Litecoin Price Prediction: LTC faces one significant resistance before ultimate push to $200

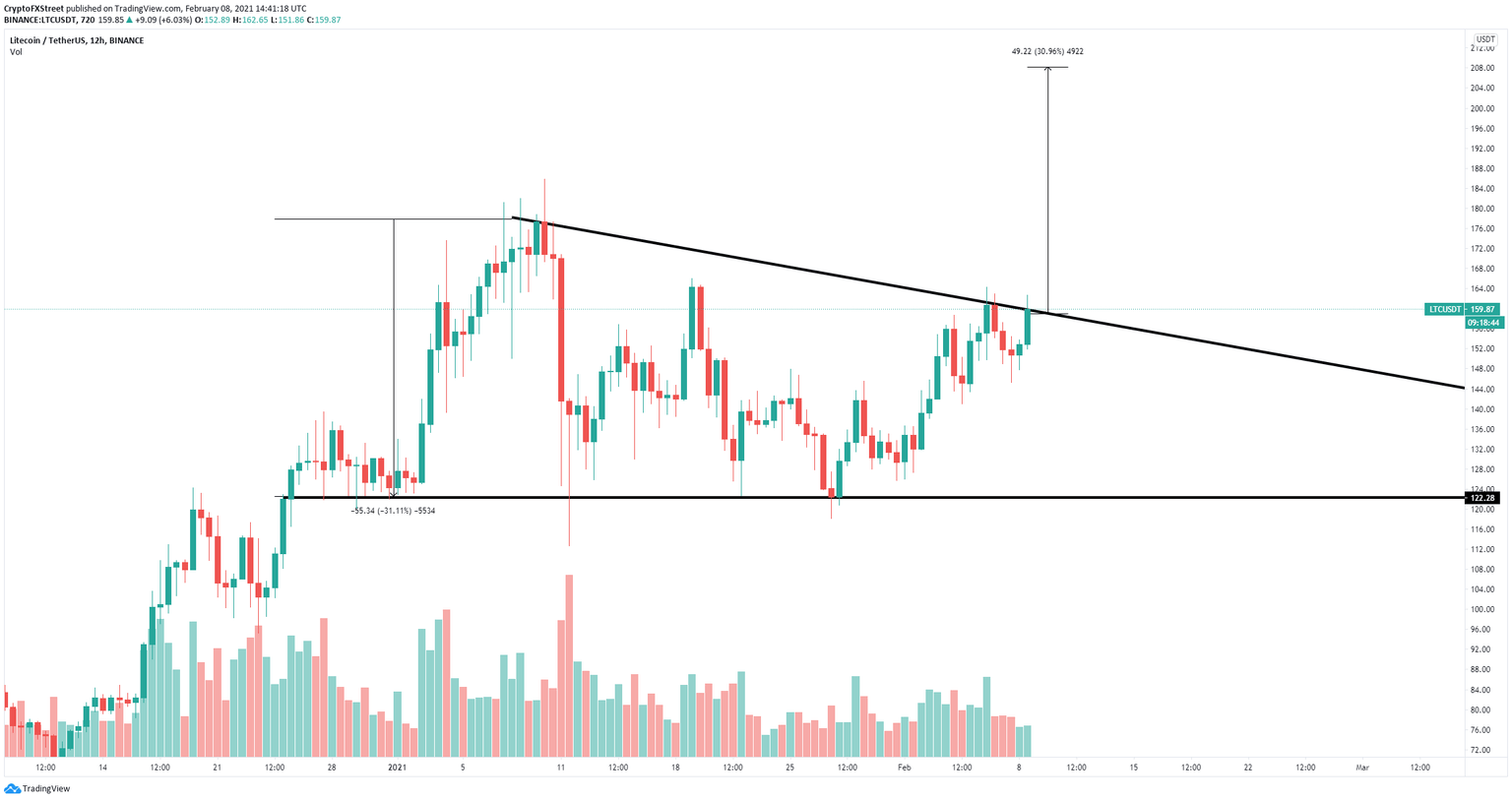

- Litecoin price is trading inside a descending triangle pattern on the 12-hour chart.

- Climbing above $160 decisively can quickly drive LTC towards $200.

- LTC faces really weak resistance on the way up as bulls hold the momentum.

Litecoin price had a significant 7% surge in the past several hours thanks to Bitcoin’s new all-time high at $45,000 after Tesla announced the purchase of $1.5 billion worth of Bitcoin and potentially other digital assets in the future.

Litecoin price can jump to $200 if this level drops

On the 12-hour chart, Litecoin has established a descending triangle pattern with a resistance level located at $160. Breaking above this point will drive Litecoin price above $200 to a price target of around $208.

