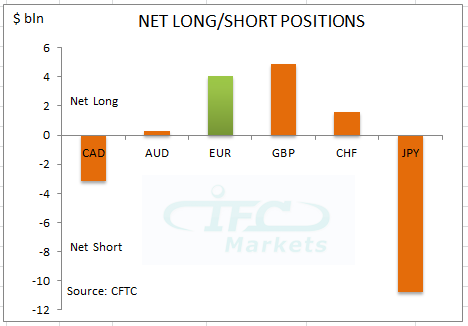

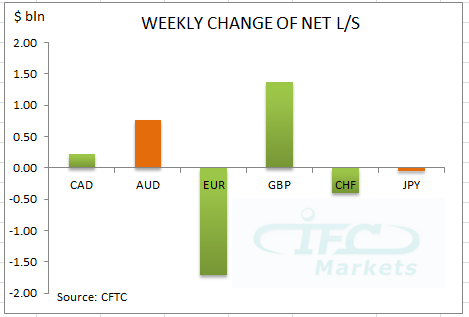

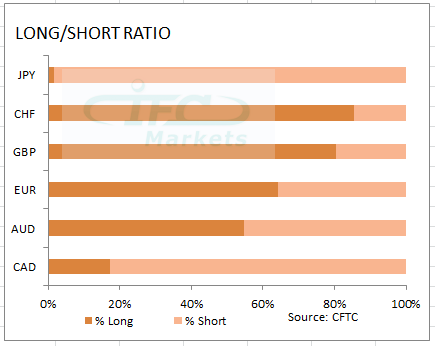

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to the 8th of April showed that the trend for the most of the currencies remained unchanged concerning investor’s sentiment. The Euro bullish sentiment moderated against the US dollar for one more week as deflation risks sustain. The Euro weekly change has been the largest negative change among major currencies in the respective week and the common currency lost the first place in net long position against the US dollar. At the same time the Japanese Yen net short position holds as the biggest for another week at minus $10.73 billion. Moreover, the samurai currency had the lowest long/short ratio however the weekly negative change diminished and next week’s data might reveal positive weekly transformation due to current risk aversion.

Furthermore, the Canadian dollar negative bias calmed as the net short decreased by $0.21 billion to minus $3.14 billion. On the other hand the British pound bullish bias increased by $1.37 billion against the US dollar which is the largest bullish weekly change. The Australian dollar bias turned bullish with net long position climbing to $0.31 billion. In the reporting week the kangaroo currency weekly change has been the second strongest and it is coupled with uptrend establishment in the price pattern.

Lastly, the biggest long/short ratio was built by the Swiss franc according to the latest report. This dynamic has been the same like the previous report despite that the net long position declined by $0.41 billion according to CFTC. The second largest long/short ratio is with the British pound which is gradually building its bullish sentiment in recent weeks. The net long at GBP is making a new high but the exchange rate failed for another week to rise above 3 and a half years cap at 1.6820.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.