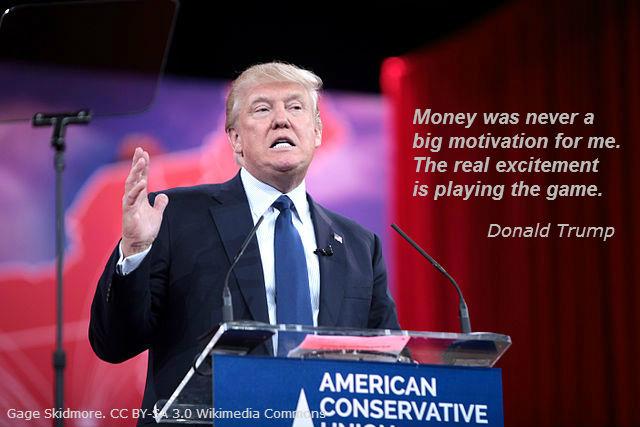

Since Donald Trump announced his candidacy for president some weeks ago, he has filled hundreds of pages on newspapers and magazines with his controversial comments. Despite he is one the most hated candidates his popularity has increased with the support of the growing anti-establishment politician trend and he is leading the polls of the republican presidential race.

After all, he is a successful businessman with a fortune of 4 billion dollar.

Following his father's steps

Born in June 14th of 1946 in Queens, New York, his professional career has always been related to real state development influenced by his father. However his personal goals were much grander than those of his senior. He said: “My father was my mentor, and I learned a tremendous amount about every aspect of the construction industry from him.”

In 1971 he became involved in large profitable building projects in Manhattan. He opened the Grand Hyatt in 1980, which made him the city's best known and most controversial developer.

His most known real state developments are Trump Plaza, 40 Wall Street in Manhattan, golf resorts in Florida and casinos in Atlantic City.

King of Mass Media

He has one of the most active twitter account among forbes list members

Trump is the most googled presidential candidate. He was the most searched in every state the day of his announcement, and his “search interest” — percentage of national queries for the hour after he announced — was 87%.

In 2004 Trump began starring in the hit NBC reality series The Apprentice,. In 2007, Trump received his own Hollywood Walk of Fame star for his role as producer in this TV programme.

The B word

"I don't like the B word,” he said in 2010 while testifying in a New Jersey bankruptcy courtroom about his company, Trump Entertainment Resorts Inc., which had filed for bankruptcy for the third time. After this, he has faced bankruptcy several times.

A significant amount of debt was garnered from financing the Taj Mahal, one of Trump’s casinos acquired in 1988, through high-interest junk bonds. However, he ceded 50 percent ownership of the casino to the original bondholders, who lowered Trump’s interest rates and extended the loan so Trump had more time to pay off the debt.

Diversifying investments

Some of the business he was involved are a Vodka brand, a board game, a mortgage company, a own line of clothing, casinos, a luxury airlines or even a university. All of them bear his name but not all of them had the same success.

A controversial political career

In 2008 and 2012 he talked of seeking the Republican presidential nomination but eventually withdrew from the race. He is very critical with President Obama's policies. He also appeared often with other candidates, such as Sarah Palin.

He has won a presidential primary in a major state: In 2000, Trump was among five candidates listed on the Reform Party primary ballot in California. He had filed papers the previous autumn to become a member of that party and one of its presidential candidates. Although he had withdrawn months earlier and did not campaign for the primary in California, he received 15,311 votes in the June event, 44 percent of the total.

A national phone poll completed on July 2015 showed Trump in the lead for a Republican nomination. Ex-governor of Florida and younger brother of ex-president George Bush, Jeb Bush, was slightly behind.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.