RBA Gov Glen Stevens is due to speak in Sydney tomorrow, and with a shortfall of domestic news traders will be listening out for further clues regarding interest rates and the "historically high" A$.

The markets are now pricing in a 7% chance of a rate cut following a rising unemployment and jawboning from RBA Gov Glenn Stevens. However I doubt we'll be seeing any rate cut soon as RBA remain within a 'neutral' stance and continue to reiterate the message "The most prudent course was likely to be a period of stability in interest rates." Whilst Stevens has hinted he would like a lower A$ (and expects we will see one) he has steered away from more stern words of intervention, and I expect this to be the case tomorrow.

Of course if there are talks of the high A$ or stern words relating to their "extra ammunition" then we should see A$ firmly back below 94c.

However over the coming weeks whilst both the FED and RBA are reluctant to outline a clear timetable of interest rate changes then AUDUSD will continue to frustrate position traders in seek of that next home run.

The US will release housing and inflation data on Tuesday night to provide further direction for the A$. Existing home sales are forecast at an 8-month high whilst Core CPI is expected to rise a further 0.2%. If these come to fruition then I'd expect to see A$ back below 94c.

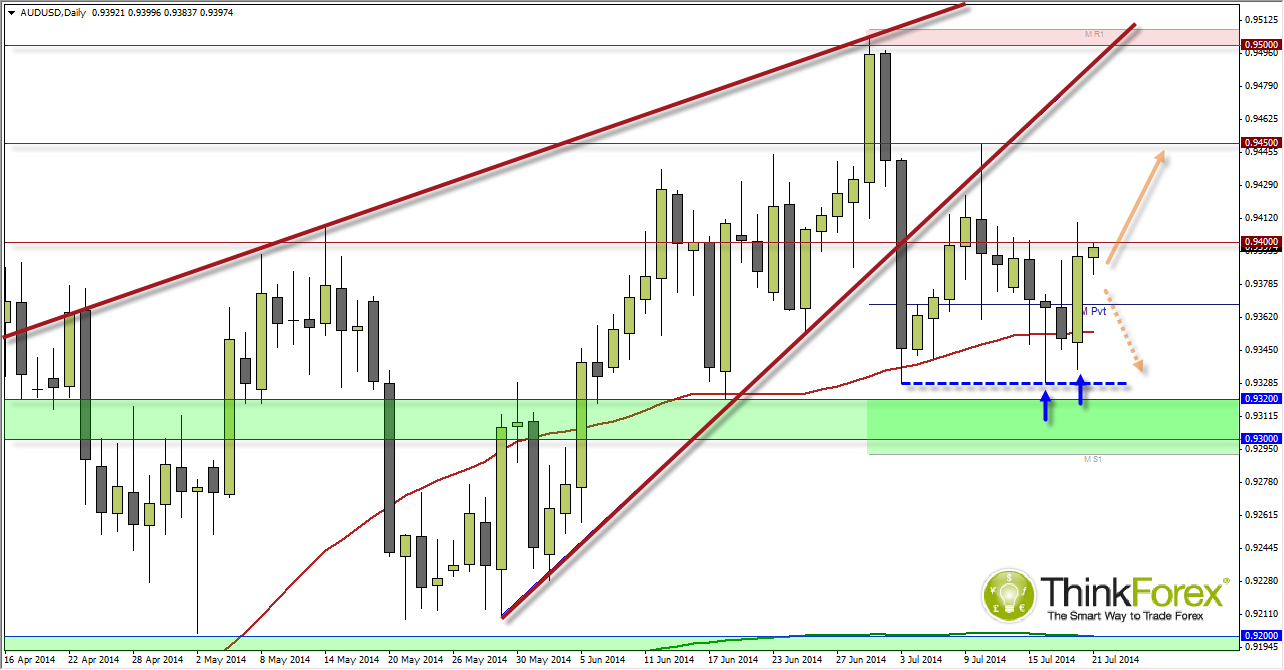

There is a bed of support between 0.9362-68, but a break below here should then target last weeks lows at 0.9328. However this is where it begins to get more interest due to the price action at these levels last week: The 2-day decline from the 0.95c highs were the most bearish since Jan, yet last Wednesday the A$ bulls managed to keep above this low by 0.7 pips and close the session with a bullish pinbar. Last Friday then saw a bullish engulfing candle close to a 5-day high, and remain above the 50-day eMA. Tis paints a more bullish picture near-term and raises the potential for a break back above 94c.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.