In the last 24 hours the Australian dollar has rallied strongly back up only to run into strong resistance at the 0.82 level, which is presently offering strong supply. The day before saw it fall even further down to another new multi-year low near 0.8100. The Australian dollar has a experienced a bad last month moving from resistance around 0.88 down to the new lows. For a few days earlier this week the Australian dollar was able to halt the strong decline a little allowing it to consolidate and establish a narrow range between 0.8200 and 0.8350. It appears to have its eyes firmly fixed on the 0.80 level. A few weeks ago it enjoyed some temporary support from 0.85, however this eventually gave way to overwhelming supply. To start that week it rallied back above 0.8650 again before falling lower throughout the rest of the week. In the week prior the Australian dollar was able to rally higher and bounce off multi year lows around 0.8550 and in doing so move back within the previously well established trading range between 0.8650 and 0.88 however it all seems some distance away now.

For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australia’s economy is likely to grow at an even slower pace in 2015, a major bank says. Westpac says it believes annual growth will be markedly below trend until the middle of 2015. It expects gross domestic product to grow by 2.7 per cent, which is slower than a previous forecast of 3.2 per cent. Westpac chief economist Bill Evans said economic growth in November marked the tenth consecutive month where it was below trend. “We can expect growth in the Australian economy to stay below trend in the final quarter of 2014 and well into 2015,” he said in a statement on Wednesday. However, Westpac anticipates growth to rise to 3.2 per cent during the second half of 2015, with an expectation the Reserve Bank will cut interest rates in February and March and the Australian dollar will weaken further. It also expects an improvement in Australia’s dire terms of trade, the ratio of export to import prices. The Westpac-Melbourne Institute leading index, which measures the likely pace of economic growth three to nine months into the future, fell from -0.15 per cent in October to -0.47 per cent in November.

(Daily chart / 4 hourly chart below)

AUD/USD December 18 at 20:55 GMT 0.8163 H: 0.8203 L: 0.8116

AUD/USD Technical

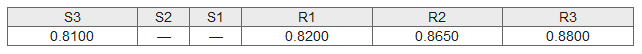

During the early hours of the Asian trading session on Friday, the AUD/USD is trying to rally higher back to the resistance level at 0.82 after enjoying a solid move back to that level in the last 24 hours. Current range: trading right around 0.8160.

Further levels in both directions:

- Below: 0.8100.

- Above: 0.8200, 0.8650, and 0.8800.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.