Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,910, S&P 500 index).

Our intraday outlook is neutral, and our short-term outlook is bullish:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

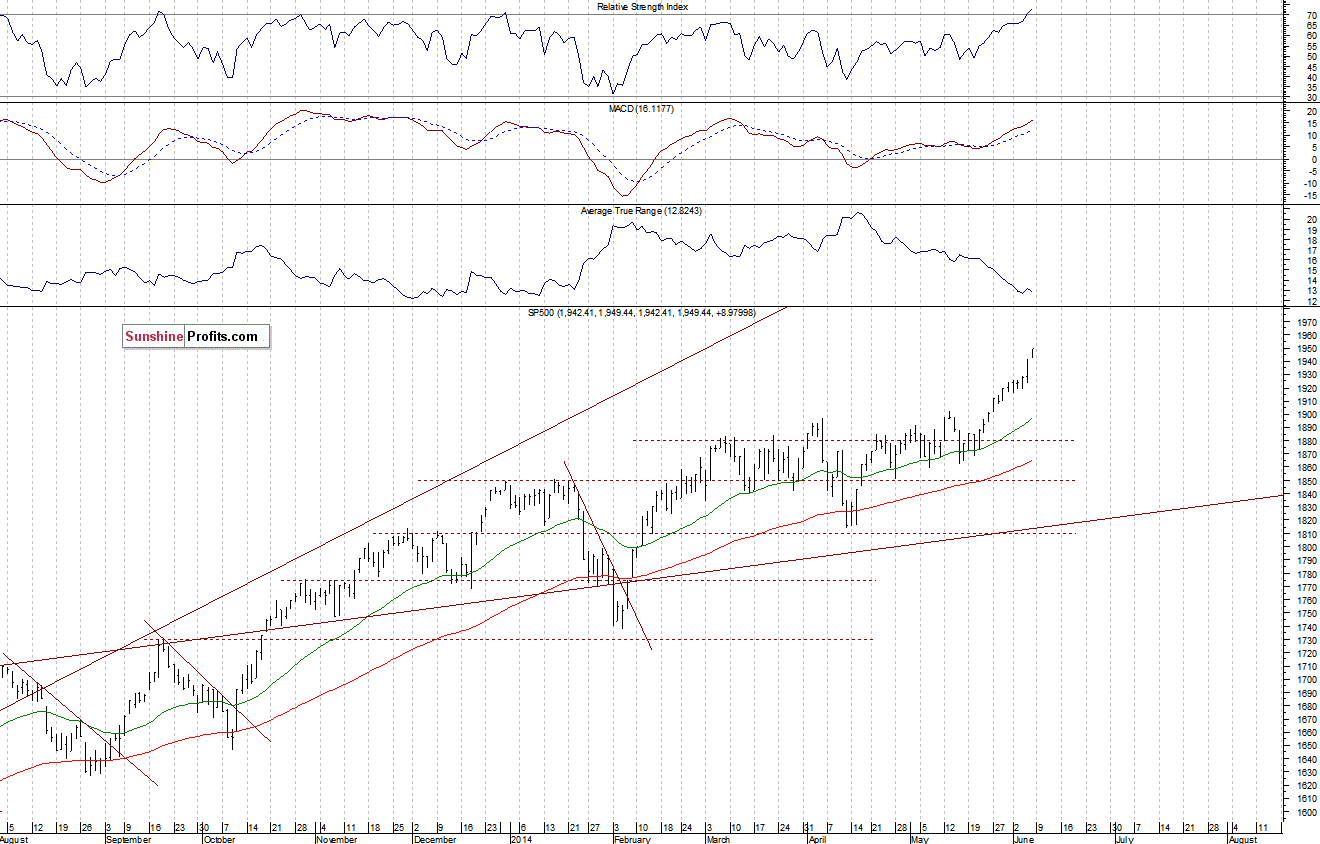

The U.S. stock market indexes gained 0.5% on Friday, extending their recent rally, as investors reacted to monthly unemployment data release. So, our short-term bullish outlook from May 28 continues to be accurate. The S&P 500 index has reached a new all-time high at 1,949.44, which is very close to a potential resistance level of 1,950. The next resistance is at the psychological level of 2,000. On the other hand, the nearest important support level is at around 1,925-1,930, marked by the recent consolidation. The next support is at 1,915. There have been no confirmed negative signals so far, as we can see on the daily chart:

