and Puts in different combinations to take advantage of market moves in many different ways.

This lesson will focus on a specific strategy, a Long Straddle.

The long straddle is commonly used over news announcements and major economic events to trade an increase in volatility. WTI Oil is known for its market volatility (even without news announcements), thus you buy a Call and Put together in a strategy with the expectation that volatility will increase.

To execute this strategy, you buy a Put and Call at the same time with the same strike, expiry, and amount. This results in a profit if the market moves in either direction beyond the premium paid for both options; the Put option will bring a profit if the market falls and the Call option will bring a profit if the market rises.

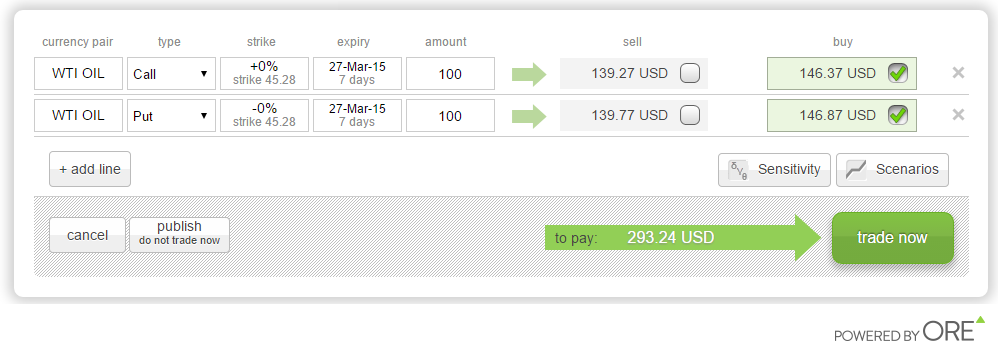

WTI OIL Long Straddle example:

The above image is an at-the-money WTI OIL Long Straddle where both the Call and Put are set with strike rates equal to the underlying market (0%) at execution. The strike rates do not have to be at 0%, but they do have to be the same.

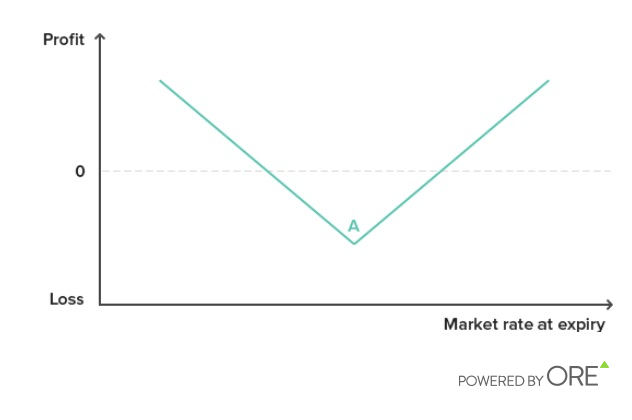

The chart below shows the strategies’ profit or loss at expiry over a range of market rates. The dotted grey line highlights when profit/loss equals zero (the break-even point). Anything above the grey line is a profit and anything below it is a loss. The letter 'A' indicates the strike rate. If the market moves far enough in either direction past the break-even points, the strategy is profitable. But if the market rate does not break-out in either direction, the strategy creates a loss. This ‘V’ shaped chart is a classic Long Straddle strategy.

Advantage:

- Your maximum loss is limited to the premium paid at open

- You will not get stopped-out

- You can profit from a move in either direction.

Disadvantages:

- It involves a higher premium cost compared with trading in one direction because you are buying two options

- As time passes and the options get closer to expiry, time value is against you since both legs are decaying

