EUR/CHF 4H Chart: Channel Up

Comment: Although the quality of the pattern is poor, there is a high chance of EUR/CHF developing the ascending channel further. First, the currency pair is facing a solid demand area around 1.0840, created by the weekly S1, monthly PP, up-trend, and 200-period SMA. Secondly, the single currency is oversold, being that 72% of open positions are short, and therefore there is not much room for new bears to enter the market. At the same time, even though the signals are weak, the daily and weekly indicators are mostly pointing north. Accordingly, the base scenario is a rally from 1.0840 up to the October’s high at 1.0950. In case of a dip beneath the key support there should be a sell-off at least to 1.0770/55.

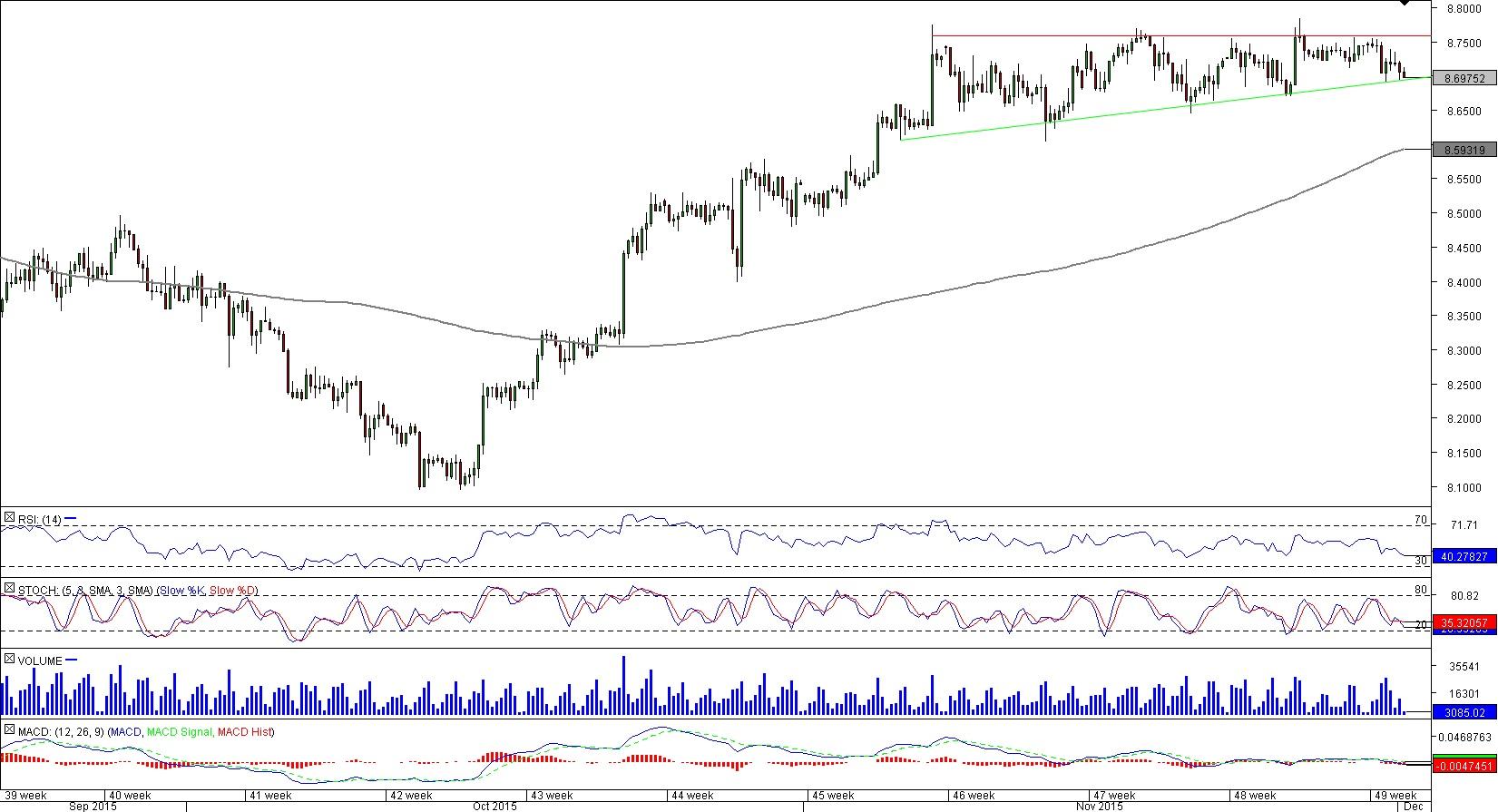

USD/SEK 4H Chart: Ascending Triangle

Comment: USD/SEK is currently struggling at 8.76, but eventually the bulls should be able to push through this resistance. The ascending triangle the pair is forming suggests that demand is building up, and a break-out to the upside is the likely resolution to the pattern, which developed after the Oct 15-Nov 6 advancement.

We therefore expect the price to close above 8.76 this week and start its journey towards 8.84, where the rate should meet the monthly R1 and August high. In the meantime, the main support is between 8.70 and 8.67, violation of which will expose the 200-period SMA and monthly S1 at 8.5800/8.5550.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.