To start this new week the Australian dollar fell sharply but landed on the previous key level at 0.77 which has offered considerable support since that time. The Australian dollar enjoyed a solid week last week moving off support around 0.76 to reach a three week high just shy of the resistance level at 0.7850. In doing so, it moved through the key resistance level at 0.77. After placing great pressure on the resistance level at 0.77 a couple of weeks ago, the Australian dollar fell heavily earlier last week before surging higher again to finish out the week. Over the best part of the last few weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior, and it is relying on this level again presently. Throughout the last couple of weeks it felt significant resistance from the key 0.77 level which has been severely tested during this period and it will be interesting to see whether this level now acts as some support.

Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia’s central bank is willing to cut interest rates again if needed, but is cautious about the likely impact on house prices and debt levels, a top policy maker said on Monday. Speaking in New York, Reserve Bank of Australia (RBA) Governor Glenn Stevens also reiterated that the Australian dollar was “very likely” to fall further over time. The central bank cut interest rates to a record low of 2.25 percent in February, but it surprised many analysts by skipping further moves at its policy meetings in March and April. “The (RBA) Board has clearly signalled a willingness to lower it even further, should that be helpful in securing sustainable economic growth,” Stevens told the American Australian Association. “The Board has been proceeding with a degree of caution that is appropriate in the circumstances,” he added, “It also has, I would say, a realistic assessment of how much monetary policy can be expected to achieve in supporting the adjustment the economy needs to make.” Financial markets imply around a 50-50 chance of a cut to 2 percent at the RBA’s next meeting on May 5, having lengthened the odds after a surprisingly strong jobs report out last week.

(Daily chart / 4 hourly chart below)

AUD/USD April 22 at 02:10 GMT 0.7724 H: 0.7726 L: 0.7706

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is bouncing off support at the key 0.77 level after easing back from the resistance level at 0.7850. Current range: trading right above 0.7700.

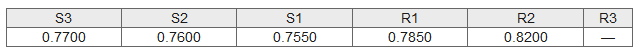

Further levels in both directions:

- Below: 0.7700, 0.7600 and 0.7550.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.