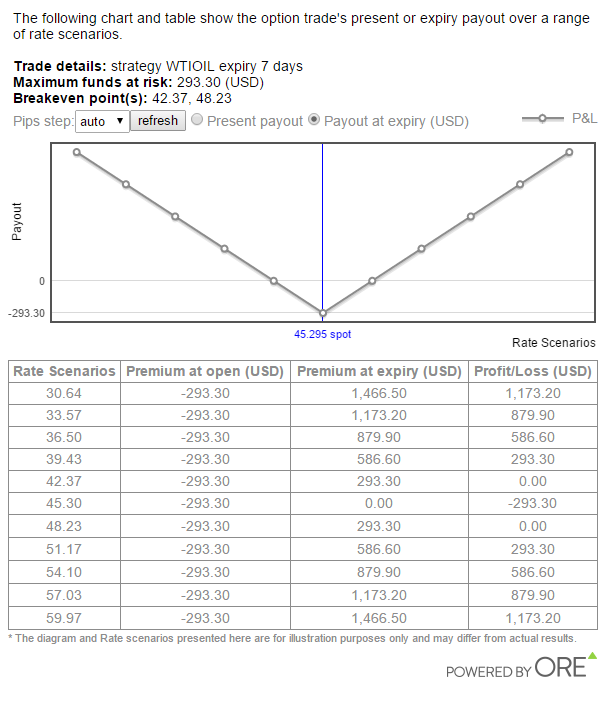

Below is an actual scenario chart and table from the ORE Web-platform, optionsReasy. It shows the payout from a long straddle in WTI Oil, you can see you will profit as long as the market moves in either direction:

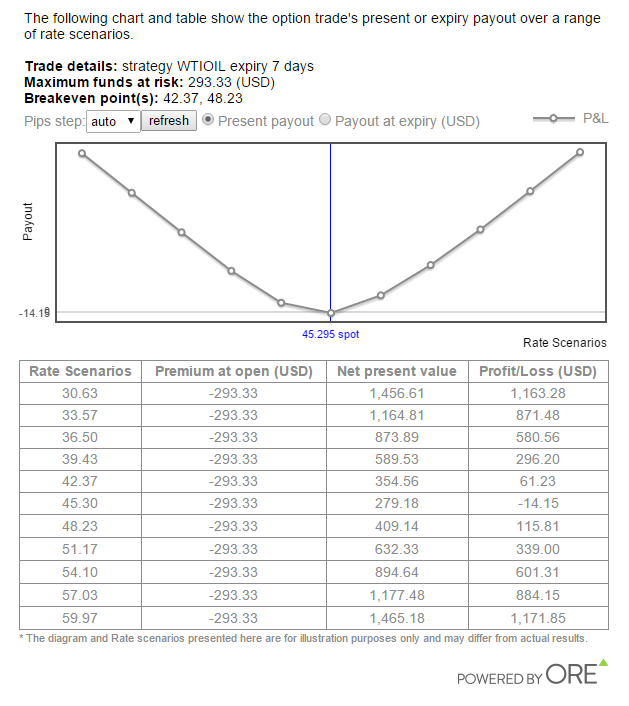

The chart below shows the strategies present payout (before expiry). Notice how the payout is higher than the payout at expiry. When you buy an option, or multiple options, you ideally want the market to move sooner, so you can cash-in before expiry and not suffer time decay.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

AUD/USD eases toward 0.7050 after RBA minutes

AUD/USD inches lower toward 0.7050 in Tuesday's Asian trading, reacting little to the RBA February Minutes, which reinforced a tightening bias. The hawkish outlook, however, fails to provide any impetus to the Australian Dollar as the timing of the next rate hike is unclear. In contrast, bets for more rate cuts by the Fed keep the US Dollar bulls on the defensive and act as a tailwind for the Aussie amid the underlying bullish sentiment.

USD/JPY falls back toward 153.00 as Japanese Yen finds its feet

USD/JPY has turned south to test the 153.00 level after having faced resistance near the 153.75 zone in Asian trading on Tuesday. The divergent BoJ-Fed policy expectations offer some support to the Japanese Yen. That said, Japan's weak Q4 GDP print, released on Monday, tempered bets for an immediate BoJ rate hike. This, along with the underlying bullish sentiment, could limit the pair's downside.

Gold declines as trading volumes remain subdued due to holidays in China

Gold price extends its losses for the second successive session, trading around $4,930 per troy ounce during the Asian hours on Tuesday. Gold price is trading nearly 0.7% lower at the time of writing as trading volumes stayed thin due to market holidays across China, Hong Kong, and other parts of Asia.

Top Crypto Gainers: Stable, MemeCore and Nexo rally test critical resistance levels

Stable, MemeCore, and Nexo are among the leading gainers in the crypto market over the last 24 hours, while Bitcoin remains below $70,000, suggesting renewed interest in altcoins among investors.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.