LTC/USD 12-hour chart

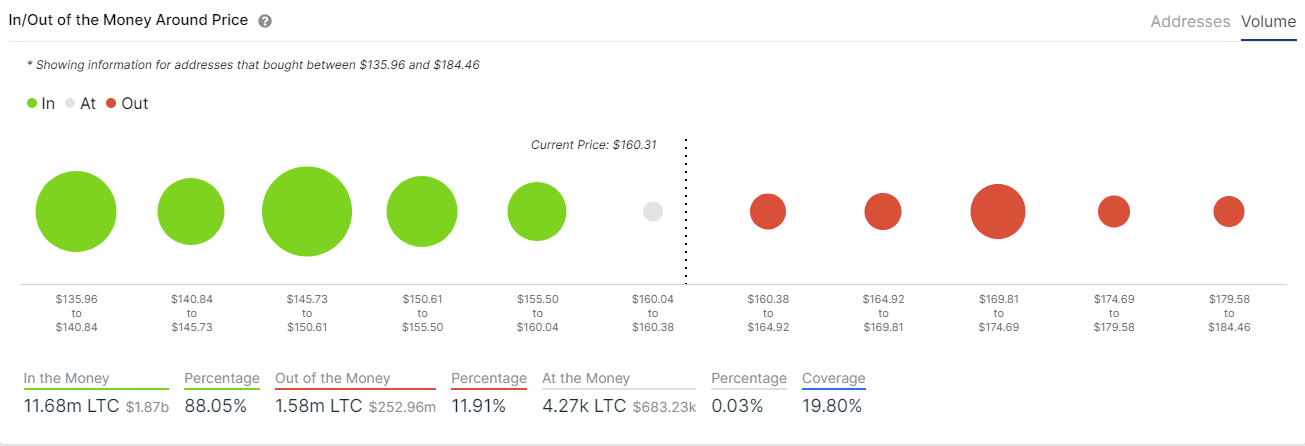

The In/Out of the Money Around Price (IOMAP) chart shows that bulls have far better odds than bears as the resistance above is extremely weak while there is a lot of support on the way down.

LTC IOMAP chart

The IOMAP model indicates that the strongest resistance area is located between $170 and $174 which means that LTC should spike to $200 if this range is broken.

LTC Holders Distribution chart

Unfortunately, it seems that the number of whales holding between 100,000 and 1,000,000 LTC ($16,000,000 and $160,000,000) has significantly declined in the past week from a peak of 116 on January 31 to 111 currently which indicates large holders have been selling and taking profits.

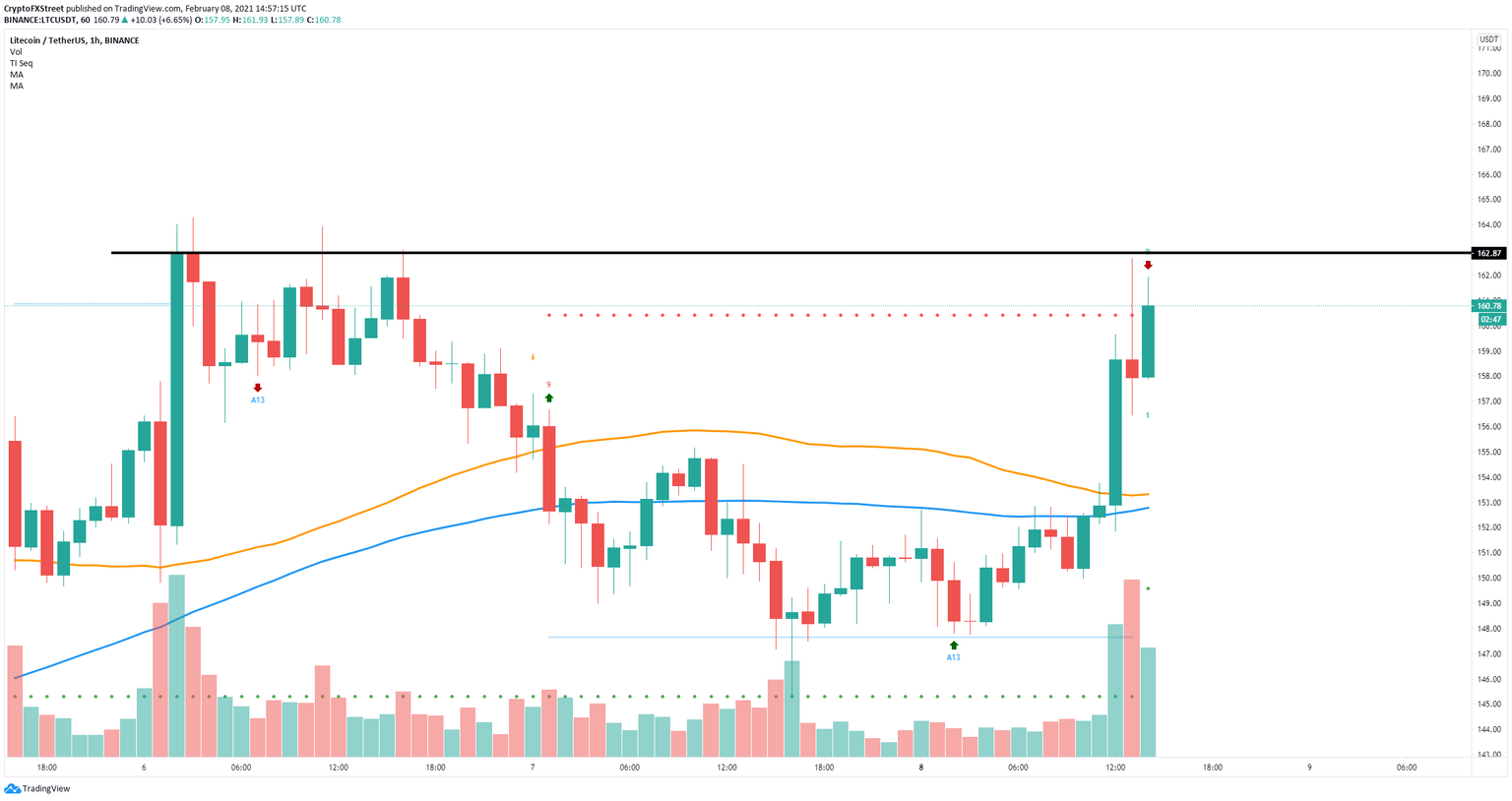

LTC/USD 1-hour chart

On the 1-hour chart, the TD Sequential indicator has presented a sell signal right at the top of another significant resistance level at $163. Validation of this call could push Litecoin price down towards $153 where both the 50-SMA and the 100-SMA converge.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.58.44%2C%252008%2520Feb%2C%25202021%5D-637483931306044982.png&w=1536&q=95)