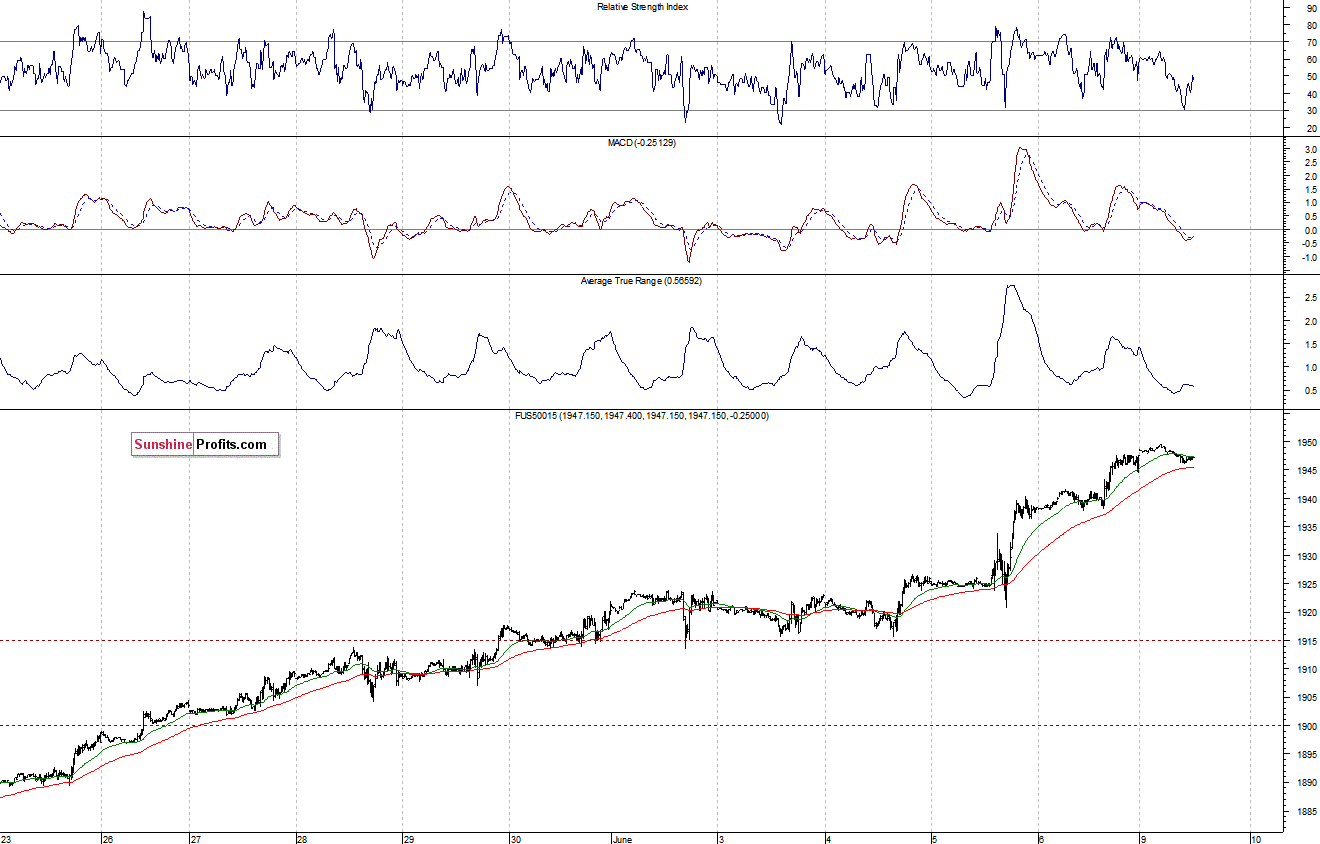

Expectations before the opening of today’s session are virtually flat, with index futures currently down 0.1%. The main European stock market indexes have been mixed so far. The S&P 500 futures contract (CFD) remains close to its recent highs, trading in a relatively narrow intraday range. The nearest important resistance is at around 1,950, and the support level is at 1,940, among others. For now, it looks just like another flat correction within an uptrend, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades close to the level of resistance at 3,800. The nearest important level of support is at around 3,770-3,780, marked by some of the recent local lows:

Concluding, the broad stock market extends its long-term uptrend, as indexes continue to reach new all-time highs. We remain cautiously optimistic, expecting uptrend to continue while maintaining our already profitable long position. The stop-loss remains at 1,910 (S&P 500 index).

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.