The Australian dollar enjoyed a solid week last week moving up from below 0.9300 to a three week high around 0.9370 before easing a little lower to finish the week. It has started this new week doing similar as it just eases away and looks like heading back down to the key 0.93 level. For the best part of the last few weeks the Australian dollar has traded close and around the 0.93 level after spending the preceding few weeks drifting lower from near 0.95. A couple of weeks ago it fell lower to below the 0.93 level level and down towards a two month low near 0.9220, before rallying well to return to the 0.93 level. Throughout July it generally slid lower from close to 0.95 down to its present trading levels around 0.93. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. Several weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance.

The Australian dollar reached a three week high just shy of 0.9480 a month ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Housing prices in Australia have posted their strongest winter gain in seven years, according to a widely-watched gauge. The RP Data CoreLogic Hedonic home value index of Australian capital city dwelling prices rose by 1.1 per cent in August, RP data said on Monday. The rise brought the total gain over the June, July and August to 4.2 per cent, the biggest rise over the winter months since 2007. Annual growth in prices came in at 10.9 per cent, more than double the gain of the 12 months to August 2013, but the gains were not evenly spread across the country. RP Data research director Tim Lawless said Sydney and Melbourne are driving a two tier market. The RP Data figures show Sydney home prices rose by 16.1 per cent in the past year, while Melbourne's were up by 11.7 per cent. The next strongest markets were Adelaide, Brisbane and Darwin, with price rises averaging between five and six per cent. At the other end of the scale was Canberra, hit by government spending cutbacks, where prices rose by only 1.4 per cent through the year. Mr Lawless said that now spring has begun there would be a rise in listings of properties for sale over the coming few months, which would be a "real test" for the market.

(Daily chart / 4 hourly chart below)

AUD/USD September 1 at 23:35 GMT 0.9333 H: 0.9351 L: 0.9320

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is drifting a little lower from its three week high around 0.9370. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9330.

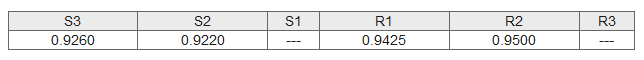

Further levels in both directions:

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.