Bitcoin Cash Price Forecast: BCH bulls face critical resistance – Confluence Detector

- Bitcoin Cash bulls took control after bouncing up from the 50-day SMA.

- The price currently faces immediate resistance at the 100-day SMA.

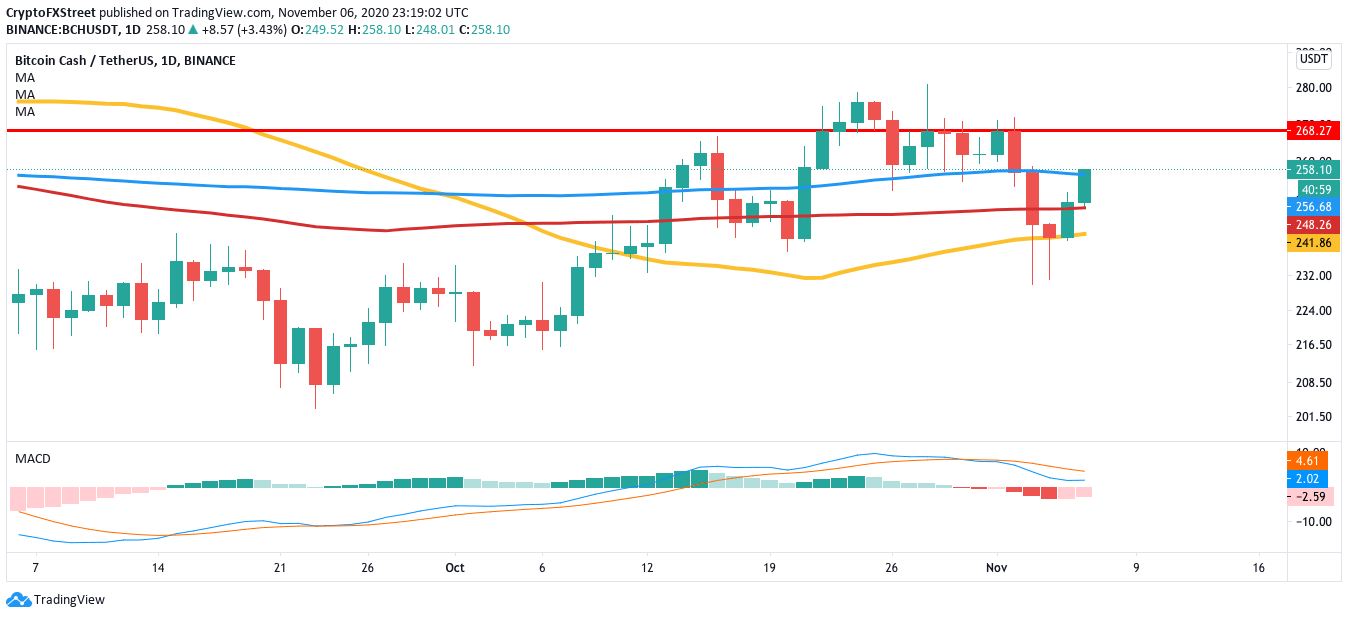

Bitcoin Cash fell from $268.25 to $241.70 in three days between November 2 and November 4. In the process, it broke below the 100-day SMA and 200-day SMA. However, the 50-day SMA managed to stay strong and keep the price up.

The bulls back with a vengeance

Over the last two days, the Bitcoin fork has risen from $240 to $258. In the process, they have managed to cross above the 200-day SMA ($248). Currently, the price faces resistance at the 100-day SMA ($258). A break above this level should give the buyers enough momentum to aim for the $268 resistance barrier, as defined by the daily confluence detector.

BCH/USD daily chart

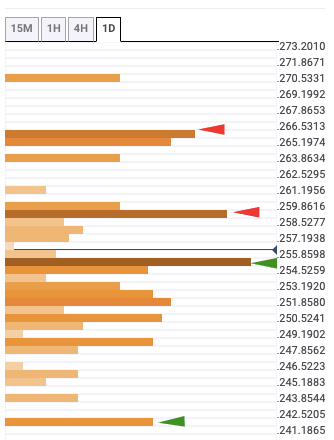

The daily confluence detector is a handy little tool that helps us define strong support and resistance levels. As per the tool, BCH currently has two notable resistance, at the 100-day SMA ($258) and $268. A break above them will take Bitcoin Cash to $275.

BCH daily confluence detector

The sellers can completely change this bullish outlook by dropping the price below the 200-day SMA ($250). If this happens, the top-5 cryptocurrency lacks healthy support levels that could hold the price up. Any further drop will see BCH fall to the 50-day SMA ($240).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.