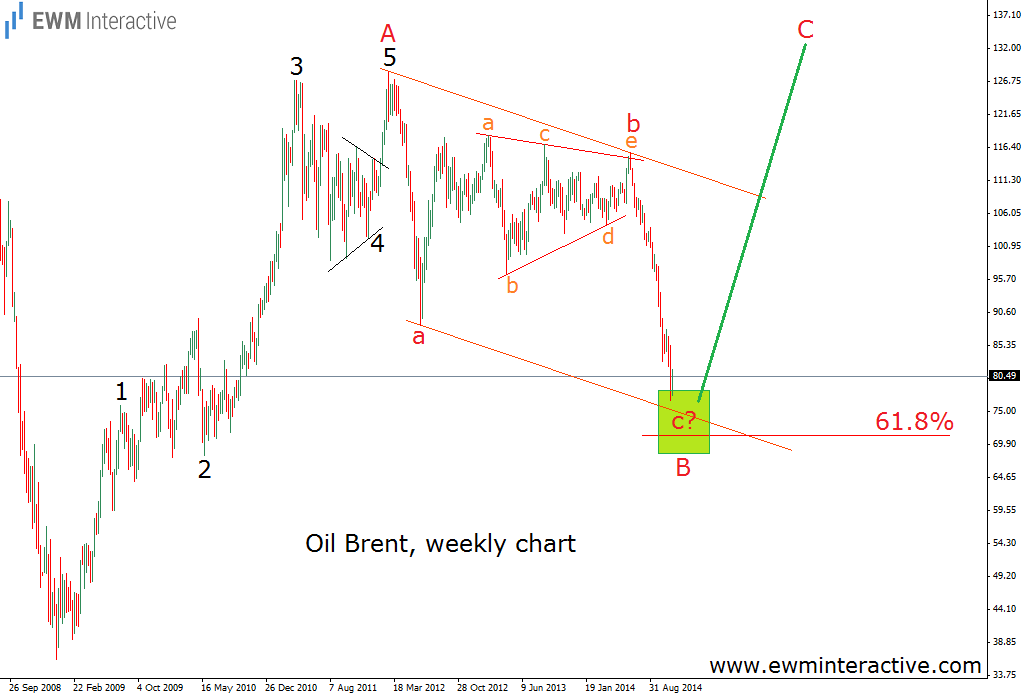

Brent Oil has been declining sharply during the last five months, falling down from above $115 per barrel in June to under $77 in November. It may seem the sell-off will last forever, but the Elliott Wave Principle gives us the right to disagree. It states that every price move, regardless of how big, is just one wave of a larger patterned cycle. So, where does this 38-dollar slump fit into the bigger picture? In order to find the answer, we have to look at a large enough time-frame chart, such as weekly.

According to the theory, the five-wave impulse shows the direction of the larger trend. Every impulse is followed by a three-wave correction in the opposite direction. The chart shows, that after the crash of 2008 there is one such impulse from $36 to $128. We will label it “A”. This means that all that happened after the $128 peak should be the natural three-wave retracement. And it really looks like oil brent has drawn an a-b-c zig-zag corrective pattern, where wave “b” is a triangle. Triangles precede the last move of the larger sequence. Here, the larger sequence is the a-b-c zig-zag and the last move is wave “c”, which is currently in progress. If this is the correct count, wave “c” of B should be expected to end somewhere in the zone of the 61.8% Fibonacci level. Then the 5-3 Elliott Wave cycle would be completed and the uptrend could resume in the face of wave C. It may seem impossible now, but if this count is right, brent oil could reach the $130 mark in the next two or three years.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.