Why Solana price is being removed from traders’ hodl list

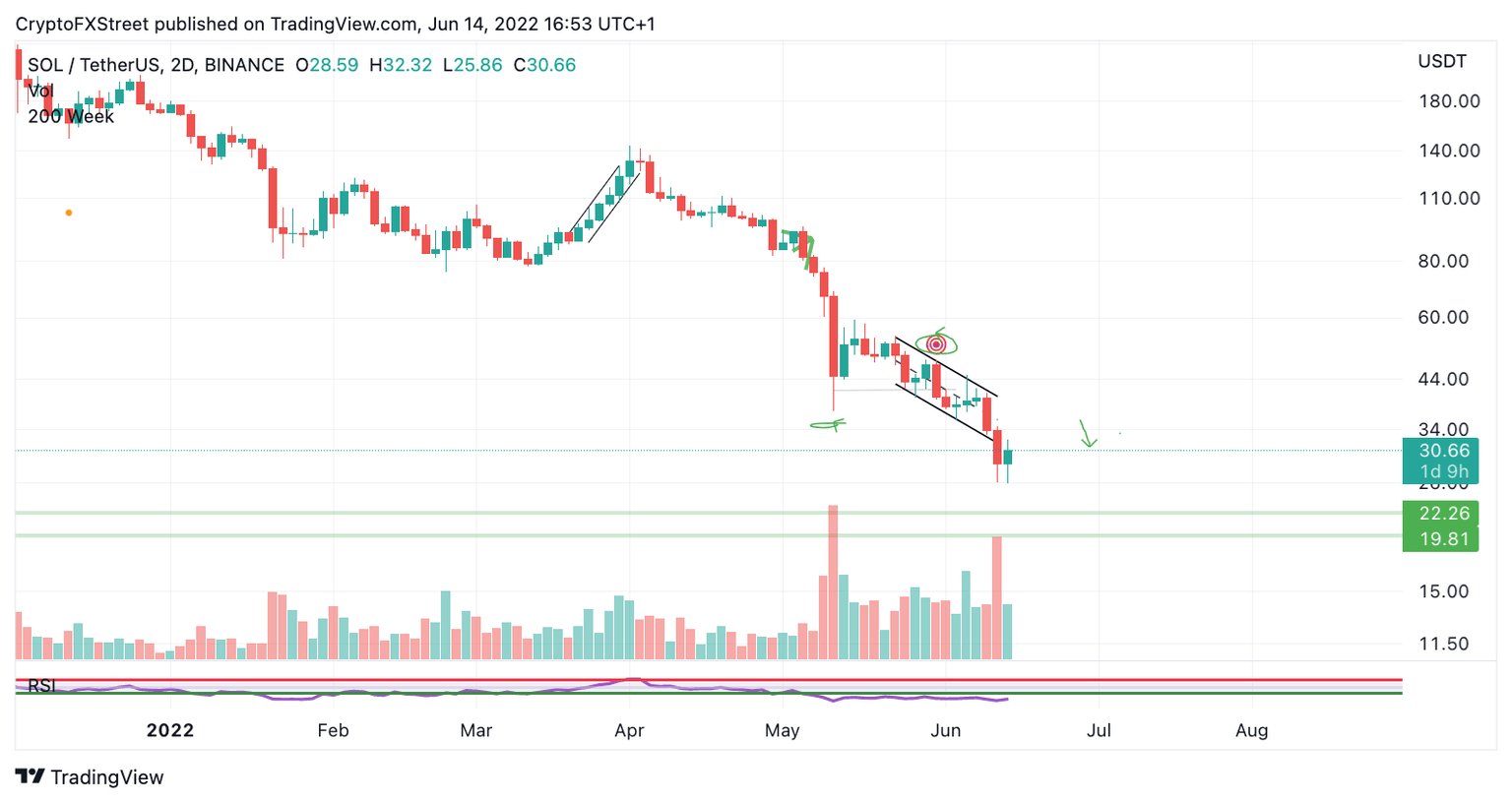

- Solana price has breached a consolidative trend line in an impulsive fashion.

- An increase in selling volume warrants the idea of more decline.

- Invalidation of the downtrend is a breach above $43.

Solana price could continue the bearish downtrend as technical indicators show that the bears are not yet ready to release their grip.

Solana price can't say when, but it says how

Solana price displays negative behavior as the bears have suppressed the "centralized Ethereum killer" into a zone unprovoked since July 2021. The bearish decline has been accomplished in a "penny from the Eiffel style" manner as what was once thought as a back-and-forth chop ultimately led to a free-fall frenzy on the daily chart.

Solana price currently trades at $30, now a 88% decrease from the all-time highs at $259.90. The bears have flexed their guns, printing several engulfing candles, which seem unchallenged at the current time. If the bulls do not seek vengeance very soon, the bears could push the price into liquidity levels below $20. The most disturbing signal which confounds the bearish idea is the volume pattern. The bears have significantly shown up with pressure, a well-defined ramping pattern and the influx of transactions as prices descend. Investors seeing these odds are likely to look for better opportunities in the crypto market.

Sol/USDT 2-Day Chart

Invalidation of the downtrend is a breach above the previous wave four degree at $43. A breach at this level could trigger a rally as high as the $60 mark, resulting in a 100% increase from the current Solana price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.