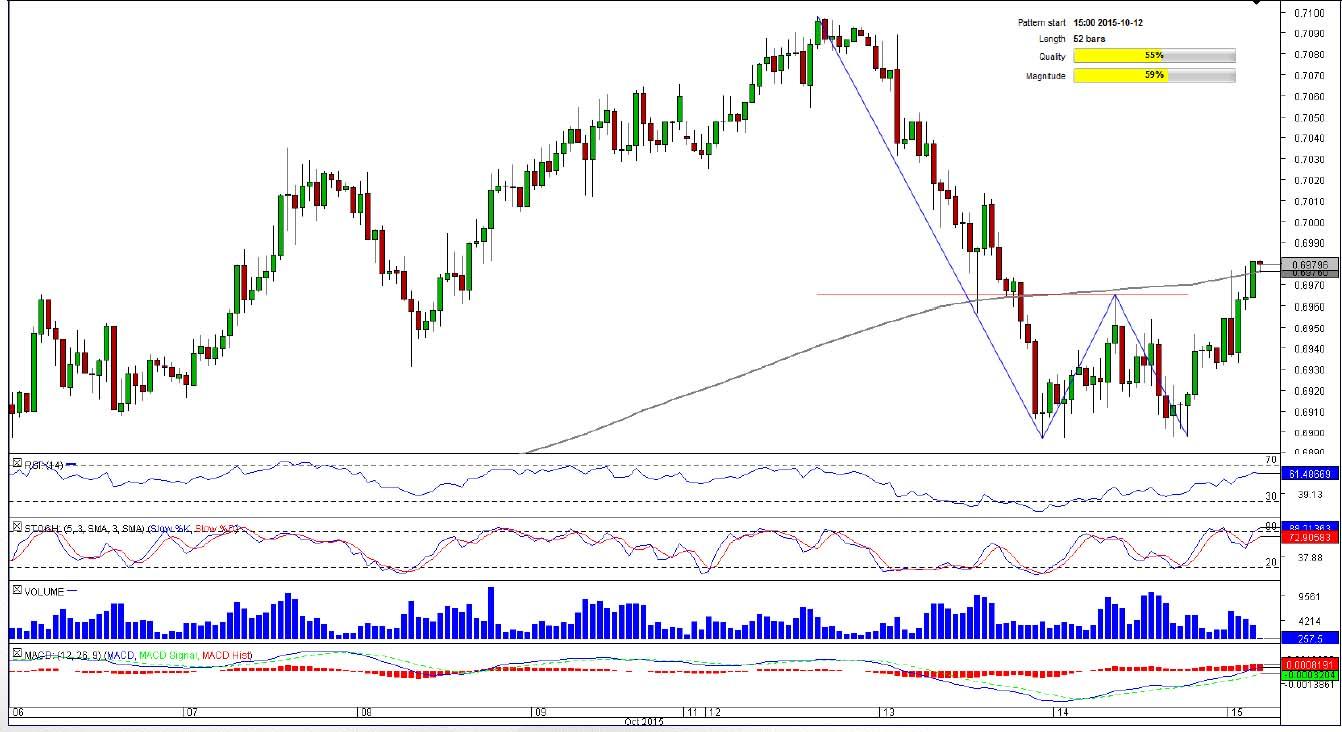

AUD/CHF 1H Chart: Double Bottom

Comment: Our bias towards AUD/CHF for today is strongly bullish, even though the technical indicators at the moment are mixed. The currency pair has just broken through the neck-line of the double bottom, and by the end of Thursday the price of the Australian Dollar is likely to increase by 70 pips, which is the distance between the neck-line and the Oct 13 low. The target coincides with the daily R3 level, which is currently standing at 0.7039. In case the Aussie preserves bullish momentum after hitting the target, the next objective could be 0.7097, namely the October 12 high. Meanwhile, the sentiment among the SWFX market participants is distinctly positive: 74% of all open positions are long.

CHF/JPY 4H Chart: Channel Up

Comment: In the lower time-frames (H1) going long in CHF/JPY might seem to be a good idea, but the H4 chart suggests a decline is more likely. The pair has just encountered an upper boundary of an emerging channel, which is also reinforced by the monthly R1 level. Accordingly, we expect a sell-off from here, especially considering the weekly technical studies. The immediate support is at 124.54, but a serious test of the bearish momentum will be at 123.70, where the monthly PP merges with the weekly S1 and 200-period SMA. Correction should start near the lower edge of the pattern, namely circa 122.70. At the same time, SWFX sentiment is negative: 74% of positions are shorts.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.